Published Nov 2025

A Half of Story and The Danger of Invisible Risks

This article exposes the hidden vulnerabilities that traditional financial metrics fail to capture in today’s volatile economy. By connecting insights from EY’s “Half the Picture” report with real-world supply-chain, operational, environmental, and behavioral risks, it reveals why businesses must embrace full-spectrum intelligence and alternative data to prevent costly surprises and make truly informed decisions.

The global economy is experiencing a period where volatility is more common than rare. Supply chains stretch across continents, digital ecosystems expand faster than security measures can keep up, and geopolitical tensions cause sudden disruptions that ripple through markets. Every business decision, from choosing capital investments to selecting suppliers and approving customer credit, carries greater implications than it did a decade ago. However, the harsh reality is that many organizations still make high-stakes decisions without the necessary visibility or intelligence to fully understand their risks.

According to the recent EY report “Half the Picture or the Whole Story?”, many leaders still make major strategic and financial decisions based on incomplete information. The report emphasizes that organizations often rely on partial data, primarily financial metrics, while lacking operational, environmental, and behavioral indicators necessary to see the full risk landscape. This article builds on that theme, showing why relying on only part of the picture leaves companies dangerously vulnerable.

Traditional risk management tools, which depend on financial statements, compliance checklists, and backward-looking ratios, no longer fully reflect today’s complex risks. Companies might believe they are accurately analyzing performance, but in reality, they see only a small part of the risk landscape, focusing on financial metrics and overlooking operational, environmental, behavioral, or reputational factors that can influence a business's success or failure.

Uncovering Hidden Risks in Modern Supply Chains

The modern enterprise sits between two unpredictable fronts: upstream suppliers and downstream customers. Each side carries its own set of hazards.

Upstream, companies face vulnerabilities that go well beyond the solvency of a direct supplier. Tier-2 and tier-3 subcontractors may operate in regions with unstable political situations, weak labor protections, or extreme weather risks. Even when financial numbers appear strong, a business could be disrupted by a factory fire, port closure, or regulatory investigation. The increasing complexity of logistics introduces additional pressure that financial reporting can't fully reflect.

Downstream, the risks shift toward customer behavior, liquidity challenges, digital threats, and compliance lapses. A customer with strong revenue can still default after a cyberattack, a data breach, an unexpected regulatory penalty, or a sudden drop in market sentiment. Traditional credit models are not well-equipped to handle such shocks, leaving businesses vulnerable to risks that do not show up on an income statement.

In this environment, decision-makers may feel confident, but they are often navigating with incomplete maps and incomplete maps lead to costly surprises.

Why Instinct Still Dominates Corporate Decision-Making

One of the biggest challenges for executives today is the growing gap between the large amount of data available and the limited data that is actually useful. Information is scattered across systems that don’t communicate with each other: operational dashboards in one area, sustainability metrics in another, customer behavior data in a third, and cybersecurity indicators hidden deep within IT systems. As a result, leaders often rely on experience, intuition, or simplified financial metrics when pressure is high.

The problem is not a lack of intelligence; it is a lack of integration. A company may have hundreds of data signals pointing to future risk, yet none reach the boardroom in time to inform a strategic decision. When decisions must be made quickly, instinct fills the void that structured intelligence should occupy.

The Rise of Non-Financial Intelligence

Financial performance tells a story but only a story about the past. The risks that shape a company’s future often appear in non-financial areas long before they show up in the financials. That’s why non-financial intelligence has become crucial for evaluating counterparties, suppliers, and customers.

Workforce indicators such as turnover, absenteeism, safety incidents, and union activity reveal organizational stress that financial ratios mask. Environmental metrics, carbon exposure, and compliance gaps signal long-term vulnerabilities that will translate into costs as regulation tightens. Customer-experience scores, online sentiment, and service-quality patterns reflect changes in behavior that may precede revenue decline. Operational data, ranging from shipping delays to digital outages, exposes a business’s resilience, or lack of it, during disruptions.

The story of risk is now told through a wider set of signals, and ignoring them means ignoring the early warnings that matter most.

The New Role of Alternative Data in Financial Risk Assessment

If traditional data shows where a company has been, alternative data shows where it is heading. This category of intelligence has rapidly expanded and now includes a wide range of indicators that were once outside the scope of financial analysis.

Satellite imagery detects factory output, warehouse inventory levels, and port congestion before companies report them. Web-scraped pricing data indicates whether a business is losing competitiveness in real time. Cybersecurity monitoring platforms reveal exposure to ransomware, data leaks, or compromised systems that could cause operational shutdowns.

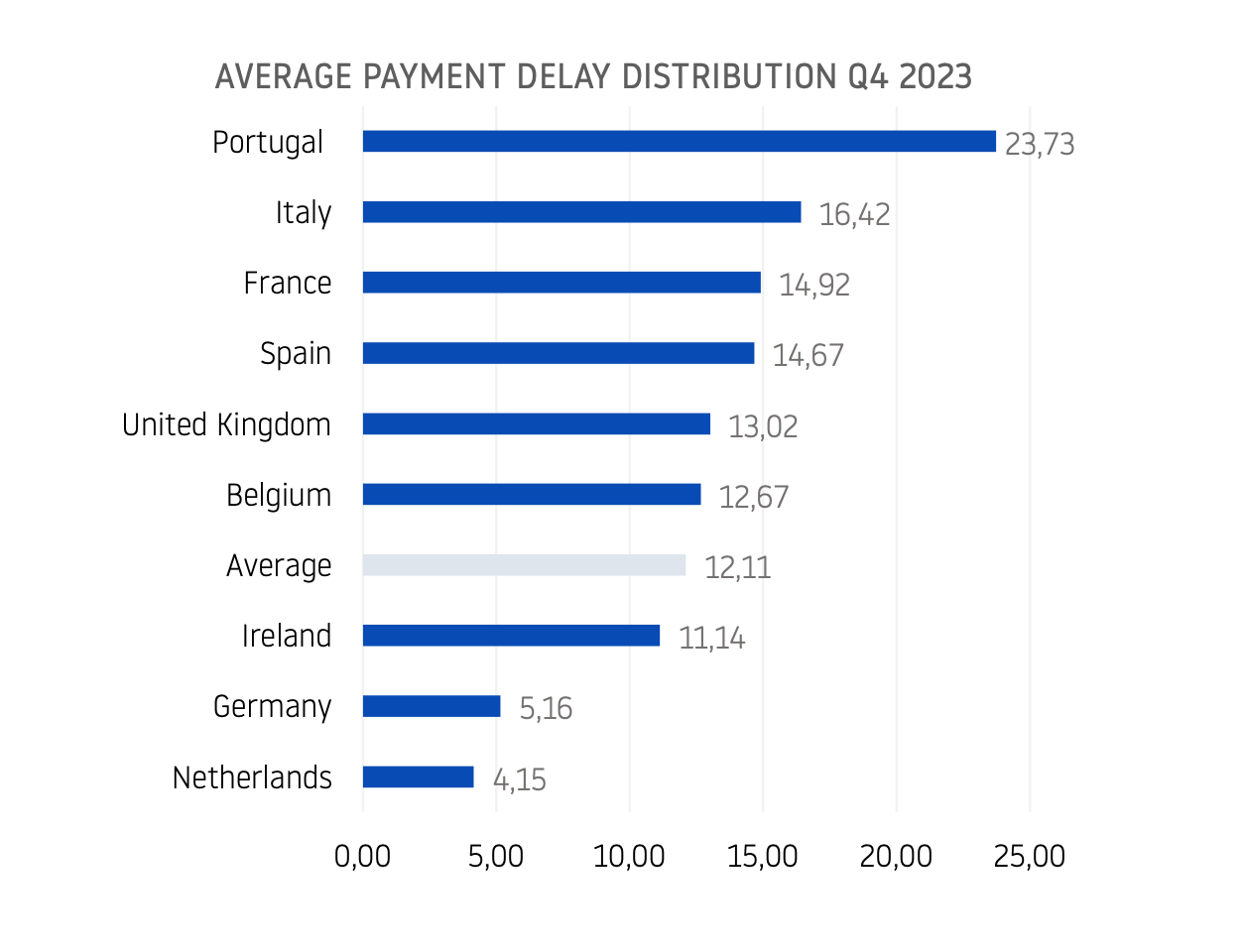

Supplier-payment behavior derived from trade networks provides early-warning signals of distress weeks before a formal default. Reputation analytics monitor social-media sentiment, customer complaints, and brand controversies that could hurt demand or trigger regulatory scrutiny. Even environmental sensors like tracking water levels, pollution spikes, or extreme weather… now play a role in credit decisioning for companies operating in vulnerable regions.

These alternative signals do not replace financial analysis; they elevate it. Credit-risk evaluation becomes predictive instead of reactive. Companies gain the ability to identify deterioration before balance sheets reveal it, and to respond before a disruption or default becomes irreversible.

The Expanding Risk Universe of the Modern Economy

Beyond data itself, the nature of risk has changed. Geopolitical realignments continuously redraw trade routes. Extreme climate events disrupt production and transportation. Digital transformation expands the attack surface for cybercriminals. Consumer expectations evolve overnight, placing reputational pressure on businesses unprepared for transparency. Regulatory regimes grow more demanding, especially in sectors tied to sustainability, data protection, and cross-border commerce.

Each of these forces introduces new vulnerabilities and traditional financial reporting captures almost none of them. A company’s resilience now relies on its ability to navigate volatile, multidimensional risks that develop faster than outdated reporting cycles.

Full-Spectrum Intelligence Is the Future of Risk Management

The only way forward is to develop a more integrated, real-time view of risk that combines financial data with operational, environmental, behavioral, and reputational intelligence. Modern risk management requires early-warning systems that identify irregularities before they become serious, analytics tools that merge human insight with technology, and reporting frameworks that treat non-financial intelligence equally with financial metrics.

For executives, this signifies a strategic shift. The question is no longer just whether a business is profitable, but whether it can withstand challenges. For credit risk managers, lenders, and investors, the focus isn't only on balance sheet strength but also on vulnerabilities within the broader ecosystem in which a company operates. For supply chain leaders, visibility must go well beyond the first tier. And for boards, the responsibility is growing from oversight of financial statements to understanding the full scope of operational and strategic risks.

Seeing the Whole Story Is a Strategic Imperative

The modern corporation cannot operate with half the picture. It cannot make decisions based solely on financial ratios, outdated reports, or static models. Resilience depends on the ability to interpret signals from across the business landscape, financial and non-financial, internal and external, traditional and alternative.

In an age where every disruption cascades through global networks, intelligence becomes the most valuable asset. Companies that see the full picture will make sharper decisions, avoid costly missteps, and respond faster to emerging threats. Those that continue relying on partial visibility will find themselves reacting too late, absorbing shocks they could have foreseen, and falling behind competitors who have embraced a more complete view of risk.

In this environment, one truth stands above all: It’s no longer enough to read the numbers. You must read the signals behind them.