Published Nov 2025

How to improve Company Negative Credit History

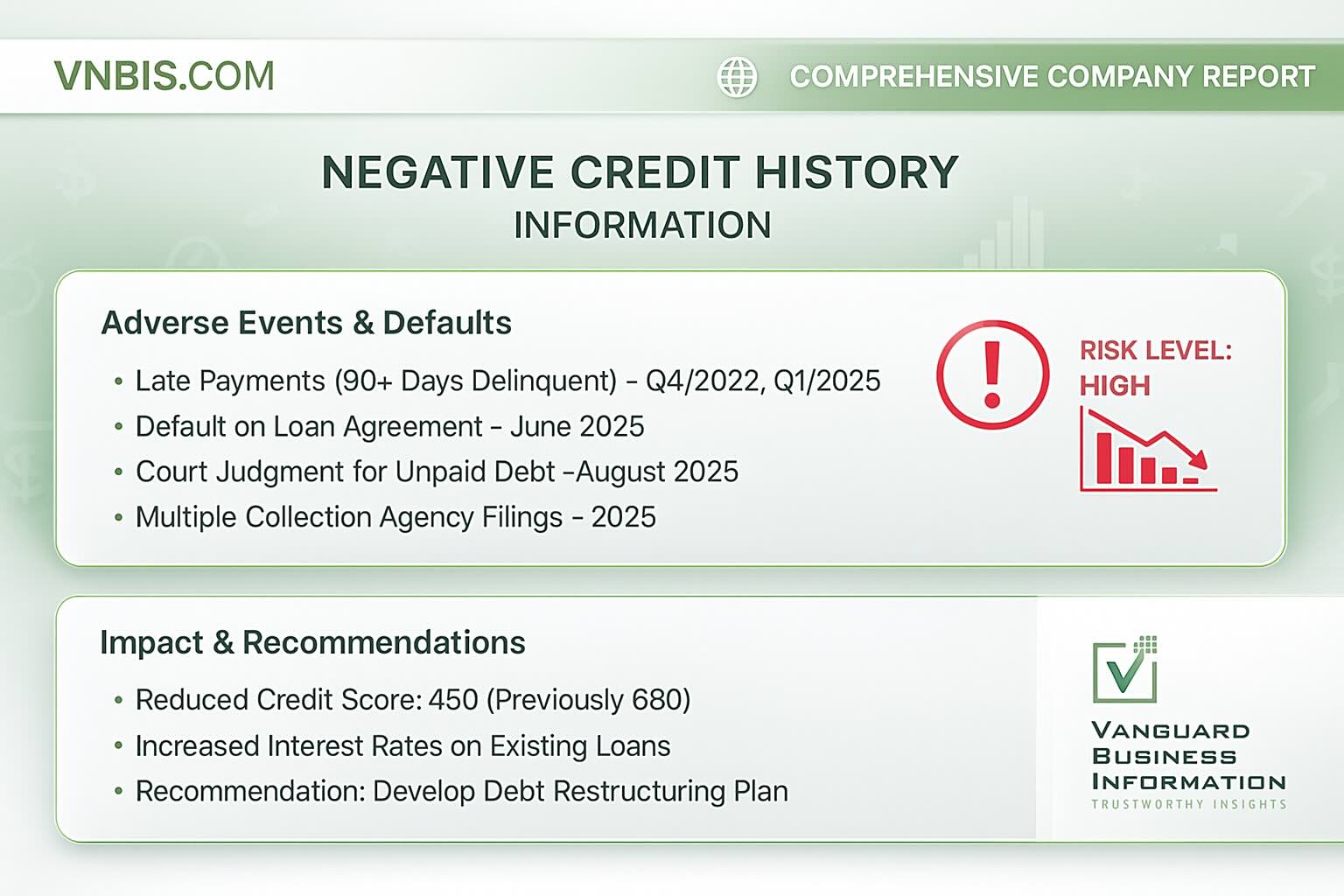

This article explains how businesses can repair a negative credit history by addressing past delinquencies, restructuring overdue debts, rebuilding financial discipline, and restoring lender confidence through transparent actions and consistent repayment behavior. It provides practical steps to help companies regain credibility, reduce risk levels, and improve long-term access to capital.

A company’s credit history is a key indicator of its financial reliability. Banks, suppliers, international insurers, and potential business partners depend on this record to determine if the company can be trusted with credit, capital, or contracts.

When a business has a negative credit history, the effects can be widespread. It may find it difficult to secure funding for new projects, face higher borrowing or insurance costs, be required to pay security deposits for essential utilities, or experience delays in banking transactions. Ultimately, a negative credit history undermines the company’s bargaining power, reduces trust, and hampers its ability to participate in both domestic and international trade confidently.

Although the effects of a damaged credit history can be mitigated, removing the consequences entirely is extremely difficult. Still, improvement is possible, and in many cases, essential for long-term corporate stability.

What Is a Negative Credit History?

A negative credit history indicates a company’s record of unfavorable or risky financial behavior in the past. This information appears on the company’s credit report, which details all previous and current credit accounts, payment histories, debt obligations, legal judgments, and interactions with lenders.

Typical elements that contribute to a negative credit history include:

- Late or missed payments on loans, trade credit, or financial obligations

- Severely delinquent accounts, especially if overdue for 90–180 days

- Debt collections initiated by banks or suppliers

- Collateral repossession or asset foreclosure

- Court judgments, including commercial disputes or enforcement decisions

- Tax liens, unpaid tax obligations, or penalties

- Corporate bankruptcy filings

- Others

Having one or two late payments is generally not enough to create a severely adverse history. However, repeated delays across multiple accounts, large overdue balances, or legal actions can quickly worsening the company’s credit rating.

A business that consistently holds high loan or credit-card balances relative to its credit capacity is also considered higher risk. Lenders interpret this as evidence of financial strain.

How to Identify a Negative Credit History

The most reliable way to determine whether a company has a negative credit history is by reviewing its comprehensive credit report issued by an accredited credit bureau or corporate information provider.

What a Credit Report Reveals

A complete company credit report typically includes:

- Legal status and registration history

- Payment and transaction behavior

- Outstanding loans and credit limits

- Financial statements and performance ratios

- Import–export performance

- Litigation records

- Public filings and tax information

- Credit scoring and risk rating

The depth of information disclosed often correlates with the severity of adverse events: the more historical delinquencies and disputes, the more extensive the negative credit section becomes.

Where to Obtain Credit Reports

Depending on the country, credit information may be collected and maintained by:

- National credit bureaus

- Central bank credit registries

- Commercial banks

- Independent credit-information companies

In Vietnam, organizations like VNBIS offer comprehensive company reports, which may include updated credit histories. These reports are sourced from reliable agencies such as government bodies, courts, financial institutions, public records, and field investigations.

Experienced credit analysts evaluate the company’s operations, risks, and financial health to provide objective assessments that help clients make informed business decisions.

How to Improve a Negative Credit History

Improving a negative credit history is neither quick nor easy. Accurate negative information can remain on a company’s credit report for up to seven years, and bankruptcy records can stay for up to ten years. However, companies can take structured, effective steps to rehabilitate their credit profile and rebuild trust.

1. Correct Inaccurate or Outdated Information

The first step is to ensure the negative information is accurate.

- If the company identifies errors such as incorrect overdue dates or misreported balances, it can file a dispute with the credit bureau.

- Credit bureaus are required to investigate and correct inaccurate or outdated entries.

- Supporting documents (bank letters, court decisions, settlement agreements) strengthen the company’s case.

Correcting errors alone can significantly improve a company’s credit score.

2. Negotiate With Creditors

When negative information is accurate but solvable, companies may try:

Pay-for-Delete Negotiation

A creditor may agree to remove negative remarks if the company pays the overdue balance in full or negotiates a settlement. Some lenders refuse this practice, but others may consider it for long-standing clients.

Goodwill Letters

Suppose the company has a long history of otherwise on-time payments. In that case, a goodwill request may persuade the creditor to remove an isolated late payment from the report as a gesture of goodwill.

While creditors are not required to remove accurate negative information, establishing transparent communication and reasonable faith efforts can sometimes yield favorable results.

3. Pay Overdue Accounts and Reduce Debt Levels

Even though paying overdue accounts does not erase past delinquencies, it still benefits the company:

- Lenders prefer a “paid delinquency” over an unpaid one.

- It improves the company’s credit utilization ratio, a significant factor in credit scoring.

- It prevents accounts from entering collections or legal disputes.

Reducing outstanding debt also improves liquidity ratios and enhances the company’s image in the eyes of credit analysts.

4. Build Positive Credit Behavior Over Time

Time is the most powerful healer in credit rehabilitation.

To accelerate improvement, the company should:

- Pay every invoice, credit line, and loan on time, every time

- Avoid taking on new high-interest debt

- Keep credit utilization under 30% of available limits

- Maintain stable relationships with suppliers and banks

- Strengthen internal financial controls to avoid late payment cycles

As older negative items age beyond 12–24 months, their influence decreases, especially when counterbalanced with strong, consistent positive behavior.

5. Improve Financial Transparency and Reporting

Credit assessors place strong emphasis on transparency. A company with a previously negative history can improve its rating by:

- Publishing audited financial statements

- Ensuring timely tax declarations

- Providing detailed notes on restructuring activities

- Demonstrating improved governance, internal controls, and debt management practices

Transparent reporting reduces perceived risk, helping lenders reconsider credit limits or approve new financing.

6. Strengthen Corporate Stability and Governance

Credit bureaus increasingly examine qualitative risk factors, not just numbers. To enhance creditworthiness, a company should:

- Improve capital adequacy and liquidity

- Diversify revenue streams

- Implement strong risk-management frameworks

- Reduce dependence on single suppliers or major customers

- Resolve litigation or pending disputes promptly

Stable governance and business continuity planning reassure lenders that the company can withstand financial stress.

7. Partner With a Credit-Information Agency

For businesses dealing in cross-border trade or entering new partnerships, using professional business information services can accelerate credit recovery. Agencies such as VNBIS provide:

- Independent assessment of a company’s improving financial health

- Industry benchmarking

- Updated credit scores

- Verification of settlement agreements

- Guidance on risk-management strategies

These third-party assessments help insurers, banks, and suppliers see documented improvements rather than relying solely on outdated negative records.

Rebuilding Credit Is a Process, Not an Event

A negative credit history does not permanently define a company. Although past mistakes and financial difficulties can leave lasting marks on a credit report, consistent financial discipline, strategic restructuring, and transparent communication can gradually rebuild trust. Over time, lenders begin to see improvement, opening the door to new credit options, better interest rates, and renewed confidence from partners.

In today’s globalized business landscape, strong creditworthiness is more important than ever. Companies that focus on rebuilding their credit reputation not only lower financial risks but also boost long-term competitiveness, reliability, and market trust.