Published Feb 2025

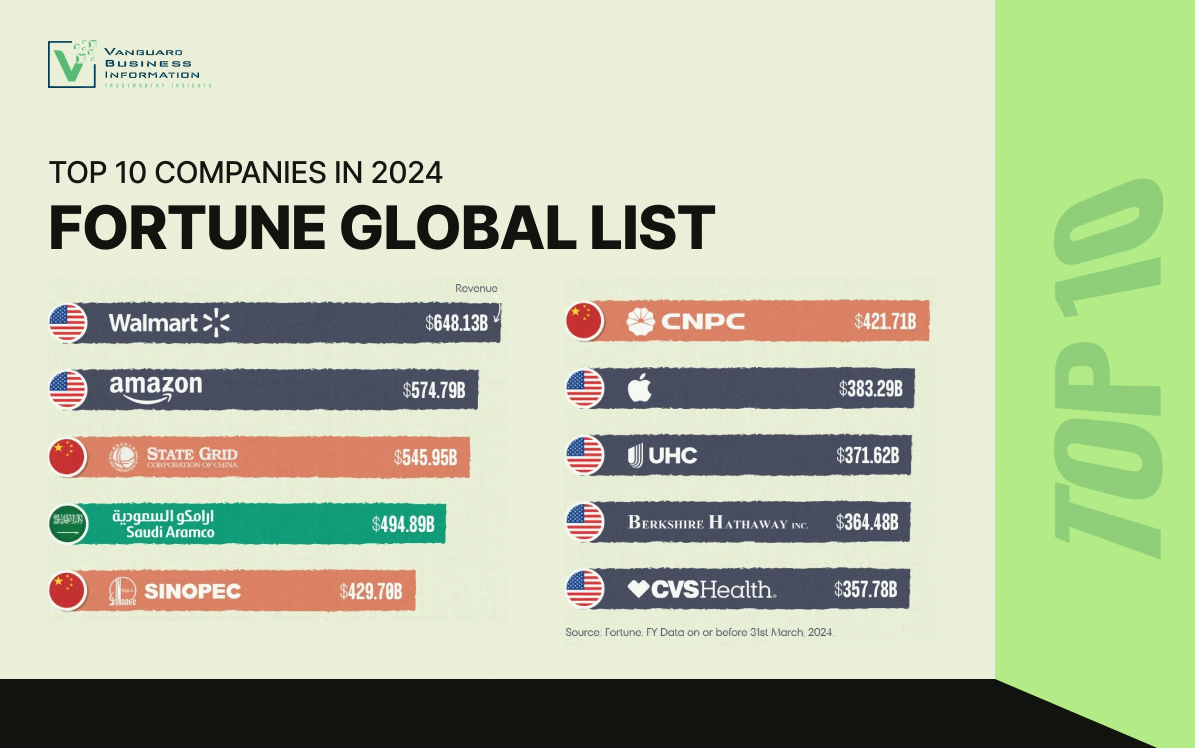

THE TOP 10 BIGGEST COMPANIES IN THE WORLD BY REVENUE: A 2024 SNAPSHOT

The 2024 Fortune Global 500 list highlights the top 10 revenue-generating companies, showcasing a mix of retail, energy, and technology giants dominated by the U.S. and China. Walmart leads with $648.1 billion, followed closely by Amazon at $574.8 billion, Apple ($383.3 billion) and UnitedHealth Group ($371.6 billion) round out the list, illustrating how innovation in tech and healthcare drive massive revenue in a world balancing profit with evolving global challenges.

1. Walmart - $648,125 Million (U.S.)

Walmart reigns supreme at the top of the 2024 Fortune Global 500 with a staggering revenue of $648.1 billion. This American retail giant, headquartered in Bentonville, Arkansas, has long been a household name, operating over 10,500 stores across 19 countries. Its formula for success lies in its vast scale, low-cost business model, and relentless expansion into e-commerce. In 2023, Walmart’s online sales surged, fueled by its Walmart+ subscription service and investments in supply chain efficiency. Despite inflationary pressures, the company’s ability to offer everyday low prices keeps it a go-to for millions, cementing its position as the world’s revenue leader.

2. Amazon - $574,785 Million (U.S.)

Close on Walmart’s heels is Amazon, with $574.8 billion in revenue. Based in Seattle, Washington, Amazon transcends traditional retail, blending it with cutting-edge technology. Founded by Jeff Bezos in 1994 as an online bookstore, it has morphed into a global powerhouse encompassing e-commerce, cloud computing (via Amazon Web Services), and entertainment (Prime Video). AWS alone generated over $90 billion in 2023, underscoring Amazon’s diversification. Its aggressive push into artificial intelligence and logistics—think drone deliveries and automated warehouses—keeps it at the forefront of innovation, making it a formidable rival to Walmart.

3. State Grid - $545,948 Million (China)

China’s State Grid Corporation claims third place with $545.9 billion in revenue. As the world’s largest utility company, it powers much of China’s vast population through an extensive network of electricity transmission and distribution. Headquartered in Beijing, State Grid has invested heavily in renewable energy and smart grid technology, aligning with China’s ambitious carbon neutrality goals. Its dominance reflects the critical role infrastructure plays in supporting the world’s second-largest economy, though its state-owned status gives it a unique edge over private competitors.

4. Saudi Aramco - $495,409 Million (Saudi Arabia)

Saudi Aramco, the oil and gas juggernaut from Dhahran, Saudi Arabia, secures fourth place with $495.4 billion in revenue. As the backbone of Saudi Arabia’s economy, Aramco controls some of the world’s largest oil reserves, producing roughly one in every eight barrels of oil globally. High oil prices in 2023 bolstered its earnings, though the company is also pivoting toward sustainability, investing in hydrogen and carbon capture technologies. Its 2019 IPO, the largest in history, continues to fuel its growth, blending traditional energy dominance with a nod to a greener future.

5. Sinopec Group - $444,763 Million (China)

China Petroleum & Chemical Corporation, or Sinopec, ranks fifth with $444.8 billion in revenue. Headquartered in Beijing, this state-owned enterprise is one of the world’s largest integrated energy and chemical companies. Sinopec’s operations span oil exploration, refining, and petrochemical production, feeding China’s industrial and consumer demands. In 2023, it expanded its renewable energy portfolio, including biofuels, while maintaining its core strength in fossil fuels. Its scale and government backing make it a linchpin in China’s energy security strategy.

6. China National Petroleum - $435,414 Million (China)

Another Chinese energy titan, China National Petroleum Corporation (CNPC), takes sixth place with $435.4 billion in revenue. Based in Beijing, CNPC is the country’s largest oil and gas producer, operating both domestically and internationally. Its subsidiary, PetroChina, is a publicly traded giant in its own right. CNPC’s revenue reflects robust demand for energy in China, though it’s also investing in natural gas and renewables to diversify its portfolio. Its global reach, from Africa to Central Asia, underscores China’s growing influence in the energy sector.

7. Apple - $383,285 Million (U.S.)

Apple, the Cupertino, California-based tech icon, secures seventh place with $383.3 billion in revenue. Known for its iPhones, Macs, and ecosystem of services like Apple Music and iCloud, Apple redefined consumer technology under Steve Jobs and continues to thrive under Tim Cook. In 2023, the company saw strong sales of its iPhone 15 series and a growing services segment, which now accounts for over 20% of its revenue. Apple’s brand loyalty, innovation in wearables (like the Apple Watch), and push into augmented reality position it as a tech leader, even amid supply chain challenges.

8. Exxon Mobil - $344,582 Million (U.S.)

Exxon Mobil, headquartered in Spring, Texas, ranks eighth with $344.6 billion in revenue. As one of the world’s largest publicly traded oil and gas companies, it thrives on exploration, refining, and chemical production. High energy prices in 2023 boosted its profits, with its Permian Basin operations in the U.S. playing a key role. Exxon Mobil is also investing in lower-carbon technologies, like biofuels and carbon capture, though its core business remains tied to fossil fuels. Its resilience in a volatile market underscores its enduring strength.

9. Shell - $323,183 Million (Netherlands)

Shell, based in The Hague, Netherlands (though historically tied to the U.K.), lands ninth with $323.2 billion in revenue. This global energy company balances oil and gas production with a growing emphasis on renewables. In 2023, Shell capitalized on strong liquefied natural gas (LNG) demand while expanding its wind and solar projects. Its transition from a pure oil major to a broader energy player reflects industry trends, though its legacy assets—like offshore drilling—still drive the bulk of its revenue. Shell’s adaptability keeps it competitive in a shifting energy landscape.

10. UnitedHealth Group - $371,622 Million (U.S.)

Rounding out the top 10 is UnitedHealth Group, with $371.6 billion in revenue. Based in Minnetonka, Minnesota, this healthcare giant operates through its insurance arm (UnitedHealthcare) and its Optum health services division. It serves millions of Americans, leveraging data analytics and a sprawling network of providers to dominate the U.S. healthcare market. In 2023, rising healthcare costs and an aging population fueled its growth, though regulatory scrutiny over its size looms. UnitedHealth’s blend of insurance and care delivery makes it a unique player among the top 10.

Trends and Takeaways

The 2024 top 10 list reveals a world economy shaped by retail, energy, and technology. The U.S. and China dominate, with five and three companies respectively, reflecting their economic heft. Retail leaders like Walmart and Amazon thrive on scale and digital transformation, while energy firms—Saudi Aramco, Sinopec, CNPC, Exxon Mobil, and Shell—ride fossil fuel demand even as they eye renewables. Apple’s tech prowess and UnitedHealth’s healthcare dominance highlight sector-specific innovation.

Revenue totals here dwarf many nations’ GDPs, underscoring these companies’ global influence. Yet, challenges like climate change, geopolitical tensions, and technological disruption loom large. As 2025 unfolds, these giants will navigate a world demanding both profit and purpose, shaping economies and societies alike. For now, their 2024 revenues cement their status as the planet’s corporate elite.