Published Aug 2024

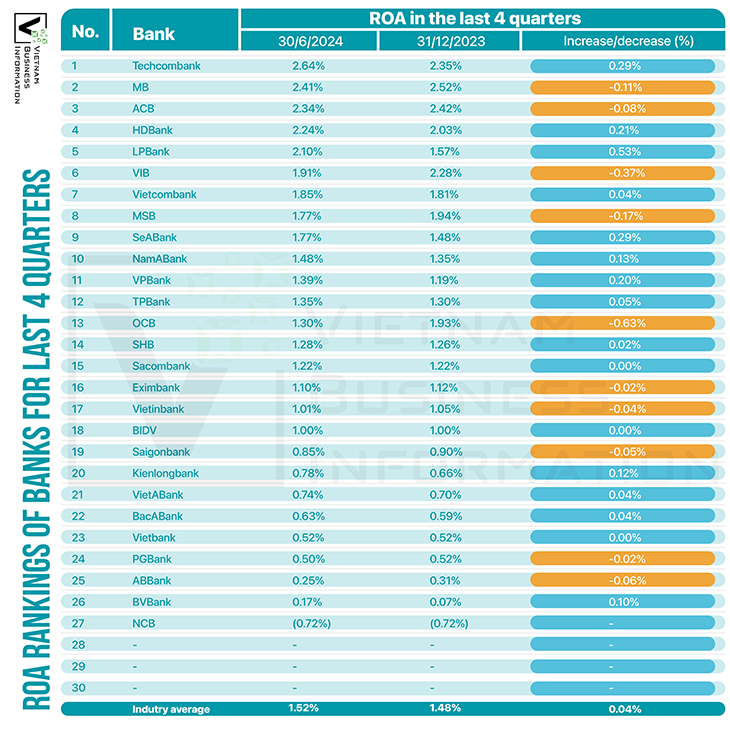

Top 10 banks by ROA in H1 2024

In the first half of 2024, Techcombank has solidified its lead in ROA (Return on Assets), further distancing itself from MB and ACB. State-owned banks are trailing in the ROA rankings due to their larger asset bases.

Top banks in Vietnam by ROA

Data from the financial reports of listed banks reveal a recovery in ROA compared to the end of 2023. The ROA for the banking sector, comprising 27 banks, increased by 0.04 percentage points to 1.52% by the end of Q2 2024.

Joint-stock banks dominate the ROA rankings, with Vietcombank, despite leading in profitability, only reaching seventh place. VietinBank and BIDV are further down the list at 17th and 18th positions, respectively, primarily due to their larger asset sizes.

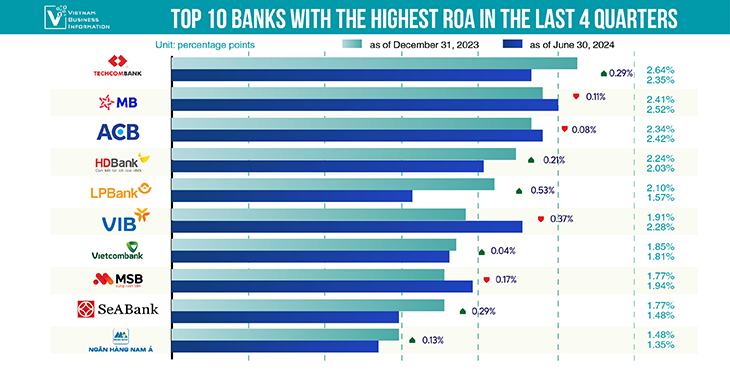

The top three banks in terms of ROA are Techcombank, MB, and ACB, with their ROA over the past four quarters ranging from 2.64% to 2.34%. Techcombank, in particular, has seen a notable improvement, with its ROA rising by 0.29 percentage points, driven by record profits in the first half of 2024. Since Q1 2024, Techcombank has overtaken MB and ACB to become the industry leader in ROA.

In H1 2024, Techcombank reported after-tax profits of VND 12.547 trillion, marking a 38.8% year-on-year increase and placing it second in the industry. Its total assets stood at VND 908.307 trillion.

Conversely, the ROA for MB and ACB decreased by 0.11 and 0.08 percentage points, respectively, due to slower profit growth in the first half of the year. Compared to Q1 results, the ROA for these major joint-stock banks continued to decline.

The Top 10 banks for ROA also include HDBank, LPBank, VIB, Vietcombank, MSB, SeABank, and Nam A Bank. Among these, VIB saw a sharp decline in ROA due to decreased after-tax profits in H1 2024.

LPBank, however, reported the highest ROA growth in the sector, up by 0.53 percentage points, following a 142% increase in after-tax profits in the first quarter of the year.

Additionally, Nam A Bank has moved ahead of OCB to enter the Top 10. OCB's after-tax profits for the first half of the year fell by over 18%, resulting in a 0.63 percentage point decrease in ROA from the start of the year, dropping to 1.3%. At the end of last year, OCB's ROA had surpassed that of Vietcombank.

ROA rankings of banks

Source: FS of banks, vietnambiz

Amie Le - Vietnam Business Information