Published Sep 2024

Top 10 banks with the largest securities investment in 1H2024

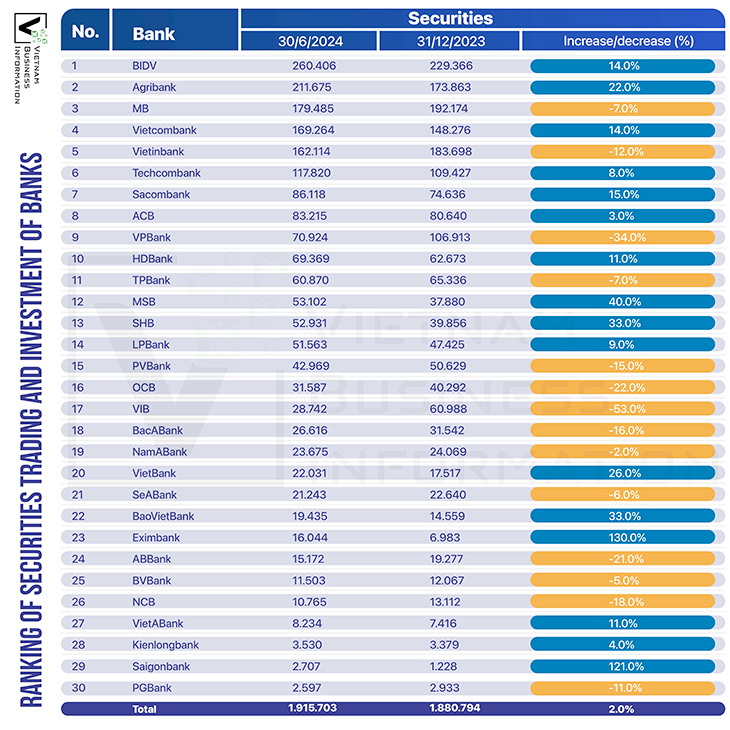

In the first six months of 2024, the banking sector allocated nearly VND 2 quadrillion into trading and investment securities, reflecting a 2% growth compared to the end of 2023.

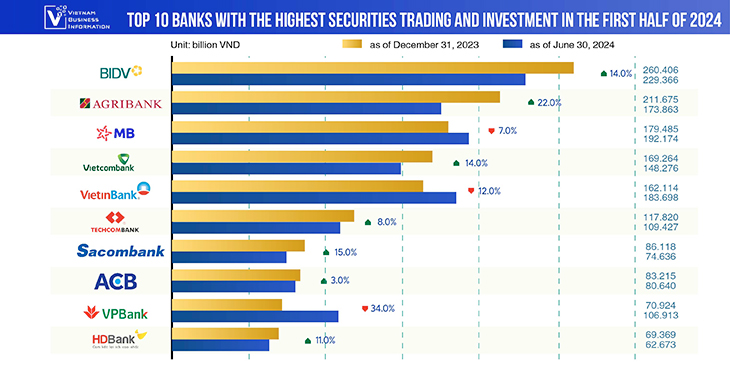

BIDV emerged as the leader, channeling VND 260,406 billion into this segment, marking a 14% increase from the previous year.

Top 10 banks in Vietnam with the highest securities trading and investment

According to unaudited financial statements from 30 banks, the cumulative balance in trading and investment securities reached over VND 1.9 quadrillion by mid-year. Trading securities typically encompass debt and equity instruments held for short-term profit, while investment securities, predominantly government bonds, constitute the bulk of these holdings.

As of June's end, BIDV stood at the forefront, with VND 260,406 billion invested in trading and investment securities, of which investment securities accounted for a significant VND 252,220 billion. Agribank followed closely, demonstrating the highest growth rate within the Top 10 at 22%, raising its securities investment from VND 173,863 billion at the close of 2023 to VND 211,675 billion by the end of June 2024.

MB secured the third position despite a modest 7% reduction in its securities portfolio, amounting to VND 179,485 billion. Vietcombank, occupying the fourth spot, reported VND 169,264 billion in securities, with investment securities comprising VND 166,832 billion, including VND 41,599 billion in government bonds available for sale.

The remaining positions in the Top 10 were claimed by VietinBank, Techcombank, Sacombank, ACB, VPBank, and HDBank. Noteworthy is the triple-digit growth in securities investment recorded by Eximbank and Saigonbank, at 130% and 121% respectively. Conversely, 14 banks reported a contraction in their securities holdings during the first half of the year, with VIB experiencing the most significant decline, at 53%.

Ranking of securities trading and investment

Source: FS of banks, vietnambiz

Compiled by Vietnam Business Information