Published Jan 2026

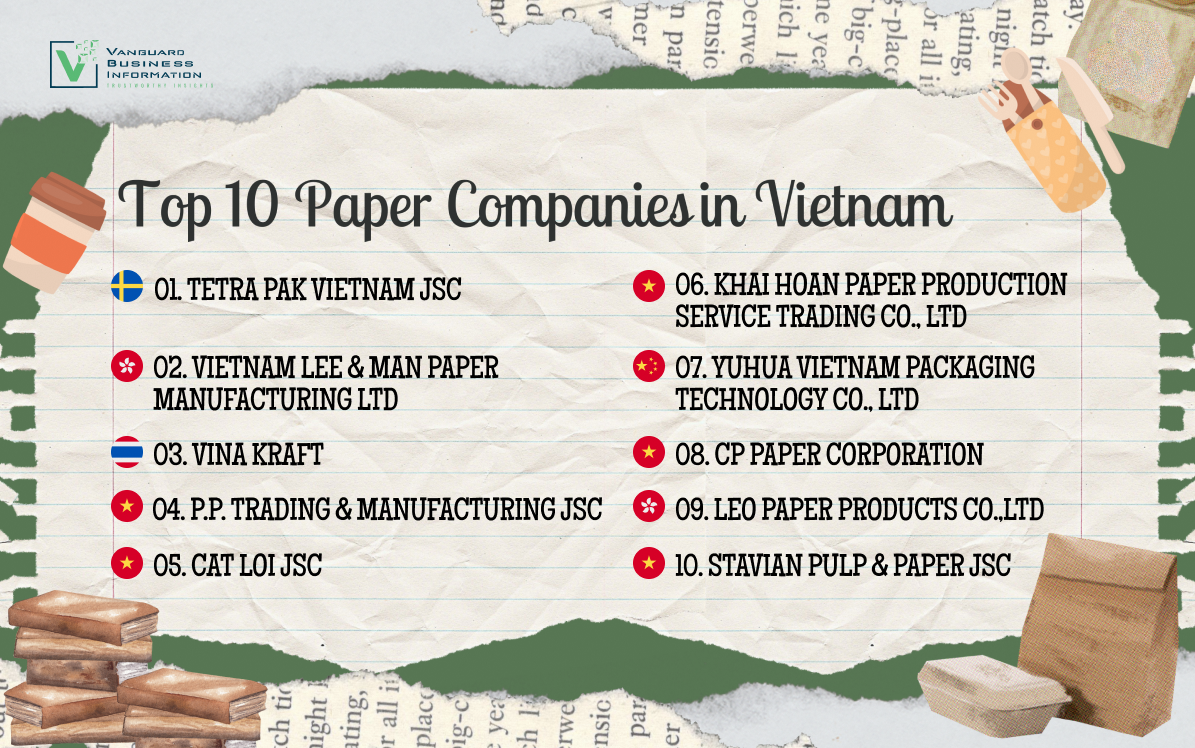

TOP 10 Companies of Vietnam Paper Industry

Vietnam’s paper industry is no longer just about mills and machines. Based on verified sales data, this article ranks the Top 10 paper companies in Vietnam and digs into the business models behind the numbers—showing how foreign capital, export-driven packaging demand, and control over key supply-chain nodes are quietly reshaping who really holds power in the market, and why these structural shifts matter for investors, suppliers, and industry watchers alike.

Vietnam’s paper and paper-based packaging sector is no longer a single, linear industry. It has evolved into a layered industrial system comprising upstream pulp and industrial paper mills, midstream recycled-paper and containerboard producers, and downstream converters that transform paper into cartons, food-grade packaging, labels, and branded boxes for electronics, FMCG, and export manufacturing. This structure reflects Vietnam’s deeper integration into global supply chains and the growing importance of packaging as an industrial input rather than a consumer commodity.

Based on verified sales volume data (VND) from the attached dataset, the following are the Top 10 paper industry companies in Vietnam, ranked from No. 1 to No. 10. Each company is linked to its profile on VNBIS.com, with key observations on ownership, operating model, and strategic position.

NO.1 TETRA PAK VIETNAM JSC: VND 7.84 tn

Tetra Pak Vietnam operates at the premium end of the paper value chain, combining paperboard with packaging technology to deliver integrated carton systems for dairy and beverage producers. According to VNBIS, the company is an FDI joint-stock entity within Tetra Pak’s regional structure, with foreign shareholders linked to Singapore-based entities, ensuring close alignment with global procurement, quality, and compliance standards.

What differentiates Tetra Pak is that it does not merely sell paper-based packaging, but complete systems: processing equipment, packaging machinery, installation, engineering support, and long-term servicing. This creates high switching costs and stable customer relationships. While its model is relatively resilient, it remains exposed to fluctuations in input prices, client capital expenditure cycles, and evolving packaging regulations tied to sustainability and recycling standards.

NO.2- VIETNAM LEE & MAN PAPER MANUFACTURING LTD: VND 6.19 tn

Vietnam Lee & Man Paper Manufacturing Ltd illustrates how Vietnam’s paper industry has been shaped by large-scale foreign capital and export-linked demand. VNBIS profiles the company as a 100% FDI one-member limited liability company registered in Hau Giang, producing industrial paper that underpins much of Vietnam’s corrugated packaging supply.

Despite its scale, the company’s profile highlights an important reality: size does not eliminate volatility. Large mills remain highly sensitive to recovered paper prices, energy costs, and global demand cycles. Periods of soft export demand or cost inflation can quickly compress margins. For partners and lenders, Lee & Man’s case underscores the importance of monitoring working capital dynamics, payment behavior, and broader industry conditions, not just topline revenue.

NO.3 -VINA KRAFT: VND 5.85 tn

Vina Kraft is widely regarded as a cornerstone of Vietnam’s industrial packaging paper backbone, supplying containerboard and kraft grades to corrugated carton manufacturers serving export-oriented industries. Industry references position Vina Kraft consistently as a major stabilizing force in the packaging supply.

Strategically, its importance lies in its high-throughput, scale-driven role. When production runs smoothly, it supports stable packaging availability for manufacturers. When supply tightens, the effects are immediate: carton prices rise, and pressure cascades down to converters and end-users. Vina Kraft therefore serves as a barometer for Vietnam’s broader manufacturing economy—its performance closely tracks demand from electronics, textiles, furniture, and FMCG exports.

NO.4 - P.P. TRADING & MANUFACTURING JSC: VND 5.72 tn

P.P Trading and Manufacturing JSC reflects a standard Vietnamese growth model: the integration of trading and manufacturing. This dual capability allows the company to influence margins not only through production efficiency but also through raw material sourcing and distribution.

Such a model can enable rapid expansion during favorable price cycles. Still, it also increases exposure to foreign exchange movements, freight costs, and global shocks to pulp or recovered paper prices. When companies with substantial trading leverage grow quickly, they can reshape margin distribution across the value chain, affecting mills, converters, and end users alike. For buyers and partners, the critical due diligence questions relate to contract stability, supplier concentration, and the balance between spot trading and long-term supply.

NO.5 CAT LOI JSC: VND 3.69 tn

Cat Loi stands out as a downstream value-added player rather than a pulp- or paper-heavy producer. Historically linked to packaging materials serving Vietnam’s tobacco industry, Cat Loi has built expertise in packaging, printing, and compliance-driven products. Public profiles describe the company as established in the early 1990s and later equitized, with a focus on specialized packaging solutions.

This specialization creates defensive advantages through client stickiness, quality requirements, and regulatory compliance. However, it also introduces concentration risk, as reliance on a limited ecosystem of key customers can amplify demand shocks. Within the Top 10, Cat Loi represents the segment where branding, quality control, and customer approval processes can matter as much as raw material costs.

NO.6 - KHAI HOAN PAPER PRODUCTION SERVICE TRADING CO., Ltd: VND 3.46 tn

Khai Hoan Paper appears in the Top 10 primarily due to its distribution reach and trading scale, rather than ownership of the largest mills. Commonly referenced in Vietnamese business directories, the company has a long-standing presence in paper trading and related services.

Midstream players like Khai Hoan can act as shock absorbers or amplifiers in the market. Effective inventory management can stabilize supply for customers during tight periods, while aggressive spot trading can transmit volatility rapidly downstream. For B2B buyers, the key risk consideration is the proportion of recurring contractual supply versus spot-driven revenue, which affects pricing stability and reliability.

NO.7 - YUHUA VIETNAM PACKAGING TECHNOLOGY CO., Ltd: VND 2.96 tn

Yuhua Vietnam is frequently cited as part of the high-end packaging ecosystem serving global electronics and branded consumer goods manufacturers. Industry sources link the company to the broader YUTO Group network, which has strengths in premium packaging and printing.

Trade data indicates significant shipment activity in paper packaging-related categories, reflecting close integration with multinational procurement systems. Yuhua’s role highlights how Vietnam has become a manufacturing hub where packaging must meet international standards for traceability, consistency, and compliance. While this raises the overall quality bar in the domestic market, it also intensifies competitive pressure on smaller local converters.

NO.8 - CP PAPER CORPORATION: VND 2.43 tn

CP Paper rounds out the Top 10, operating within a broader Asian industrial landscape where packaging and industrial paper demand is driven by export manufacturing. While detailed narrative data is limited, its ranking highlights a consistent industry theme: competitive success depends on securing raw materials, maintaining efficient mill operations, and reliably serving large B2B customers.

CP Paper’s presence reinforces that small local workshops no longer characterize Vietnam’s paper sector. It has become a high-throughput, capital-intensive supply chain, susceptible to energy costs, import pricing, and export demand cycles.

No.9 – LEO PAPER PRODUCTS VIETNAM LIMITED — VND 1.89 tn

Leo Paper Products Vietnam Limited represents a foreign-invested packaging manufacturer focused on paper-based packaging products. According to its VNBIS profile, the company is integrated into international supply chains, serving export-oriented customers that demand standardized quality and reliable delivery. Its presence in the Top 10 reflects the continuing inflow of FDI into Vietnam’s packaging sector, particularly from firms seeking to diversify production bases and reduce supply-chain risk.

No.10 – STAVIAN PULP & PAPER JOINT STOCK COMPANY: VND 1.73 tn

Stavian Pulp & Paper Joint Stock Company stands out as a strategic upstream–midstream player, leveraging Stavian Group’s broader strengths in commodities, logistics, and international trade. The company’s activities extend beyond paper manufacturing into pulp sourcing and distribution, positioning it at critical raw-material chokepoints. This model provides scale and reach but also ties performance closely to global pulp markets, FX movements, and freight dynamics.

Key Structural Risks and Market Dynamics

Vietnam’s paper ecosystem is increasingly shaped by FDI-linked scale and global supply chains. Many of the top companies are foreign-owned, part of multinational networks, or deeply dependent on export manufacturing. As a result, pricing and availability are often influenced as much by foreign exchange movements, freight rates, global pulp and recovered paper markets, and geopolitical shocks as by domestic consumption.

A second reality is that this is not simply an industry of paper mills. Control over conversion capacity, packaging specifications, and customer approvals can be as robust as owning upstream production assets. Once validated within export supply chains, suppliers can scale rapidly—but they also face intense margin pressure from powerful buyers.

Finally, scale does not equal safety. Even companies with multi-trillion-VND revenues can experience profit compression, adverse news signals, or working-capital stress. These are warning signs that warrant deeper scrutiny before extending credit, entering long-term contracts, or relying heavily on a single supplier.

This is precisely where VNBIS.com plays a critical role—helping banks, credit insurers, exporters, importers, and procurement teams verify legal status, ownership structures, operational scale, financial trends, and risk signals, so decisions are grounded in evidence rather than assumptions.