Published May 2024

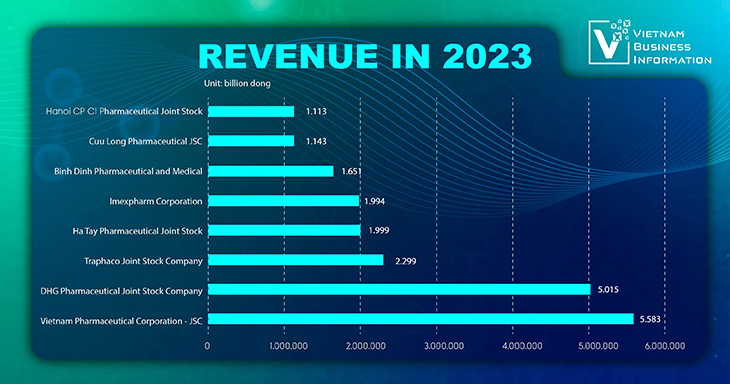

Top largest pharmaceutical companies in Vietnam in 2023 by revenue

Vietnam's pharmaceutical industry has seen significant growth, largely driven by the contributions of its leading companies.

Here, we provide a comprehensive look at the seven largest pharmaceutical firms in Vietnam, including their history, detailed business activities, and financial performance for 2023.

1. Vietnam Pharmaceutical Corporation - JSC (Vinapharm)

Founded in 1971, Vinapharm has played a crucial role in the development of Vietnam's pharmaceutical sector. Initially state-owned, it transitioned to a joint-stock company to enhance operational efficiency and competitiveness.

Vinapharm is involved in:

- Manufacturing: Producing a wide range of pharmaceuticals including antibiotics, analgesics, and cardiovascular drugs.

- Trading: Importing and exporting pharmaceuticals, medical equipment, and health supplements.

- Distribution: Operating an extensive distribution network across Vietnam, ensuring wide availability of its products.

- Research and Development: Investing in R&D to develop new drugs and improve existing formulations, focusing on quality and efficacy.

- Healthcare Services: Providing consultancy and healthcare services through its network of pharmacies and clinics.

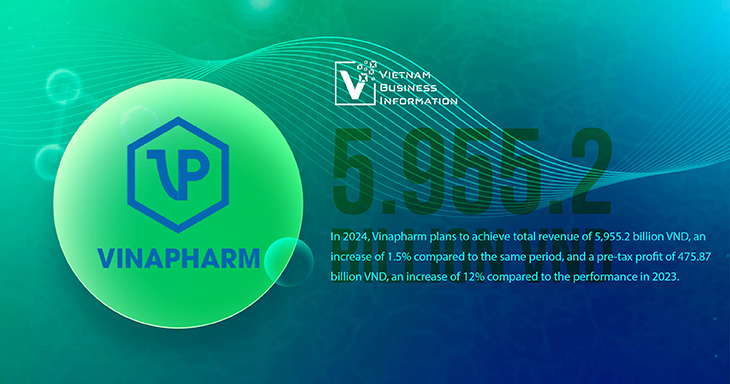

In 2024, Vinapharm plans to achieve total revenue of 5,955.2 billion VND, an increase of 1.5% compared to the same period, and a pre-tax profit of 475.87 billion VND, an increase of 12% compared to the performance in 2023.

In 2023, Vinapharm recorded total revenue of 5,868.2 billion VND, an increase of 3.5% compared to the same period and reached 99.2% of the planned 5,917.8 billion VND; and pre-tax profit reached 425 billion VND, an increase of 222.2% compared to the same period and completed 127.1% of the planned profit of 334.5 billion VND.

2. DHG Pharmaceutical Joint Stock Company

Established in 1974, DHG Pharmaceutical JSC (DHG) is one of Vietnam’s most established pharmaceutical companies. The company became a joint-stock entity in 2004, which spurred its expansion.

DHG core activities include:

- Pharmaceutical Production: Manufacturing over 300 types of medicines including antibiotics, antifungals, and cardiovascular drugs.

- Herbal Medicines: Producing herbal and traditional medicines, integrating modern technology with traditional practices.

- Distribution: Operating a broad distribution network throughout Vietnam, ensuring its products are widely accessible.

- R&D: Focusing on developing new pharmaceutical products and improving existing ones, with an emphasis on quality control.

- Export: Expanding its market reach to various international markets, enhancing its global footprint.

In 2023, DHG recorded net revenue of 5,015 billion VND, an increase of 7%, but the cost of goods sold increased by 10% year-over-year (YoY) to 2,672 billion VND. This resulted in gross profit rising by only 4% to nearly 2,344 billion VND.

On the other hand, financial income for the entire year increased significantly by 54% YoY to nearly 218 billion VND, while financial expenses decreased by 10% to nearly 91 billion VND, despite interest expenses still being 2.3 times higher than the same period, at nearly 30 billion VND.

Selling expenses and general administrative expenses increased by 7% and 16% YoY, respectively, to 978 billion VND and 312 billion VND. As a result, by the end of 2023, DHG achieved a pre-tax profit of nearly 1,160 billion VND and a post-tax profit of nearly 1,051 billion VND, an increase of 5% and 6% YoY. This marks the first year that DHG net profit has exceeded 1,000 billion VND since it was listed.

In 2023, the company set targets of 5,000 billion VND in net revenue and 1,130 billion VND in pre-tax profit. Thus, in 2023, DHG successfully met both its revenue and profit targets for the year.

With this result, for 2024, DHG aims for a slight increase in revenue by 4% to 5,200 billion VND, but a decrease in pre-tax profit from 1,160 billion VND to 1,080 billion VND.

3. Traphaco Joint Stock Company

Founded in 1972, Traphaco is well-known for its blend of traditional Vietnamese medicine and modern pharmaceuticals. It went public in 2001, enhancing its ability to raise capital.

Traphaco’s activities include:

- Traditional and Modern Pharmaceuticals: Producing a wide range of products from traditional herbal medicines to modern pharmaceuticals.

- Sustainable Practices: Emphasizing sustainable development and environmentally friendly production methods.

- R&D: Conducting research to integrate traditional medicine with modern techniques, aiming to create innovative products.

- Distribution: Operating an extensive distribution network within Vietnam and expanding its reach to international markets.

- Healthcare Services: Offering health consultation and services through its network of pharmacies and clinics.

In 2023, Traphaco did not achieve the planned revenue and profit targets. Specifically, the company's net revenue from sales and service provision reached only 90% of the plan, equivalent to 2,330 billion VND. Post-tax profit reached 285 billion VND, achieving 87.42% of the planned target.

Explaining the reasons, a company representative stated that Traphaco's revenue from the pharmacy channel (OTC) accounted for over 90% of the company's total revenue, while the completion rate of the OTC channel was 8% below the plan. Additionally, the high gold prices led to higher revenue reductions from the point accumulation and gold exchange program for OTC system customers than planned.

However, revenue from the hospital channel (ETC) grew by 24% year-over-year (YoY), exceeding the plan by 6%, demonstrating that the company has made timely and appropriate adjustments by focusing on developing the segment with a large proportion (two-thirds of the pharmaceutical market) and high growth rate.

Regarding profit, in the context of a challenging economy, the overall OTC market did not grow. The company concentrated resources to ensure the goals of maintaining revenue, market share, and customer trust to guarantee long-term growth. Simultaneously, through strict financial management, the company reduced costs wherever possible to maintain the profit-to-revenue ratio, enhancing overall efficiency.

4. Ha Tay Pharmaceutical Joint Stock Company (Hataphar)

Established in 1965, Hataphar has grown from a small factory into a leading pharmaceutical company. It became a joint-stock company in 2006.

Hataphar focuses on:

- Pharmaceutical Production: Manufacturing a variety of drugs including antibiotics, analgesics, and vitamins.

- Medical Devices: Producing and distributing medical devices and equipment.

- Health Supplements: Developing and marketing dietary supplements and wellness products.

- R&D: Investing in research to develop new products and enhance existing ones, focusing on efficacy and safety.

- Distribution: Utilizing a vast distribution network to ensure the availability of its products across Vietnam.

- Export: Entering international markets to expand its global presence.

In 2023, Hataphar recorded revenue of 2,000.6 billion VND, an increase of nearly 9% compared to the same period. However, post-tax profit decreased by 10% compared to the previous year, reaching nearly 89 billion VND.

As of December 31, 2023, the total assets of Hataphar stood at 1,838.3 billion VND, an increase of 25% compared to the beginning of the year.

Among these, its cash and bank deposits increased significantly by 2.6 times, reaching 381.8 billion VND. Inventory was at 378.9 billion VND, a decrease of 17.7% compared to the beginning of the year.

As of the end of Q4 2023, Hataphar had total liabilities of 771 billion VND, an increase of nearly 15% compared to the beginning of the year. Of this, nearly 504 billion VND was financial debt.

According to the resolution of the extraordinary General Meeting of Shareholders in 2023, Hataphar approved the transfer of capital contribution by Hatay Pharmaceutical and Medical Equipment Joint Stock Company at Hanoi Medical and Pharmaceutical Technical College. As of the date of this financial report, the transfer of the aforementioned capital contribution has not yet been completed. The book value of this investment as of December 31, 2023, was nearly 3.3 billion VND.

5. Imexpharm Corporation

Founded in 1977, Imexpharm has become a leader in the pharmaceutical industry in Vietnam. It transitioned to a joint-stock company in 2001.

Imexpharm’s key activities include:

- Pharmaceutical Production: Producing a broad range of pharmaceuticals such as antibiotics, cardiovascular drugs, and OTC products.

- R&D: Conducting research to innovate and develop new pharmaceutical products, focusing on high-quality standards.

- Quality Control: Implementing stringent quality control measures to ensure the safety and efficacy of its products.

- Distribution: Managing an extensive distribution network that covers both urban and rural areas of Vietnam.

- Export: Expanding its presence in international markets, exporting its products to various countries.

Total revenue in 2023 of the company increased by 26% to reach 2,113 billion VND. This marks a record growth year for the company compared to the overall market growth rate of 8%. EBITDA increased by 31%, ending the year at 466 billion VND, significantly exceeding the company's planned target.

Expenses for the year were well controlled, with selling expenses increasing by 15%, which is lower than the revenue growth rate. General and administrative expenses decreased by 9% as the company continued to improve the efficiency of its processes in both production and sales.

6. Binh Dinh Pharmaceutical and Medical Equipment JSC (Bidiphar)

Established in 1979, Bidiphar has become a key player in Vietnam’s pharmaceutical market. It became a joint-stock company in 2003.

Bidiphar’s operations include:

- Pharmaceutical Production: Manufacturing a wide range of drugs, from essential medications to specialized therapies.

- Medical Equipment: Producing and distributing medical equipment and supplies, catering to hospitals and clinics.

- R&D: Investing in research to develop innovative drugs and medical products, focusing on unmet medical needs.

- Distribution: Operating a comprehensive distribution network to ensure nationwide availability of its products.

- Export: Engaging in the international export of pharmaceuticals and medical equipment.

Despite a less-than-stellar performance in the last quarter of the year, Bidiphar still achieved record highs in both revenue and profit for the entire year of 2023.

Accordingly, the company's net revenue reached 1,657.7 billion VND, an increase of 6% compared to the same period. The largest revenue contributor was the pharmaceutical manufacturing sector, bringing in 1,194.7 billion VND. Pre-tax and post-tax profits reached 320 billion VND and 269.3 billion VND respectively, up by 8% and 11% compared to the same period last year.

In 2023, Bidiphar adopted a relatively cautious business plan with the goal of achieving total revenue of 1,800 billion VND and pre-tax profit almost flat compared to the same period at around 300 billion VND.

With the results achieved, the company accomplished 92% of its revenue target and exceeded nearly 7% of the full-year pre-tax profit target.

As of December 31, 2023, Bidiphar's total assets reached 1,989.6 billion VND, an increase of 94 billion VND compared to the beginning of the year. Among these, cash and cash equivalents amounted to 309 billion VND, up by 12% compared to the beginning of the year.

Inventory increased by 8% to 487.8 billion VND. Construction in progress costs increased by 68% to nearly 163 billion VND, mainly related to the high-tech pharmaceutical manufacturing plant and powder injection line.

Regarding capital, as of December 31, Bidiphar's total liabilities stood at 556.6 billion VND, slightly up compared to the beginning of the year. Short-term loans from BIDV more than doubled to 35 billion VND. Additionally, the company had a long-term loan of 44 billion VND from the Binh Dinh Investment Development Fund.

The enterprise's equity capital reached 1,428 billion VND, consisting of 748 billion VND in contributed capital and 478.6 billion VND in undistributed post-tax profits.

7. Cuu Long Pharmaceutical JSC (Pharimexco)

Founded in 1975, Pharimexco has been a prominent player in Vietnam's pharmaceutical industry. The company transitioned to a joint-stock model in 2000.

Pharimexco focuses on:

- Pharmaceutical Production: Producing generic drugs, prescription medications, and over-the-counter products.

- Medical Devices: Manufacturing and distributing a range of medical devices and supplies.

- R&D: Conducting research to develop new pharmaceutical products and improve existing formulations.

- Distribution: Ensuring a wide distribution network within Vietnam to make its products easily accessible.

- Export: Expanding its market reach to various countries through the export of its pharmaceutical products.

According to the audited Consolidated Financial Statements for 2023, by the end of the year, Pharimexco’s total assets increased from 2,105 billion VND to over 2,277 billion VND; shareholders' equity increased from over 1,391 billion VND to over 1,450 billion VND.

The pharmaceutical industry in Vietnam is thriving, driven by the robust performance and strategic initiatives of these leading companies. With steady growth in revenue and profits, these companies not only cater to the domestic market but also significantly expand their international presence. Their continuous investments in research and development ensure they remain competitive and innovative in the global pharmaceutical landscape.

Interested in assessing the credibility of companies? Simply reach out to sales@vnbis.com to request a report. Alternatively, visit a particular company information page to discover the range of reports we offer!