Published Mar 2024

UOB: Vietnam’s GDP to reach 5.5% in the first quarter

According to experts from UOB, the GDP growth rate of Vietnam will be about 5.5% over the same period due to the impact of the Lunar New Year holiday. Although GDP growth in the first quarter of this year is not as high as the target of 6.0 -6.5%, it has increased significantly compared to 3 the first quarter of 2023.

Strong recovery in the 2H2024

UOB's Vietnam economic growth forecast report for the first quarter of 2024 points out that the general momentum in the manufacturing and external trade sectors is showing positive signs.

Specifically, exports in the first two months of the year increased by 17.6% over the same period in 2023, industrial production also increased by 5.7%, much higher than the -2.2% result of the same period in 2023. The average PMI of the first two months of 2024 is also above 50, compared to an average of 49.3 for the same period in 2023.

With such figures, experts from UOB expect the recovery to be strong in the second half of 2024 when the semiconductor sector strengthens and central banks begin to shift to more accommodative interest rate policies.

The report from UOB states that, while risks from external events continue to weigh on the global economic outlook (including conflicts in Eastern Europe and the Middle East), Vietnam's prospects are strengthened by the recovery of the semiconductor industry, steady growth in China and the region, as well as a shift in supply chains in favor of Vietnam and ASEAN.

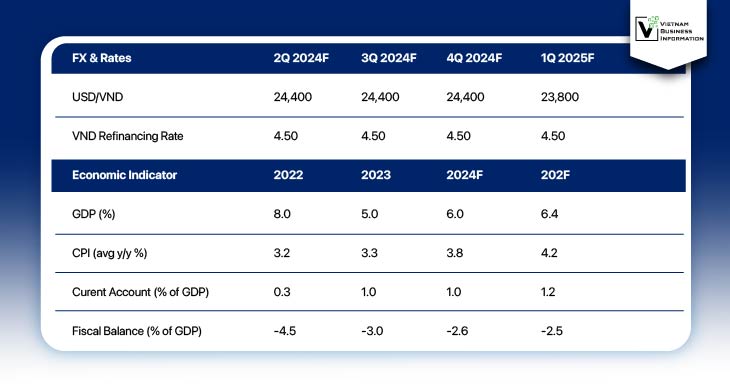

"We maintain Vietnam's growth forecast at 6.0% for 2024, and inflation at about 3.8% which is within the Government's official target of 6.0 - 6.5%", the UOB experts forecast.

For the first quarter of 2024 alone, it is expected that the GDP growth rate will decrease to 5.5% over the same period due to the impact of the Lunar New Year holiday. This growth rate, despite being lower than the target of 6.0 - 6.5%, increases compared to the level of 3.3% in the same period last year. In fact, the first quarter normally sees the lowest GDP growth of the year.

Forecast by UOB

Policies of the SBV

Assessing the policy management of the State Bank of Vietnam (SBV), UOB experts said that the SBV responded promptly to the economic downturn early last year by quickly cutting interest rates.

The last reduction in interest rates took place in June 2023, when the refinancing rate was cut by a total of 150 basis points, to 4.5%. With the fast pace of economic recovery, the possibility of cutting interest rates is limited. Therefore, UOB estimates that the State Bank will keep the refinancing interest rate at the current level of 4.5%.

Instead of continuing to lower interest rates with restrictions on calculating the lower bound, the Government has shifted its focus to non-interest rate measures to support the economy. One of them is the delivery of credit to borrowers (i.e. quantitative measures).

In 2023, bank credit growth reached about 13.5% over the same period, slightly lower than the target of 14 - 15% set for the year, as regulators require banks to simplify lending procedures and improve businesses' access to bank loans. For 2024, the State Bank aims to promote credit growth to about 15% with the ability to flexibly adjust based on economic developments during the year.

Source: UOB

Compiled by VBI