Published Jan 2024

Updates on banks’ business results for 2023

Despite experiencing a difficult year, many banks recorded strong recovery in business results in the fourth quarter. There are currently at least 4 banks with pre-tax profits exceeding 1 billion USD in 2023.

Banks with billion-dollar profits

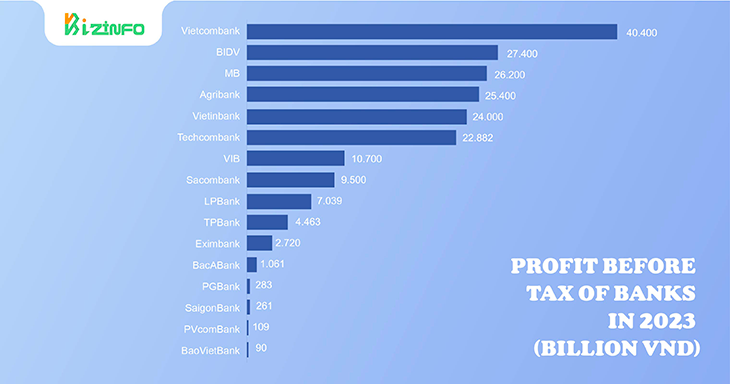

As of January 23, a total of 16 banks had announced business results for the fourth quarter and the whole year of 2023.

Among them, 7 banks have provided detailed financial reports and 4 banks recorded profits exceeding the billion USD level in 2023 such as Vietcombank, BIDV, Agribank, and MB.

Vietcombank is currently leading the entire industry with individual profits in 2023 estimated at 40,400 billion VND, an increase of 10.2% over the same period.

It is likely that BIDV will rank second with individual pre-tax profit of 26,750 billion VND, consolidated pre-tax profit of 27,400 billion VND, an increase of nearly 19% over the same period. Agribank reported individual pre-tax profit at between 25,300 and 25,400 billion VND.

Meanwhile, VietinBank said its pre-tax profit exceeded the plan, at over 24,000 billion VND, an increase of 20% compared to last year.

In the group of joint stock banks, MB recorded positive results with the parent bank's pre-tax profit reaching 24,688 billion VND, and the bank's consolidated profit reaching 26,200 billion VND.

On the bank profit ranking, there were 7 banks recording profits exceeding 10,000 billion VND, in addition to the above-mentioned giants, there were also Techcombank (22,882 billion VND) and VIB (10,700 billion VND).

Besides, some banks have also revealed their profits in 2023 such as Sacombank, LPBank, TPBank, Eximbank, Bac A Bank, PGBank, Saigonbank, PVcomBank, and BaoViet Bank.

Profits increased sharply in the fourth quarter

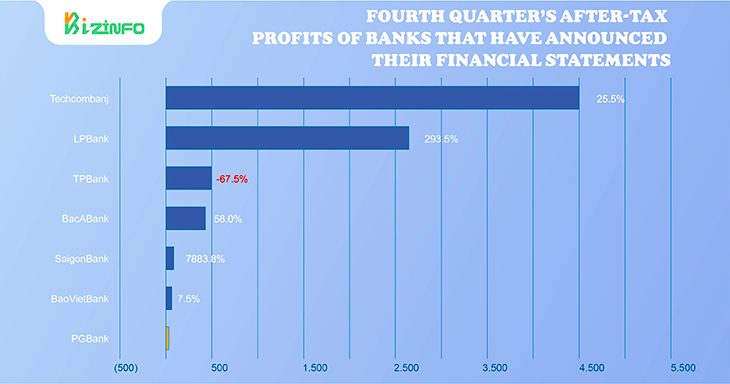

In general, banks that have released their fourth-quarter financial reports all recorded a recovery in profits. However, 2/7 banks still reported a decrease in profit or loss in the last quarter.

According to the financial report of Saigon Joint Stock Commercial Bank for Industry and Trade (SaigonBank - Code: SGB), profit after tax in the fourth quarter reached 66.9 billion VND, nearly 80 times higher than the same period last year. This is also the highest fourth-quarter profit since the bank began publishing quarterly financial reports.

Thanks to positive results in the last quarter of the year, Saigonbank's yearly after-tax profit increased by 40.4% compared to last year, reaching 266.8 billion VND, and pre-tax profit at 332.2 billion VND.

LPBank (Code: LPB) reported fourth-quarter after-tax profit of 2,627.9 billion VND, up 293.5% over the same period last year, ranking second in profit growth rate, only behind Saigonbank.

For the whole year, LPBank's profit after tax reached 5,572.2 billion VND, up 23.5% over the same period. Pre-tax profit for the fourth quarter and the whole year was VND 3,352.6 billion and VND 7,039.4 billion, respectively - the highest profit levels in the bank's history.

Ranked third is Bac A Bank with profit after tax in the fourth quarter growing by nearly 60%, reaching 410.2 billion VND. In 2023, this bank's after-tax profit was at 854.4 billion VND, an increase of 2.6%. Bac A Bank's pre-tax profit in the fourth quarter and 2023 was 509.6 billion VND and 1,060.8 billion VND, respectively.

In the fourth quarter, profits from trading investment securities and other business activities supported Bac A Bank's profits, in the context of net interest income, services and foreign exchange trading all going down.

On January 22, Techcombank announced its business results for the fourth quarter of 2023 with profit after tax reaching 4,482 billion VND, an increase of 25.5% over the same period last year. The bank's profit after tax in 2023 was nearly 18,200 billion VND, down 11% over the same period.

Source: vietnambiz

Compiled by VBI