Published Jun 2025

Vietnam Footwear Export Industry: Growth Momentum, Global Markets, and Strategic Shifts in 2025

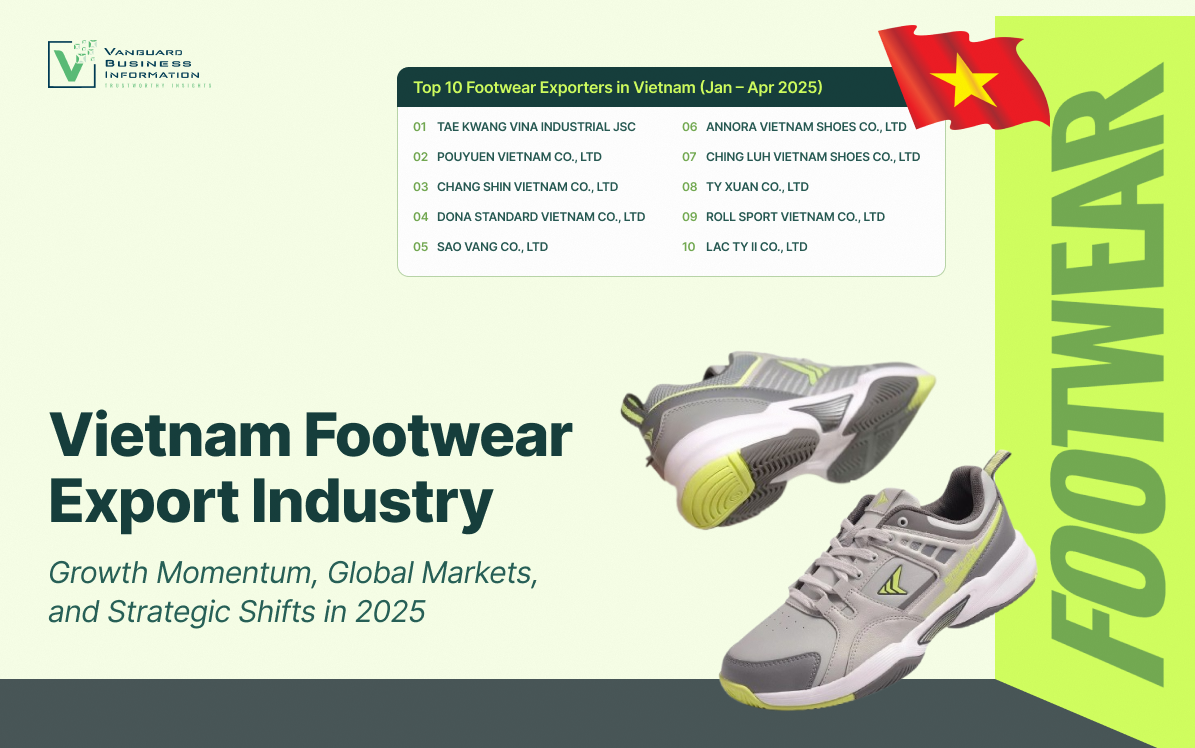

Vietnam’s footwear industry isn’t just holding steady—it’s redefining global supply chains. As demand shifts and trade routes evolve, Vietnam has surged ahead as one of the world’s leading footwear exporters, supplying major markets like the U.S., EU, and Japan. But behind this growth lies a complex story of rising export volumes, tightening margins, and a new generation of industrial giants—including names like TAE KWANG VINA, POUYUEN, and CHANG SHIN.

Vietnam’s footwear industry continues to solidify its status as a global manufacturing powerhouse, reporting significant export growth in the first five months of 2025. Amid changing international trade dynamics and increasing sustainability expectations, Vietnamese exporters are managing both unprecedented opportunities and structural challenges.

Strong Export Performance in the First Five Months of 2025

According to preliminary data from the Vietnam Customs Department, Vietnam’s total footwear exports reached USD 9.90 billion in the first five months of 2025, reflecting a 13.1% year-on-year increase. This surge is driven by strong demand from key markets, including the United States, European Union, Japan, and Canada.

In May 2025 alone, footwear exports were estimated at USD 2.3 billion, up 3.3% from April and 9.1% over May 2024. The steady monthly growth reflects Vietnam's capacity to maintain output and fulfill international orders amid global supply chain disruptions.

Key Export Markets: U.S. and EU Lead the Way

The United States remains Vietnam’s largest footwear export market, accounting for 37.1% of total export value in April 2025, followed by the European Union with 25.6%. Notably, exports to the U.S. rose by 22.0% and to the EU by 24.4%compared to the same month last year.

Other markets also showed impressive growth during the first four months of the year:

- Mexico: up 57.3%

- Canada: up 18.2%

- Japan: up 14.3%

- Australia: up 14.6%

- United Kingdom: up 10.7%

These figures demonstrate Vietnam’s increasing competitiveness and geographical diversification in global footwear trade.

Strategic Opportunities from Free Trade Agreements

Vietnam’s participation in key trade agreements such as the EVFTA and CPTPP provides substantial tariff advantages and market access opportunities. However, Vietnamese exporters must comply with stringent rules of origin, social responsibility commitments, and environmental standards to fully leverage these FTAs.

Industry Challenges: Trade Policies and Supply Chain Shifts

The Vietnamese footwear sector faces heightened risks from global trade uncertainties, particularly policy changes in the U.S. and EU. Additionally, supply chain relocation trends are pressuring Vietnamese firms to compete with emerging hubs like Indonesia, Bangladesh, and India, where labor and compliance costs may be lower.

Moreover, major global brands—including Nike, Adidas, and Puma—are tightening sustainability requirements. Vietnamese suppliers must now demonstrate compliance with ESG standards, ethical labor practices, and low carbon footprints to retain contracts.

Innovation and Automation: The Future of Vietnamese Footwear

To maintain global competitiveness, many Vietnamese manufacturers are accelerating the adoption of Industry 4.0 technologies, such as:

- AI-powered production planning

- IoT-integrated supply chains

- Blockchain for material traceability

- Robotic assembly lines and renewable energy adoption

These innovations not only optimize cost structures but also align with buyers’ sustainability mandates.

Toward a Greener Supply Chain

Vietnamese footwear exporters are increasingly investing in green production practices, such as using recycled materials, applying LEED certifications, and complying with BSCI and SA8000 standards. Building a sustainable supply chain is now essential—not just for reputation, but also for market survival.

Top 20 Footwear Exporters in Vietnam (Jan–Apr 2025)

The following companies led the industry in export value during the first four months of 2025:

|

Rank |

Company Name |

Export Value (USD '000) |

|

1 |

363,512 |

|

|

2 |

326,169 |

|

|

3 |

289,934 |

|

|

4 |

170,255 |

|

|

5 |

156,742 |

|

|

6 |

149,255 |

|

|

7 |

128,520 |

|

|

8 |

118,691 |

|

|

9 |

117,067 |

|

|

10 |

111,865 |

|

|

11 |

109,387 |

|

|

12 |

108,933 |

|

|

13 |

105,086 |

|

|

14 |

102,677 |

|

|

15 |

101,501 |

|

|

16 |

97,602 |

|

|

17 |

96,988 |

|

|

18 |

94,404 |

|

|

19 |

91,989 |

|

|

20 |

83,874 |

These firms are recognized not only for their export volume but also for their role in driving innovation, employment, and compliance with international standards.

Conclusion

Vietnam’s footwear industry stands at a pivotal juncture in 2025. With strong export growth and diversified market presence, it holds vast potential. However, long-term success will depend on how effectively Vietnamese firms adapt to global trade pressures, technological shifts, and sustainability expectations.

For international buyers, sourcing from Vietnam remains a strategic choice—but the bar for compliance and innovation continues to rise.