Published Aug 2025

Vietnamese Banks Report Record Profits in H1 2025 with Strong Credit Growth

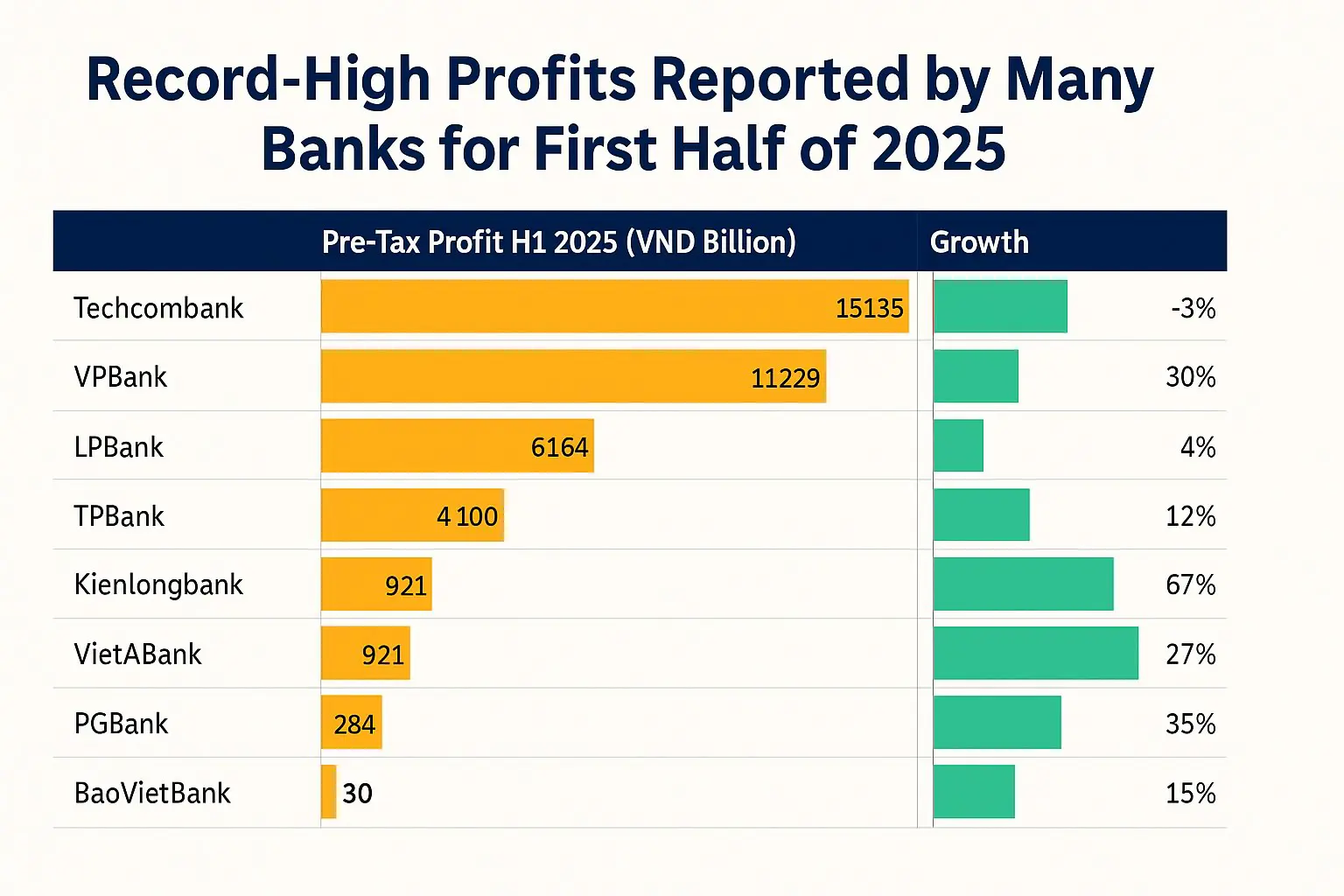

Vietnam’s banking sector delivered a stellar performance in the first half of 2025, with many commercial banks reporting record-breaking profits and robust credit growth. Despite global economic uncertainties, Vietnamese banks demonstrated strong financial health through expanding loan portfolios, improved asset quality, and operational efficiency. The following report highlights key figures and performance metrics from leading banks, offering a snapshot of the industry’s resilience and momentum heading into the second half of the year.

Vietnam’s banking sector has delivered a strong performance in the first half of 2025, with many commercial banks achieving record-high profits and double-digit credit growth. Despite macroeconomic uncertainties, banks continue to strengthen their balance sheets, improve operational efficiency, and expand market presence. This mid-year review summarizes the business results of top-performing banks in Vietnam based on pre-tax profits, credit growth, and asset expansion.

VPBank Surpasses VND 11.2 Trillion in H1 Pre-Tax Profit

By the end of June 2025, VPBank became the largest private bank in Vietnam by consolidated assets, exceeding VND 1.1 quadrillion, with standalone assets nearing VND 1.05 quadrillion. Total outstanding credit reached over VND 842 trillion, up 18.6% year-to-date and 30.3% year-over-year, driven by strong performance from both the parent bank and subsidiaries.

VPBank’s consolidated pre-tax profit in H1/2025 stood at VND 11,229 billion, marking a 30% YoY increase. The bank also recorded VND 6,215 billion in profit for Q2 alone, completing 44% of its full-year profit plan.

Techcombank Leads in Profit with VND 15.1 Trillion Despite Slower Growth

Techcombank recorded the highest pre-tax profit in the industry at VND 15,135 billion for the first six months of 2025. Q2 profits reached VND 7,898 billion, up slightly by 0.92% YoY. However, net interest income dropped by 2.98% to VND 17,442 billion due to rising deposit and bond issuance costs.

The bank’s total assets crossed VND 1 quadrillion, a 6% increase since the beginning of the year. Lending rose by 12.44% to over VND 710 trillion, while customer deposits reached VND 545 trillion and bond issuance climbed 22.73% to VND 172 trillion.

LPBank Achieves Record H1 Profit of VND 6.16 Trillion

LPBank posted a first-half pre-tax profit of VND 6,164 billion, the highest in its history and up 4.1% YoY. Non-interest income contributed 27% to total operating income, which totaled VND 9,601 billion, while the cost-to-income ratio (CIR) remained low at 28.92%.

As of June 2025, the bank’s credit outstanding reached VND 368.7 trillion, up 11.2%, and total assets stood at VND 513.6 trillion. LPBank maintained a healthy NPL ratio of 1.74%.

TPBank Reports VND 4.1 Trillion Profit, Leads in H1 Growth Among Peers

TPBank’s estimated pre-tax profit in H1/2025 exceeded VND 4,100 billion, representing a 12% increase YoY. The bank focused its credit on high-margin segments such as retail, consumer finance, and controlled real estate.

TPBank’s credit growth reached 11.7%, and total assets climbed to VND 428.6 trillion, achieving 95% of the full-year plan. Total mobilized capital stood at VND 377.5 trillion, up 19% year-over-year.

Kienlongbank Delivers 67% Profit Growth – Best in the Sector

Kienlongbank reported a consolidated pre-tax profit of VND 921 billion in H1/2025, up 67% YoY. Q2 profit alone reached VND 565 billion, the highest since Q1/2021.

Total assets reached VND 97.63 trillion (+5.9% YTD), with customer loans at VND 69.5 trillion (+13.2%). The NPL ratio declined from 2.02% to 1.96%, and customer deposits rose 15.2%, the bank’s highest six-month growth in recent years.

Nam A Bank Records VND 2.5 Trillion Profit, Assets Up 30%

Nam A Bank announced a pre-tax profit of over VND 2,500 billion, increasing 14% YoY. The bank sustained a high ROE of nearly 20% and ROA of 1.5%.

Total assets surged by over 30% to nearly VND 315 trillion, while credit outstanding rose 14.7% to VND 193 trillion. Deposits also jumped 22% to VND 211 trillion, reflecting strong market trust and liquidity.

VietABank Profit Reaches VND 714 Billion, Exceeds 55% of 2025 Target

VietABank posted a first-half pre-tax profit of VND 714 billion, completing over 55% of its annual plan and growing 27% YoY. Total assets rose to VND 133.95 trillion, an increase of VND 14.1 trillion.

Outstanding loans climbed 9.39%, and customer deposits rose by VND 5.5 trillion. The CASA ratio increased 29%, reducing funding costs. ROE stood at 13.71%, ROA at 1%, and the NPL ratio improved from 1.37% to 1.11%.

PGBank Nearly Doubles Profit in Q2, H1 Profit Up 35%

PGBank’s Q2/2025 pre-tax profit soared 98.3% YoY to VND 188 billion, while H1 profits rose 35% to VND 284 billion. The bank’s assets totaled VND 78.6 trillion, with lending growing 10.2% and deposits rising 7.8%.

However, NPLs increased 42.4%, totaling VND 1.51 trillion, calling for tighter credit risk management in upcoming quarters.

NCB Sees Explosive Growth: 77-Fold Increase in Profit

NCB reported a post-tax profit of VND 462 billion in H1/2025, up from just VND 6 billion in the same period last year—a 77-fold increase. Q2 contributed over VND 311 billion to this total.

Total assets reached VND 144.05 trillion, surpassing its full-year target of VND 135.5 trillion. Customer loans grew 22%to VND 86.8 trillion, and total funding rose 19.6% to VND 120.1 trillion.

Positive Outlook for Vietnam's Banking Sector in 2025

Vietnamese banks have made strong strides in the first half of 2025, with most institutions exceeding 50% of their annual profit targets and credit growth rates consistently above 10%. As digital transformation accelerates and economic conditions stabilize, the sector is well-positioned to sustain its growth trajectory into the second half of the year.