Published Jan 2024

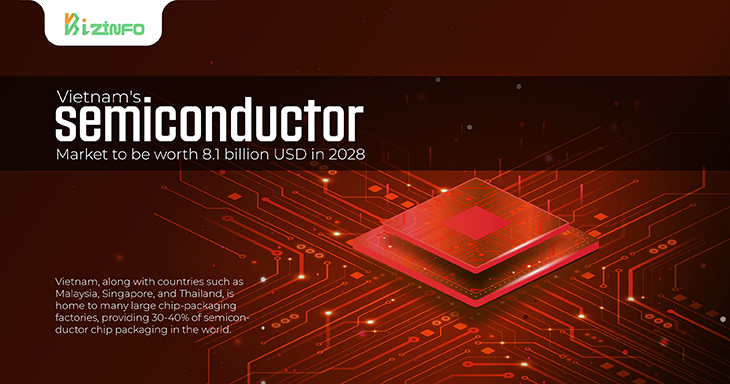

Vietnam's semiconductor market to be worth 8.1 billion USD in 2028

Vietnam, along with countries such as Malaysia, Singapore, and Thailand, is home to many large chip-packaging factories, providing 30-40% of semiconductor chip packaging in the world.

Strict requirements for production

According to the American Semiconductor Industry Association (SIA), to make a semiconductor chip, there are 3 basic stages: design, production, and finally testing and packaging.

The design stage accounts for about 53% of the value in the chip, the production stage accounts for 24% while the testing and packaging stage accounts for 6%. Vietnam currently mainly focuses on the stage with the lowest added value in the chain, which is the last stage.

To develop the semiconductor industry, Vietnam has two options: one is to upgrade to the open design-production stage, and the other is to continue expanding in the assembly-packaging and testing stages.

![]()

Regardless of the choice, meeting the requirements of the semiconductor industry is not easy. In the context of the global minimum tax taking effect from the beginning of this year, foreign businesses are no longer interested in tax incentives but are interested in preferential policies and overall support, including infrastructure and human resources.

Currently, Southeast Asia is considered an important base on the global semiconductor map. Experts say that providing infrastructure and human resources for the semiconductor industry is very important.

Vietnam, along with countries such as Malaysia, Singapore, and Thailand, is home to many large chip-packaging factories, providing 30-40% of semiconductor chip packaging globally.

A billion-dollar market

Vietnam’s semiconductor market is predicted to reach 8.1 billion USD by 2028, achieving a growth rate of 12.6% in the period 2023-2028, according to a report by IMARC Group.

Semiconductor materials are widely used in various industries across Vietnam, and the market size currently reaches 3.8 billion USD by 2022, the report said.

As demand for electronics continues to increase globally, manufacturing facilities need to increase production volumes to meet consumer demand. This increase in production requires a corresponding increase in semiconductor materials to make electronic components.

Furthermore, to maintain a competitive edge, electronics manufacturers regularly adopt the latest technologies, often requiring new materials with enhanced properties.

In addition, Vietnamese semiconductor companies are incorporating 3D packaging to maintain competitiveness in the market. The application of these technologies, such as through-silicon and stacked die configurations, has improved the performance and energy efficiency of semiconductor devices. These innovations enable the integration of multiple chips into a single package, reducing size and enhancing functionality.

![]()

Furthermore, technological advances have led to the development of advanced semiconductor materials. These materials offer outstanding electrical and thermal properties, making them ideal for high-performance applications in power electronics, wireless communications, and the automotive sector. Vietnamese semiconductor manufacturers are taking advantage of these materials to create more efficient and reliable devices.

As Vietnam’s electronics manufacturing industry focuses on exports, semiconductor material suppliers can enter the global market through partnerships with local manufacturers. This presents an opportunity for suppliers to meet international demand while benefiting from Vietnam’s competitive manufacturing landscape.

Source: theleader

Compiled by VBI