Published Jan 2026

Vietnam’s Shrimp Exports Hit a Historic High in 2025

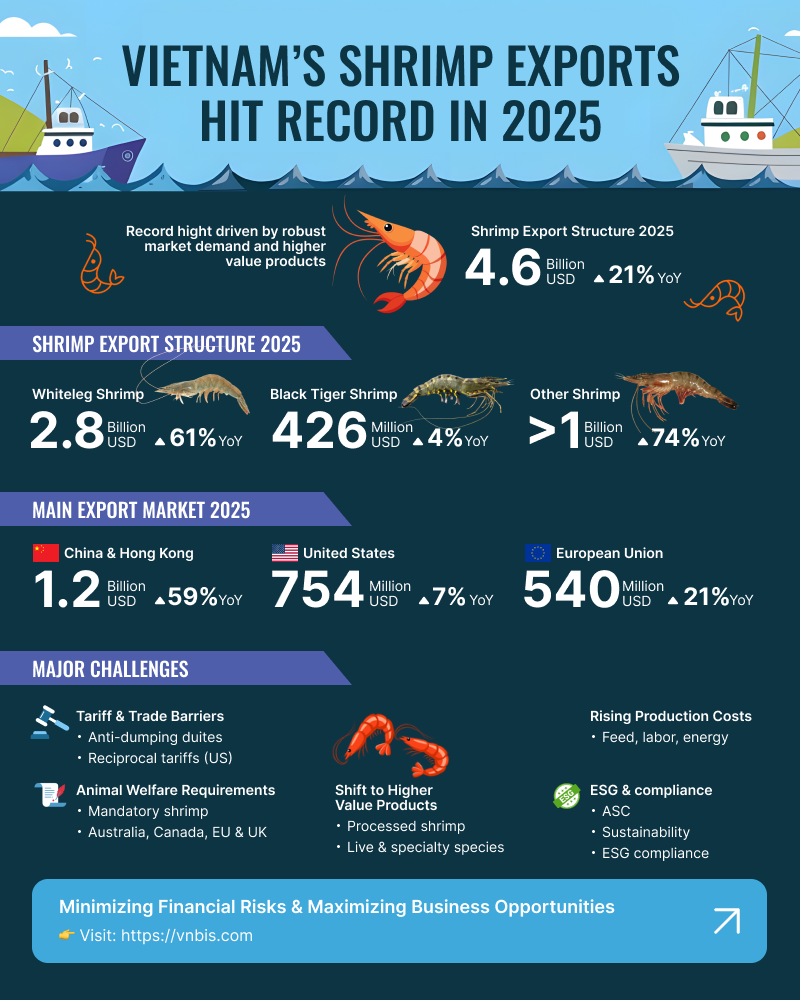

Vietnam’s shrimp industry closed 2025 with a historic milestone, as export turnover is projected to reach a record USD 4.6 billion despite rising trade barriers and intensifying global competition. Behind the impressive growth figures lies a deeper structural shift toward higher-value products, expanding CPTPP markets, and mounting challenges from tariffs, sustainability standards, and animal welfare requirements that are reshaping the industry’s future.

Overview: Backbone of Vietnam’s Seafood Exports

Vietnam’s shrimp industry remains the single most important pillar of the country’s seafood export sector. In 2025, shrimp exports are estimated to reach USD 4.6 billion, the highest level ever recorded, reaffirming shrimp’s role as the primary growth engine for Vietnam’s fisheries economy. According to preliminary statistics from Vietnam Customs, cumulative shrimp export turnover in the first 11 months of 2025 reached USD 4.3 billion, up 21% year on year, significantly outperforming most other seafood categories.

This growth occurred in a global context still marked by geopolitical tensions, inflationary pressures, and uneven consumer recovery. While many seafood-exporting countries struggled with declining demand or falling prices, Vietnam’s shrimp sector demonstrated notable resilience, supported by diversified markets, improved product mix, and a gradual shift toward higher-value segments such as processed shrimp and live lobster.

From a production perspective, shrimp farming remains concentrated in the Mekong Delta, particularly in Ca Mau, Soc Trang, Bac Lieu, and Kien Giang. Whiteleg shrimp continues to dominate output due to shorter farming cycles and higher productivity, while black tiger shrimp and specialty species retain importance in premium and niche markets.

Export: Value Growth over Volume Expansion

In terms of product structure, whiteleg shrimp accounted for USD 2.8 billion, representing 64.8% of the total shrimp export value in the first 11 months of 2025. Black tiger shrimp exports reached USD 426 million, up 4% year over year, indicating relatively stable demand in traditional high-end markets.

The most striking development, however, was the sharp rise in the category of “other shrimp,” which exceeded USD 1 billion, surging 74% compared with the same period last year. This growth was driven primarily by exports of live and frozen lobster to China and Hong Kong, significantly lifting the industry’s average export value and signaling a clear move toward higher-priced products.

This structural shift is economically significant. Rather than relying solely on volume growth, Vietnam’s shrimp industry is increasingly leveraging product differentiation, processing depth, and species diversification to offset rising costs and maintain profitability in a more competitive global environment.

Market: China, CPTPP & Others

China and Hong Kong remained Vietnam’s largest shrimp export markets in 2025, with combined export value reaching USD 1.2 billion in the first 11 months, accounting for over 28% of total shrimp exports and growing 59% year on year. Demand remained strong for live, fresh, and frozen shrimp, particularly live lobster, despite short-term monthly fluctuations.

However, competition in this market has intensified. Ecuador and India continue to dominate the low-price segment, while Thailand and Vietnam compete directly in high-end and processed products. In addition, China’s tighter customs controls, stricter traceability requirements, and evolving border trade policies are increasing compliance costs and operational risks for exporters.

In contrast, CPTPP markets emerged as a critical stabilizing pillar. Shrimp exports to CPTPP member countries reached USD 1.2 billion, up 32% year on year. Japan remained the largest CPTPP market with USD 535 million, supported by strong demand for processed shrimp serving retail and foodservice channels. Australia, Canada, and the UK also maintained steady growth, helping Vietnam reduce reliance on any single market.

The US & EU: New Tariff & Regulatory Pressure

Shrimp exports to the United States reached USD 754 million in the first 11 months of 2025, up 7% year on year, but momentum weakened in the second half of the year. November exports alone declined 7%, reflecting the impact of trade defense measures. High preliminary anti-dumping duties under POR19, combined with reciprocal tariffs, significantly increased compliance costs.

Export prices to the US rose sharply. In Q3 2025, Vietnamese whiteleg shrimp exported to the US was priced at USD 12.8–14.1/kg, while black tiger shrimp reached USD 17.9–20.4/kg, reducing price competitiveness compared with Ecuador and South Asian suppliers. As a result, many exporters adopted a more “defensive” strategy, accelerating shipments ahead of new tariff timelines.

According to VNBIS data, the EU market, by contrast, showed a clearer recovery. Shrimp export value to the EU reached USD 540 million in the first 11 months, up 21% year on year, with Germany, Belgium, and the Netherlands leading growth. Demand benefited from temporary supply shortages from India and Indonesia, as well as rising preference for processed products with sustainability certifications.

Animal Welfare: A New Technical Barrier

Beyond tariffs, the most profound structural challenge facing Vietnam’s shrimp industry lies in non-tariff technical barriers, particularly animal welfare requirements in the EU and the UK. Major retailers such as Tesco, Marks & Spencer, Sainsbury’s, and Waitrose are shifting from voluntary guidelines to mandatory requirements for shrimp stunning (primarily electrical) prior to icing, replacing traditional cold-shock methods.

These requirements cannot be addressed through paperwork or standard certification alone. Exporters must invest in new harvesting and pre-processing technologies, redesign operational workflows, and ensure strict control during live shrimp transportation. Electrical stunning systems require substantial upfront capital, while profit margins are already under pressure from rising feed costs, labor expenses, and expanding ESG compliance obligations.

From a competitive standpoint, these changes favor countries with large-scale, vertically integrated production systems and high certification coverage. Ecuador, for example, has a significantly higher proportion of ASC-certified shrimp and tighter farm–processing integration, allowing smoother adaptation. India, with low costs and rapid scaling, is also strengthening its EU market position.

Enterprises, Farmers, and the Outlook for 2026

For Vietnam, the challenge is not only technological but structural. Small and medium-sized enterprises (SMEs) and smallholder farmers account for a large share of the shrimp export supply chain. Without coordinated support mechanisms, there is a real risk that stricter standards could widen the gap between large corporations and SMEs, leading to supply chain fragmentation and reduced overall competitiveness.

Despite these challenges, leading companies such as Minh Phu Seafood Corporation, STAPIMEX, Sao Ta Foods JSC, Camimex Group, and Ca Mau Seafood Processing and Service JSC are already investing in traceability systems, processing automation, and certified farming models to stay ahead of regulatory and market shifts.

Looking ahead to 2026, the outlook is cautious but not pessimistic. Tariff pressures in the US, increasing competition in China, and rising domestic production costs will continue to be major constraints. However, if Vietnam continues to expand into markets such as the CPTPP, the EU, and the Middle East, and accelerates the shift toward higher-value, certified, and premium products, the shrimp industry still has potential to grow, though in a more selective, quality-focused way.