Published Jan 2024

Vietnam’s stock market facing attractive opportunities from low valuations

VCBF sees that a long-term recovery trend of the stock market is forming, led by both fundamental and supporting factors.

A golden time for investors

According to a recent analysis, Vietcombank Fund Management (VCBF) said that the possibility of the US falling into economic recession in 2024 cannot be ruled out. This possibility is currently being assessed as having a very low probability of occurring. Therefore, this period is a golden time for investors to increase their investment assets in stock fund certificates, with significant expectations in 2024 and the following years.

Macroeconomics has shown signs of recovery. The Government will continue to maintain an expansionary monetary policy to support economic growth. Along with the long-term trend of decreasing interest rates on the path of economic development, savings will no longer be an attractive investment channel.

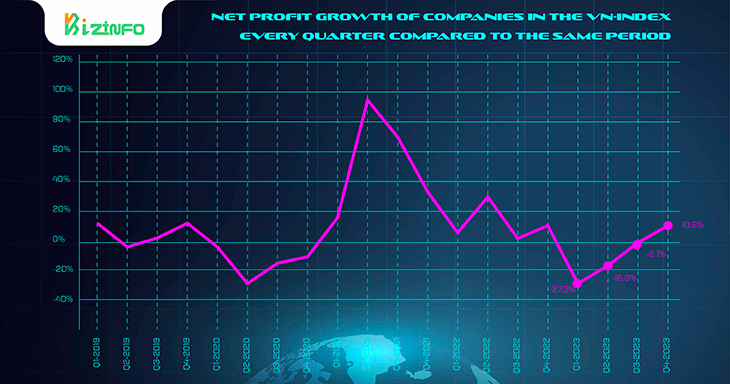

Listed company profits are expected to start recovering from the fourth quarter of 2023. According to data compiled by Bloomberg, VN-Index's profit per share decreased by 27.3% in the first quarter of 2023, 16.2% in the second quarter of 2023, and 2.1% in the third quarter of 2023 but was expected to see positive growth from the fourth quarter of 2023. The increase is forecast to be 9.7% in the last quarter of 2023 and 28.8% in 2024 (forecast data updated on December 25, 2023).

Attractive valuations

According to VCBF, profits of corporates recovered thanks to improved macroeconomic conditions, increased consumer demand, and reduced interest costs. For the banking industry, the one that accounts for the largest proportion of the market, profits are expected to improve when bad debt shows signs of improvement and the net interest margin (NIM) stabilizes after a period of decline.

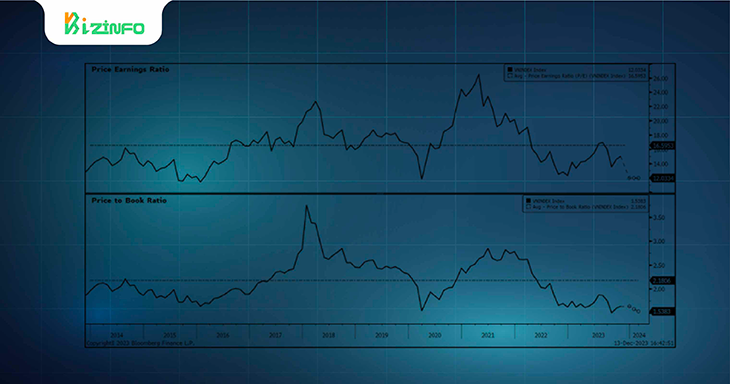

The stock market has attractive valuations with low P/E and P/B valuation indices. Specifically, P/E based on forecast profits in 2024 is only 11.8 times, significantly lower than the 10-year average of 14.1 times. VN-Index's P/B is at a low level of 1.6 times - a valuation level that has only appeared a few times in the history of the Vietnamese stock market.

Meanwhile, the supporting factor is that the Government is taking drastic actions to upgrade Vietnam to an emerging market by 2025. This will help attract foreign investment capital into the stock market.

Source: VCBF, Bloomberg

Compiled by VBI