Published Sep 2025

Vietnam’s Stock Market in September 2025: Growth Hopes Amid Structural Risks

Vietnam’s stock market enters September 2025 with renewed momentum but rising caution. While hopes are high for an FTSE upgrade and a potential Fed rate cut, risks tied to valuation, foreign outflows, and margin pressure remain. This article explores the VN-Index’s recent surge, technical resistance levels, and key sectors likely to lead or lag in the months ahead.

Vietnam's stock market enters September 2025 at a crossroads, riding on renewed investor optimism and strong macroeconomic fundamentals, yet facing underlying structural risks. With speculation mounting about a possible upgrade by FTSE Russell and expectations of a U.S. Federal Reserve rate cut, the VN-Index continues to climb—but the path ahead may be less predictable than it seems.

FTSE Upgrade Could Boost Market Momentum

One of the key themes dominating sentiment this month is FTSE Russell’s potential reclassification of Vietnam from a frontier to an emerging market. Such an upgrade could significantly enhance Vietnam's visibility on the global investment map, attracting large-scale foreign institutional flows.

This comes at a time when the domestic policy environment remains highly accommodative. The Vietnamese government continues implementing pro-growth measures, while GDP forecasts for the second half of 2025 remain robust. The "cheap money" environment—characterized by stable interest rates and fiscal stimulus—has provided a solid foundation for market recovery.

Substantial Gains in August Set the Stage

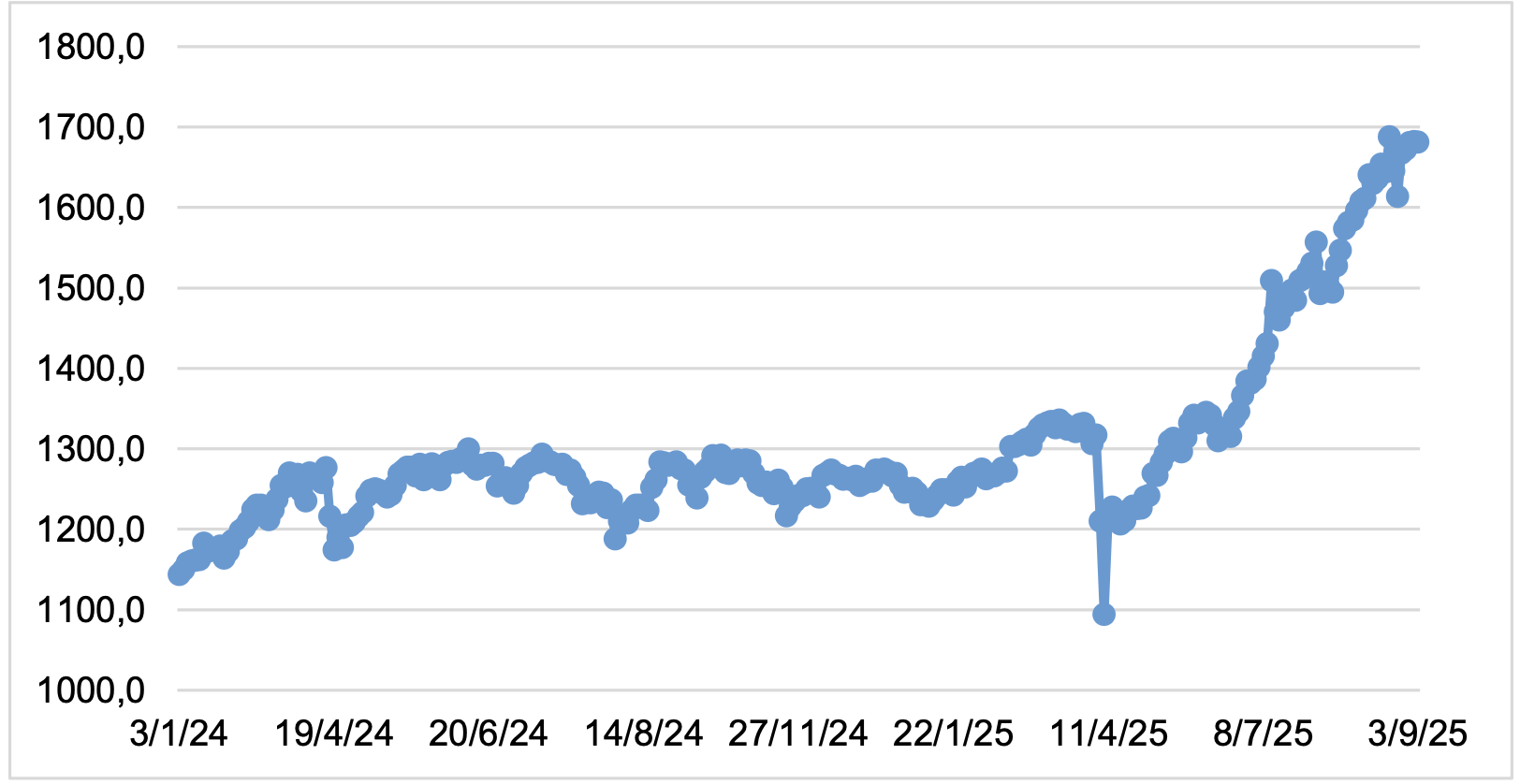

By the end of August 2025, the VN-Index had closed at 1,682 points, a 12% increase from July, and approached the psychological barrier of 1,700 points. Although the rally reflects improved sentiment, technical indicators reveal some exhaustion. Trading volumes surged during sell-offs and waned during rallies, suggesting a cautious undertone among investors.

Source: Compiled from exchange data

The chart above shows that the VN-Index has rebounded sharply from a mid-year dip, but now faces resistance. The 1,625–1,650 range is considered short-term support, with 1,780 as the upper bound. Beyond this, the market’s direction will likely depend on external catalysts and internal rebalancing.

Margin Lending & Foreign Outflows: Red Flags?

While market momentum remains strong, signs of fragility are also emerging. Margin lending has crossed 5% of total market capitalization since Q2/2025—a level that increases volatility and raises risk. Several brokerage firms have already reached their margin limits, curbing further speculative buying, particularly in bank stocks.

In parallel, the USD/VND exchange rate has been under pressure, triggering foreign investor outflows. August witnessed over VND 30 trillion in net foreign selling across Vietnam’s three stock exchanges—one of the highest monthly sell-offs in years. Although proprietary trading desks briefly became net buyers mid-month, they returned to selling as the market rebounded.

A Fed Rate Cut Could Be a Game-Changer

Looking abroad, attention is turning to the U.S. Federal Reserve’s September meeting. Following months of monetary tightening, a potential rate cut of 0.25 percentage points could ease global financial conditions. For Vietnam, this may relieve pressure on the exchange rate and open up more room for domestic monetary easing.

The State Bank of Vietnam (SBV) has already intervened in the forex market, selling USD on 180-day forward contracts at a capped rate of 26,550 VND/USD. Combined with this intervention and FTSE-related optimism, a Fed cut could reverse foreign investor outflows and stabilize capital markets.

Valuation Check: Attractive but Not Undervalued

Vietnam’s current P/E ratio stands at around 15x, above the 10-year average and the highest level since 2021. However, it is still lower than the market’s peak valuation when the VN-Index hit 1,500 points. Compared to regional peers Singapore (14.6x), Malaysia (14.4x), and Indonesia (12x), Vietnam now appears more expensive.

Yet Bloomberg’s forward P/E projection of 12.8x for 2025 suggests room for growth, supported by projected EPS increases of 18–20% year-on-year. Analysts agree that investors are no longer buying just on valuation multiples, but on confidence in listed companies’ earnings resilience.

Cautious Optimism as September Unfolds

Despite the strong performance, history urges caution. From 2000 to 2024, the VN-Index declined an average of 0.7% in September, making it the worst-performing month in the calendar year. ETF portfolio rebalancing often heightened market volatility during this period, and analysts expect this trend to continue.

September’s weakness has historically paved the way for year-end rallies. October consolidations have often laid the groundwork for substantial gains in November and December—suggesting long-term investors may find opportunities amid short-term turbulence.

Sector Rotation in Focus

Much of the recent rally has centered on large-cap banks and real estate firms. However, capital is now expected to rotate into other areas. Public investment themes—such as construction, infrastructure, and industrial development—are gaining momentum, as massive national projects are rolled out.

Other sectors poised for growth include:

- Basic resources

- Industrial goods & logistics (electrical equipment, ports, shipping)

- Financial services

- Retail

- Information technology

Annual earnings expectations of 15–22% for many listed companies support this broader trend and provide a cushion for medium- to long-term investors—even if short-term pullbacks occur.

Vietnam: A Market with Opportunity and Caution

Vietnam’s stock market is currently at a strategic inflection point. Favorable macro conditions, strong earnings potential, and the prospect of an FTSE upgrade create upward momentum. Yet high valuations, tightening margin conditions, and global macro risks remain substantial headwinds.

Investors would be wise to maintain selective exposure, avoid excessive leverage, and closely monitor domestic and international developments. While the upward trend may continue in the short term, the market will likely require consolidation before embarking on a more sustainable growth phase.