Published Mar 2024

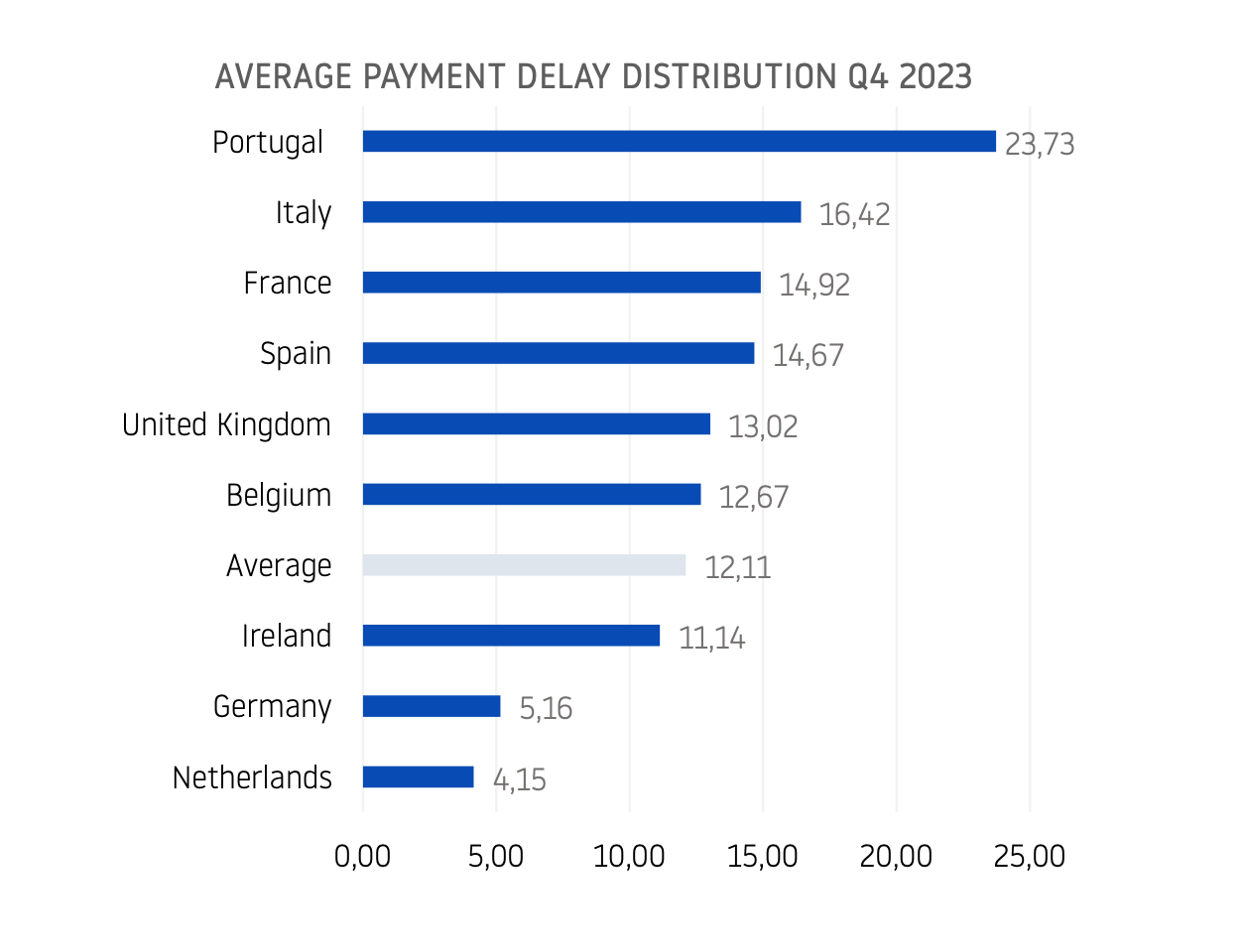

INFORMA: The European Average Payment Delay (APD) reached its lowest figure in Q3 2023 at 12.05 days.

After reaching a record low in the third quarter (Q3), the European Average Payment Delay increases in Q4 to 12.11 days, a decrease of 0.38 days compared to last year, but an increase of 0.05 days compared to the previous quarter.

The European Average Payment Delay APD) reached its lowest figure in Q3 2023 at 12.05 days.

After reaching a record low in the third quarter (Q3), the European Average Payment Delay increases in Q4 to 12.11 days, a decrease of 0.38 days compared to last year, but an increase of 0.05 days compared to the previous quarter.

Compared to Q3, the increase is observed in five of the nine countries analysed. The largest increases are seen in Belgium (+0.92 days) and Portugal (+0.81 days). On the other hand, Ireland decreases by 0.82 days compared to Q3 and ranks third, behind Germany and the Netherlands for the first time since Q2 2020.

Since last year, the European RMP has decreased by 0.38 days. The main decreases were in Ireland (-3.38 days) and the United Kingdom (-1.02 days).

The difference in payment delay days between the nine countries analysed remains considerable: there is a difference of almost 20 days between the payment delay of Dutch and Portuguese companies.

The nine countries studied are divided into three groups: good payers (the Netherlands and Germany), countries with an average RMP (Ireland, Belgium, the United Kingdom, Spain and France) and countries that pay more late (Italy and Portugal).

Source: FEBSI, BASED ON A REPORT OF INFORMA