INDUSTRY REPORT

Vietnam Logistics Industry Report 2020

INDUSTRY REPORT

Vietnam Manufacture of Food Products Industry Report 2020

VIETNAM PHARMACEUTICAL INDUSTRY REPORT

Over the last 10 year, Vietnam has maintained its position as one of the fastest-growing pharma- ceutical markets in the...

In July 2020, Pharmaceutical Industry Report is published by VietnamCredit, providing the general information about Vietnam's economic situation, an overview of the pharmaceutical industry and key ratios in 2019. Especially, the 10 outstanding enterprises in the pharmaceutical sector based on a company scale, business performance and credit rating in three consecutive years 2019, 2018 and 2017, were selected by VietnamCredit and presented in the report.

Over the last 10 year, Vietnam has maintained its position as one of the fastest-growing pharma- ceutical markets in the world, creating beneficial opportunities for numerous foreign investors. The value of Vietnam’s pharmaceutical market is expected to grow steadily due to the country's large populations, the high rate of population ageing, the raising concern from consumers and the government on this sector. Since the new revision of Pharmaceutical Law came into effect, the volume and value of domestic and cross-border M&A transactions in the pharmaceutical industry have increased significantly, showing a rising interest from both foreign and local investors. M&A is considered as an effective way to lower the costs and time of entering the market for foreign players as well as facilitate domestic enterprises with capital and technology to increase competitive advantages.

Vietnam's pharmaceutical value chain has been heavily import-reli- ant for manufacturing while lacking adequate management in trad- ing activities. Due to the limitation in technology standards, a large volume of high-quality products is purchased from France, Germa- ny and India. The number of firms that producing chemical ingredi- ents for drugs remains relatively low, thus 80-90 per cent of active pharmaceutical ingredients for drug production are imported, mainly from China and India. Therefore, the industry is vulnerable to changes in the market

Besides, there are only a small number of pharmacies in the retailing sector complying with the regulation of providing their selling activities through the information system, putting more pressure on the government in managing pharmaceutical trading activities. Most products manufactured domestically are generic drugs due to high requirements of capital and technolo- gy to produce patented drugs. Prescription drugs are predicted to continue dominating the retailing sector in the next ten years while over-the-counter sector remains a small portion in total medicine expenditure as the government are putting more effort to increase the access to healthcare infrastructure with lower costs.

Figure 1.1.1: Vietnam GDP Growth Rate 2011-2020

Figure 1.2.1: Total retail sales of consumer goods and services at current prices 2015-2019

Figure 1.2.2: GDP Growth, CPI and Inflation (Last year = 100)

Figure 1.2.3: Producer price index by sector compared to the previous quarter

Figure 1.2.4: Commodity terms of trade growth rate 2015-2019 (%)

Figure 1.3.1: Growth rate and structure of social investment capital in the first half of the 2016-2020 period at current prices

Figure 1.4.1:Import-export turnover and trade balance of goods 2011-2019 (US $ billion)

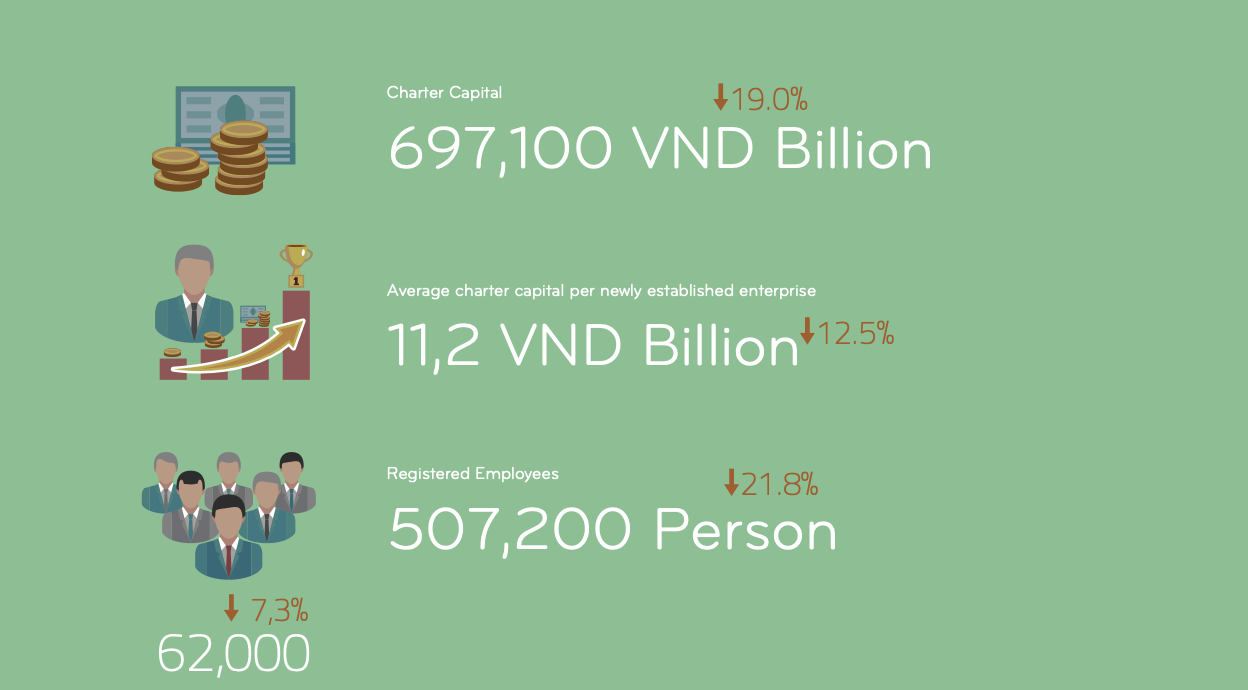

Figure 1.5.1:Enterprise Establishment in H1/2020 (compared to H1/2019)

Figure 2.1.1: GDP per capita in Vietnam (USD)

Figure 2.2.2: Vietnam total population forecast 2015-2050 (million pers.)

Figure 2.1.3: Heath expenditure, pharmaceutical sales and share of pharmaceutical sales in GDP and health expenditure forecast 2017-2023

Figure 2.1.4: Vietnam’s Pharmaceutical Value-Chain by Industry Classification

Figure 2.2.1: Number of enterprises and labours of main sectors in Vietnam’s pharmaceutical industry

Figure 2.2.2. The density of pharmacists (per 10,000 population) by countries in Southeast Asia in descending order

Figure 2.2.3: Pharmacists in Vietnam's pharmaceutical industry by education level (in thousands)

Figure 2.3.1: Growth of industrial production, consumption and inventory indexes of pharmaceuticals, medicinal chemical and botanical products manufacturing Q1/2015-Q1/2019 (same period last year = 100%)

Figure 2.3.2: Pharmaceutical import turnover in the first 5 months of 2020

Figure 2.3.3:Proportion of pharmaceutical imports by countries in 2019

Figure 2.3.4: Pharmaceutical ingredients import turnover in the first 5 months of 2020

Figure 2.3.5:Proportion of pharmaceutical ingredients imports by countries in 2019

Figure 2.3.6: Number of stores of main pharmacy chains in Vietnam

Figure 2.3.7: Growth of OTC and ETC channels in Vietnam’s pharmaceutical industry forecast 2015-2023

And so much more...

1. DHG Pharma

2. INEXPHARM

3. TRAPHACO

4. DOMESCO

5.BIDIPHAR

6. VIMEDIMEX GROUP

7.VINAPHARM

8. SANOFI

9. HATAPHAR

10. CPC1