The VBI News blog provides a multi-dimensional perspective on global business information. Here, you can find important economic news, expert reviews, and opinions. The blog covers the latest business and financial news on the global economy, backed by facts and figures. Readers are provided with crucial information that may impact their financial decisions while conducting business.

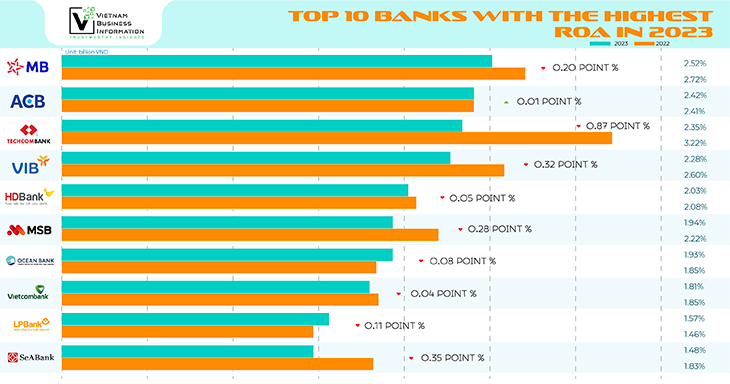

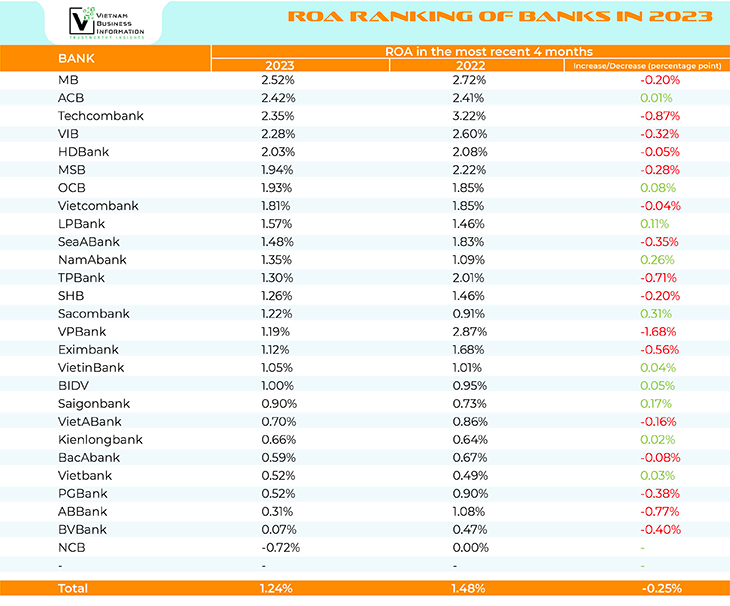

Top 10 banks with the highest ROA in 2023

Only ACB recorded an increase in ROA

According to data compiled from banks' financial reports, the ROA (return on asset) index tended to decrease in 2023.

The leading banks in terms of ROA in 2023 continue to be joint stock banks, profit "champion" Vietcombank ranked 8th while other Big 4 such as VietinBank and BIDV ranked quite far at 17,18th position.

The top 3 leading banks are MB, ACB, and Techcombank with ROA ranging from 2.35% to 2.52%. Among them, only ACB recorded an increase in ROA compared to the previous year.

In 2023, MB's after-tax profit was more than VND 20,600 billion, an increase of 15.7% over the same period with growth motivation coming from net interest income, trading securities and reducing provision costs, ranking third in terms of profits. MB's total assets also increased by nearly 30% during the year to 944,954 billion VND, largely thanks to loan growth (up 32.7%).

ACB's profit after tax reached 16,045 billion VND, an increase of 17.2% compared to last year, mainly coming from non-interest income, which increased by 48% over the same period, accounting for 24% of total income. In particular, foreign currency trading services and investment activities contributed greatly to ACB's income growth.

By the end of 2023, ACB's total assets reached 719,000 billion VND, an increase of 18.2% compared to the beginning of the year. Specifically, the loan scale reached nearly 488,000 billion VND, an increase of 17.9%. This is the bank's highest credit growth in the past 10 years.

In contrast to MB and ACB, Techcombank recorded a profit decrease of 11% over the same period with 18,200 billion VND. The bank's net interest income decreased, but thanks to non-interest income, the bank's total income only decreased by 1.2% compared to the previous year.

By the end of the year, Techcombank's total assets reached nearly 849,500 billion VND, an increase of 21.5% compared to the end of last year, mainly from increased loans to institutional customers (increased from 193,716 billion VND to 297,161 billion VND). The proportion of loans to institutional customers increased from 47.11% at the end of 2022 to 59.22% at the end of 2023.

In addition, the list of top 10 leading banks in terms of ROA also includes VIB, HDBank, MSB, OCB, Vietcombank, LPBank and SeABank.

ROA ranking of banks in 2023

Source: Wichart, vietnambiz

Compile by VBI

Challenges facing Vietnam’s banking industry in 2024

Experts say that the banking industry of Vietnam will still face many challenges...