The VBI News blog provides a multi-dimensional perspective on global business information. Here, you can find important economic news, expert reviews, and opinions. The blog covers the latest business and financial news on the global economy, backed by facts and figures. Readers are provided with crucial information that may impact their financial decisions while conducting business.

Top 10 most profitable banks in Vietnam in Q1/2024

Vietcombank maintained its leading position

After a challenging 2023, banks accelerated their profits in Q1/2024. In 2023, the total profits of 28 banks that regularly publish financial reports grew by only 3.8%, with several periods of decline compared to the previous year. However, in the early months of this year, these banks' pre-tax profits increased by 10%, reaching 72,087 billion VND.

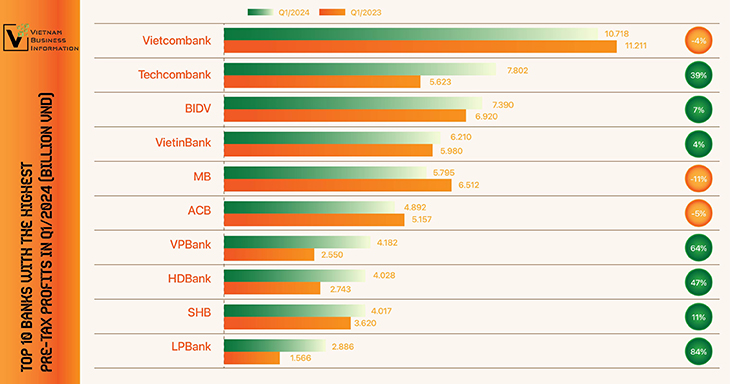

Vietcombank maintained its leading position with pre-tax profits of 10,718 billion VND, a 4% decrease compared to the same period last year. This marks the second consecutive quarter where Vietcombank's profits were lower than the previous year's.

Thanks to favorable results in both lending and non-interest income, Techcombank climbed to the second position, setting a record profit of 7,802 billion VND, a 39% increase year-over-year. BIDV ranked third with pre-tax profits of 7,390 billion VND, up 7% from the start of the year.

VietinBank secured the fourth spot with profits of 6,210 billion VND, a 4% increase compared to the same period last year. MB, which was the third most profitable bank in Q1/2023, fell to the fifth position due to a sharp increase in provisioning costs amid rising bad debts. The bank earned 5,795 billion VND in Q1, an 11% decrease.

The remaining positions in the TOP 10 were occupied by ACB, VPBank, HDBank, SHB, and LPBank. Notably, VPBank improved its ranking by four places, moving from the tenth to the seventh most profitable bank, while SHB dropped to ninth place. VIB exited the ninth position, and LPBank unexpectedly entered the TOP 10 due to an 84% profit growth.

Of the 28 banks in this list, 18 reported positive profit growth, led by BVBank (165%), LPBank (84%), and VPBank (64%). Meanwhile, 10 banks recorded lower profits compared to the same period, with ABBank (down 71%), Vietbank (down 63%), and SaigonBank (down 35%) experiencing the most significant declines.

In absolute terms, Techcombank saw the highest profit increase, adding nearly 2,200 billion VND compared to the same period last year, followed by VPBank with an increase of over 1,600 billion VND and LPBank with more than 1,300 billion VND.

Conversely, MB's pre-tax profits decreased by over 700 billion VND, Vietcombank by more than 500 billion VND, and ABBank by 430 billion VND.

Overall, net interest income increased year-over-year due to the recovery of net interest margins (NIM) and reduced provisioning costs, which were the main factors supporting bank profits. Unlike Q4 of the previous year, banks no longer relied heavily on one-off revenue sources like investment securities to maintain profit growth. Additionally, several banks, including SHB and Techcombank, reported record-breaking quarterly profits.

Pre-tax profit ranking

Source: Vietnambiz

Compiled by VBI

Vietnam’s 2023 credit growth to be lower than planned

Credit growth of Vietnam in 2023 is forecast to reach about 8.4%, lower...