The VBI News blog provides a multi-dimensional perspective on global business information. Here, you can find important economic news, expert reviews, and opinions. The blog covers the latest business and financial news on the global economy, backed by facts and figures. Readers are provided with crucial information that may impact their financial decisions while conducting business.

Top 10 banks with the largest total assets in Q1/2024

Slow growth rate in total assets

At the end of Q1/2024, the total assets of Vietnam's banks that have published financial reports (excluding Agribank) reached over VND 14.8 trillion, an increase of 0.4% compared to the end of 2023. The rate of increase in total assets of banks has slowed significantly compared to Q4 of last year in the context of weak credit growth.

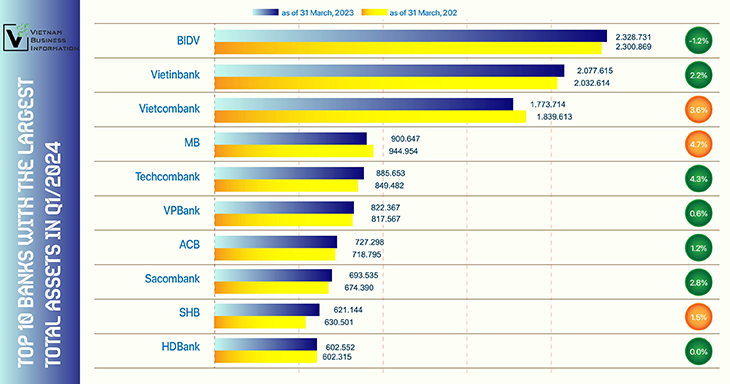

In the list, 9 banks reported a decrease in total assets, and 19 banks recorded an increase in total assets. LPBank was the bank with the fastest increase in total assets, adding 7% or VND 26.901 trillion in the past quarter. Additionally, PGBank, MSB, and Techcombank were also banks with rapidly increasing total assets, rising by 5.9%, 4.4%, and 4.3% respectively compared to the end of 2023.

In terms of absolute figures, VietinBank was the bank with the largest increase in assets, at more than VND 45 trillion, with Techcombank ranking second with an increase of VND 36.171 trillion. BIDV's total assets increased by VND 27.862 trillion in the past quarter, equivalent to 1.2%. Conversely, Vietcombank's total assets decreased by up to VND 65.9 trillion in the past quarter.

Among joint-stock banks, MB continued to lead with total assets reaching over VND 900.6 trillion, down 4.7% compared to the beginning of the year. Techcombank recorded total assets of VND 885.7 trillion, up 4.3%. The gap between the two leading joint-stock banks has narrowed significantly in just three months.

The remaining positions in the Top 10 have not changed compared to the end of last year and are respectively held by VPBank, ACB, SHB, and HDBank.

At the lower end of the list, due to a decrease in total assets by 10.7%, the highest in the industry, ABBank fell below Bac A Bank. Additionally, BVBank (Bản Việt) also dropped two places in the asset ranking, down to 26th position, behind BaoViet Bank and KienlongBank.

Total asset rankings

Source: vietnambiz

Compiled by VBI

Vietnam’s 2023 credit growth to be lower than planned

Credit growth of Vietnam in 2023 is forecast to reach about 8.4%, lower...