The VBI News blog provides a multi-dimensional perspective on global business information. Here, you can find important economic news, expert reviews, and opinions. The blog covers the latest business and financial news on the global economy, backed by facts and figures. Readers are provided with crucial information that may impact their financial decisions while conducting business.

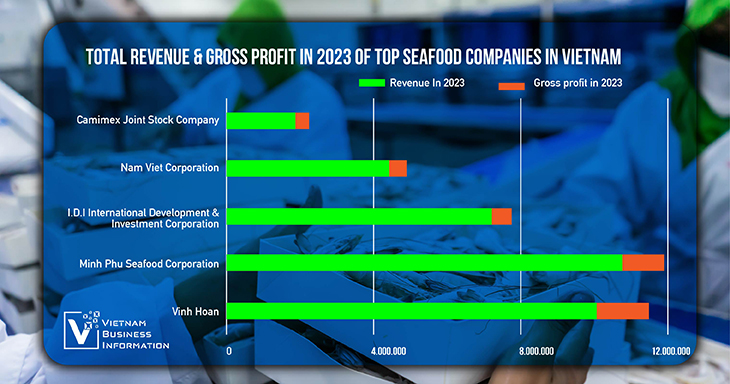

Top 5 largest seafood companies in Vietnam by gross profit

The following are the top five seafood companies in Vietnam by gross profit, known for their substantial contributions to both the local and global seafood markets.

1. Vinh Hoan Corporation

Vinh Hoan Corporation (VHC), founded in 1997, has established itself as a leader in the seafood industry, particularly in pangasius farming and processing. The company is headquartered in Dong Thap province, one of the prime locations for aquaculture in the Mekong Delta.

In the first quarter of 2024, while leading companies in the pangasius industry experienced a decline in revenue, Vinh Hoan saw a 28% increase compared to the same period last year.

According to the consolidated financial report for Q1/2024 of Vinh Hoan Corporation the company’s net revenue reached 2,855 billion VND, up 28% year-on-year (YoY). Of this, revenue from finished products and goods accounted for the largest share at 81% of total revenue, reaching 2,319 billion VND, an increase of 24.8% YoY.

Vinh Hoan’s cost of goods sold increased by 41% YoY to 2,589 billion VND. Specifically, the cost of finished products rose from 1,483 billion VND to 2,052 billion VND. As a result, VHC’s gross profit dropped to 266.2 billion VND, corresponding to a 30% decrease YoY.

The company’s financial income for the quarter increased by 28% YoY, reaching 106 billion VND. In contrast, financial expenses and corporate management costs decreased by 62% and 7% YoY, respectively, to 33.9 billion VND and 64.2 billion VND.

After deducting expenses, Vinh Hoan’s post-tax profit for Q1 stood at 189 billion VND, a 16% decline from 225.7 billion VND in the same period last year.

For 2024, Vinh Hoan has set a target for consolidated revenue at a basic level of 10,700 billion VND (up 6.6% from 2023) and a high target of 11,500 billion VND (up 14%). The basic net profit target is 800 billion VND (down 12.9% from 2023), with a high target of 1,000 billion VND (up 8.8%).

With the Q1/2024 results, Vinh Hoan has achieved 26.7% of its revenue target and 23.6% of its basic net profit target for the year.

In the first quarter, the company's revenue grew by double digits thanks to strong performance in its three main markets: the U.S., China, and domestically. Specifically, revenue in the U.S. increased by 59% YoY in January and 13% YoY in February; similarly, in China, revenue surged by 259% YoY in January and 91% YoY in February. Although there was a decline in March, the strong performance in the first two months ensured that total revenue in these markets did not drop.

For the first three months of the year, Vinh Hoan’s domestic market revenue also increased, with growth rates of 137% YoY in January, 11% YoY in February, and 17% YoY in March.

On the balance sheet, as of March 31, 2024, Vinh Hoan’s total assets were 12,092 billion VND, a slight increase of 1.2% from the 11,942 billion VND recorded at the end of 2023.

The company’s non-term bank deposits decreased from 232 billion VND to 98 billion VND. However, term deposits of over 3 months and under 1 year increased by 13.6%, reaching 2,189 billion VND.

Inventory at the end of this period stood at 3,466 billion VND, a decrease of 7.8% YoY. Finished products and work-in-progress accounted for the largest proportions at 1,557 billion VND and 1,251 billion VND, respectively; followed by raw materials at 589 billion VND.

As of March 31, 2024, the company’s liabilities totaled 3,762 billion VND, up 12.2% from 3,351 billion VND at the end of 2023. Short-term payables to suppliers increased by 54% to 476 billion VND, while payables to employees decreased by 30.9% to 145 billion VND.

Vinh Hoan’s short-term borrowings reached 2,745 billion VND, up 27%, while long-term borrowings decreased by 34% to 67 billion VND.

Previously, in 2023, Vinh Hoan recorded revenue of 10,038.6 billion VND, a 24.1% decrease YoY, and net profit attributable to shareholders of the parent company at 896.52 billion VND, a 54.6% decrease YoY.

In 2023, Vinh Hoan had set a revenue target of 11,500 billion VND and a net profit target for shareholders of the parent company at 1,000 billion VND. By the end of 2023, the company had only achieved 89.7% of its profit target for the year.

2. Minh Phu Seafood Corporation

Minh Phu Seafood Corporation (MPC), often referred to as the "Shrimp King," was established in 1992. Based in Ca Mau province, Minh Phu is one of the largest shrimp exporters globally, with a diverse product range including both farmed and wild-caught shrimp.

At the end of the first quarter of 2024, Minh Phu Seafood Corporation recorded net revenue of 1,316 billion VND on its standalone financial statements, an increase of nearly 35% compared to the same period last year. The company's gross profit margin reached 7.6%.

After deducting expenses incurred from business activities, Minh Phu Seafood recorded a pre-tax profit of 24.8 billion VND, a decrease of 35% compared to the same period last year.

This year, Minh Phu Seafood aims for a revenue of 15,805 billion VND, an increase of 46% from the 2023 performance. The post-tax profit is expected to reach 1,021 billion VND, compared to a loss of 105 billion VND in 2023. If this plan is achieved, it will be the highest profit the company has recorded since 2008.

Thus, after the first three months, Minh Phu Seafood has achieved 17% of its revenue target but is still far from the annual profit goal.

In 2023, MPC achieved net revenue of 10,689 billion VND, a decrease of 35% compared to the previous year. The gross profit was 1,066 billion VND, corresponding to a gross profit margin of about 10%, lower than the 17% of the previous year.

Notably, financial operating revenue in 2023 fell by nearly 56%, to 98 billion VND. Financial expenses also decreased by 31%, recorded at 249 billion VND, but interest expenses increased by nearly 65% compared to the previous year, reaching 141 billion VND.

After deducting selling expenses (738 billion VND) and administrative expenses (297 billion VND), MPC reported a net loss of 98 billion VND.

In the fourth quarter alone, MPC had net revenue of 3,223 billion VND, an increase of 26% compared to the same period. However, the net profit was only 12 billion VND, a decrease of 95%. MPC explained that this was due to the ineffective business operations of its commercial shrimp farming companies during the period.

On the balance sheet, MPC had assets of 10,195 billion VND at the end of 2023, a decrease of 4% compared to the beginning of the year. Cash and cash equivalents amounted to over 234 billion VND, a reduction of 62%. Construction in progress was recorded at 1,413 billion VND, an increase of 42%.

3. I.D.I International Development & Investment Corporation

I.D.I International Development & Investment Corporation (IDI), a subsidiary of Sao Mai Group, focuses on the production and export of pangasius. Founded in 2003, the company has quickly become a key player in the seafood industry.

The plunging price of pangasius led to an 87% drop in the 2023 net profit of IDI International Investment and Development Corporation.

According to the Q4/2023 financial report, IDI International Investment and Development Corporation recorded revenue of 1,883 billion VND, an increase of 10.3% compared to the same period in 2022. However, the gross profit margin sharply decreased from 8.3% to just 6%.

As a result, IDI's post-tax profit in Q4/2023 was only 20 billion VND, a 20% decline compared to the same period in 2022.

For the full year 2023, this pangasius exporting company reported net revenue of over 7,221 billion VND, a 9% decrease compared to 2022. Revenue from the sale of goods, finished products, and pangasius dropped by 19%, to only 2,896 billion VND. Revenue from the sale of fishmeal and fish oil also decreased by 2%, to 2,885 billion VND. A bright spot was the slight 2% growth in revenue from the livestock feed business, reaching 1,372 billion VND.

Meanwhile, business-related expenses increased significantly, particularly financial expenses (mainly interest expenses), which rose by 34%.

As a result, IDI's post-tax profit for 2023 was only 72 billion VND, an 87% decrease compared to 2022. Compared to the business plan, IDI achieved only 89% of the revenue target and 39% of the annual profit target.

IDI's business performance was less positive in the context of Vietnam's pangasius export turnover decreasing by 25% in 2023 due to weakening demand in key markets, high inventory levels, and sharply falling export prices.

4. Nam Viet Corporation

Nam Viet Corporation (Navico), established in 2000 and headquartered in An Giang province, is a prominent name in the pangasius export market. The company has built a strong reputation for quality and reliability.

The 2023 business results report of Navico shows that the company's revenue reached 4,439 billion VND, achieving 85.4% of the set target. Pre-tax profit reached 64.5 billion VND, achieving 10.9% of the target. Gross profit reached 447 billion VND, only 33% of the same period last year.

Revenue from financial activities was a modest 32 billion VND. However, the company managed to cut some costs, such as financial expenses, selling expenses, and administrative expenses.

In 2023, the pangasius export industry faced many challenges. Despite being a major player in the industry, Navico was not immune to these trends. Due to the impact of COVID-19 and political tensions, inventory levels in import markets for pangasius increased significantly, leading to a decrease in import demand. The prices of feed, raw materials for feed production, and transportation costs all rose sharply, affecting the production cost of pangasius.

Additionally, the Russia-Ukraine war and conflicts in the Middle East led to a sharp increase in sea freight costs, especially for shipments to European and American markets. High inflation in importing countries also caused consumers to tighten their spending, resulting in reduced demand for pangasius.

Despite these difficulties, Navico still has certain advantages. Navico is striving to maintain a closed value chain from feed production, aquaculture, to seafood processing. This helps the company to be proactive in sourcing raw materials, ensuring product quality, and reducing production costs.

The factories, with a capacity of 1,000 tons of raw materials per day, are always ready to meet production needs when the market grows. A reputable brand and an experienced team also contribute to the company's strong position in the industry.

In 2024, facing market challenges, Navico has implemented several solutions, including enhancing trade promotion and seeking new export markets. Experts forecast that Nam Viet Corporation’s net revenue and net profit attributable to the parent company for the entire year of 2024 will reach 4,902 billion VND and 261 billion VND, respectively, representing increases of 7.1% and 154% compared to 2023.

5. Camimex Joint Stock Company

Camimex Joint Stock Company (CMX), founded in 1977 and based in Ca Mau province, is one of the oldest and most established seafood companies in Vietnam. The company specializes in shrimp farming and processing.

For the entire year of 2023, CMX recorded total consolidated net revenue of 2,043 billion VND, a decrease of 30%, and a post-tax profit of 73 billion VND, a decrease of 19% compared to 2022. Compared to the post-tax profit target of 103 billion VND, CMX only achieved 71% of the annual plan.

In the fourth quarter of 2023, Camimex Group Joint Stock Company recorded an increase in net revenue by 6% to 761 billion VND, with the cost of goods sold slightly rising to 665 billion VND. Gross profit reached 96 billion VND, an increase of 37% compared to the same period last year.

Revenue from financial activities decreased by 65% to 11 billion VND, while financial expenses decreased by 10% but remained high at 39 billion VND. Selling expenses decreased by 36% to 28 billion VND, while administrative expenses increased by 20% to 22 billion VND. As a result, post-tax profit reached 16 billion VND, an increase of 95% compared to the same period last year. The parent company’s post-tax profit also reached 13 billion VND, an increase of 95%.

For the entire year of 2023, CMX recorded total consolidated net revenue of 2,043 billion VND, a decrease of 30%, and a post-tax profit of 73 billion VND, a decrease of 19% compared to 2022. Compared to the post-tax profit target of 103 billion VND, CMX only achieved 71% of the annual plan.

As of December 31, 2023, CMX's total assets reached 3,317 billion VND, an increase of 14% compared to the beginning of the year. This included a goodwill of 103 billion VND, which was not recorded at the beginning of the year.

Inventory was at 1,354 billion VND (including a provision for devaluation of 42 billion VND), a decrease of 40%. Short-term receivables also decreased by 23% to 697 billion VND.

Liabilities were 1,854 billion VND, an increase of 22% compared to the beginning of the year. Of this, short-term loans and financial lease liabilities were 1,184 billion VND, an increase of 11%.

At the end of January 2024, the Dutch Development Bank (FMO) announced that it is considering an investment of 15 million USD (equivalent to 370 billion VND) into CMX.

FMO stated that this investment aims to help Camimex Group expand its production and business scale, including the construction of a new processing plant with a cold storage and quick-freezing system; building new organic breeding farms; and adding the necessary working capital for certification and payment for imported organic shrimp products.

Vietnam’s seafood industry is marked by the success of these top companies, which have leveraged their expertise, innovation, and commitment to quality to achieve substantial gross profits. Their efforts not only boost Vietnam’s economy but also reinforce the country’s reputation as a leading global seafood supplier.

Curious about companies' creditability? Request a report by contacting [email protected], or visit a specific company information page to learn more about the reports we can provide!

Profits of beer businesses saw a decline

Beer enterprises all witnessed a decline in business results due to the...