The VBI News blog provides a multi-dimensional perspective on global business information. Here, you can find important economic news, expert reviews, and opinions. The blog covers the latest business and financial news on the global economy, backed by facts and figures. Readers are provided with crucial information that may impact their financial decisions while conducting business.

Profit targets of Vietnamese banks in 2024

Differentiated profit targets

Since the beginning of April, many banks have announced their business plans for 2024 with differentiated profit targets.

As of April 3, 13 banks have announced profit plans. Except for National Citizen Bank (NCB) with plans to use all revenues to implement restructuring plans, most other banks have set profit targets to increase by double digits compared to the previous year.

ABBank is the bank with the highest profit growth target, aiming for a 95% increase compared to the previous year, with estimated pre-tax profit for 2024 reaching 1,000 billion dong. However, the plan for 2024 is only one-third of the plan approved by the 2023 Annual General Meeting of Shareholders (AGM) at 2,826 billion dong, as well as much lower than the actual results of 2022 at 1,686 billion dong and half of the profit in 2021.

Another joint-stock bank - Eximbank, has set an equally ambitious target with pre-tax profit reaching 5,180 billion dong, a 90.5% increase compared to the results of 2023. In 2023, Eximbank's pre-tax profit was 2,720 billion dong, a 27% decrease compared to the previous year, due to a significant decrease in main revenue sources, while risk provisions increased sharply.

The top 3 in profit growth targets are OCB with a plan to achieve pre-tax profit of over 6,800 billion dong, a 66% increase compared to the performance of 2023 (4,139 billion dong after auditing). The targeted ROE and ROA ratios are 17.11% and 2.06%, respectively.

This high profit growth is partly due to OCB's adjustment to reduce pre-tax profit from 5,227 billion dong to 4,139 billion dong after auditing, equivalent to a nearly 20% decrease. This profit level is lower than the bank's 2022 results.

Many other joint-stock banks such as HDBank, Nam A Bank, TPBank, LPBank have also set high profit plans above the 20% threshold.

On the other hand, some state-owned banks and large joint-stock banks have set relatively modest and cautious profit figures. Vietcombank aims to increase pre-tax profit by at least 10% in 2024, while MB only expects profit growth of 6-8% compared to the previous year.

VIB aims for a 13% profit increase, although not too high, it has increased significantly compared to the achieved figure in 2023. Last year, VIB's pre-tax profit reached 10,704 billion dong, only a 1.2% increase compared to 2022.

Meanwhile, Techcombank plans to achieve pre-tax profit of 27,100 billion dong, an 18.4% increase compared to the previous year. This is also a challenge for the bank after breaking the 10-year profit growth streak in 2023 with 22,900 billion dong, a 10% decrease compared to 2022.

Drivers of growth

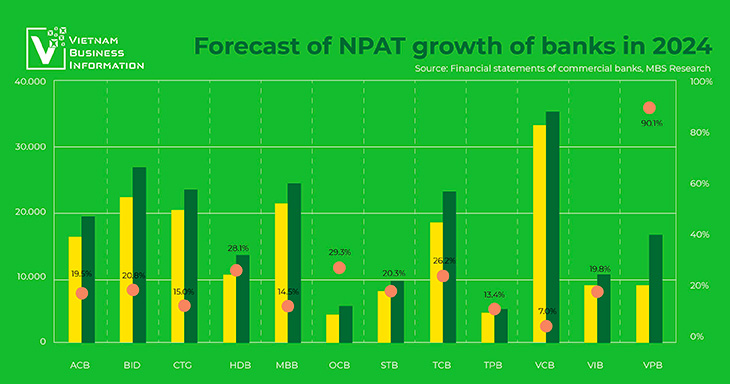

In a recent industry report, MB Securities (MBS) forecasts a 23.6% increase in after-tax profits for monitored banks in 2024.

The three main drivers are higher credit growth of the NHTMNN group; NIM slightly increasing or remaining flat, and the recovery of non-interest income due to fee-based activities. In addition, gold and foreign exchange trading are also expected to generate good income in the first 6 months of 2024 due to recent fluctuations.

According to a recent survey by the State Bank, 86.2% of credit institutions expect pre-tax profits in 2024 to grow compared to 2023. In addition, 10.1% of credit institutions are concerned about negative profit growth in 2024, and 3.7% estimate unchanged profits.

Source: vietnambiz

Compiled by VBI

Tag: banking news; vietnam banking; profit targets; banking profit targets

Vietnam’s 2023 credit growth to be lower than planned

Credit growth of Vietnam in 2023 is forecast to reach about 8.4%, lower...

.webp)