The VBI News blog provides a multi-dimensional perspective on global business information. Here, you can find important economic news, expert reviews, and opinions. The blog covers the latest business and financial news on the global economy, backed by facts and figures. Readers are provided with crucial information that may impact their financial decisions while conducting business.

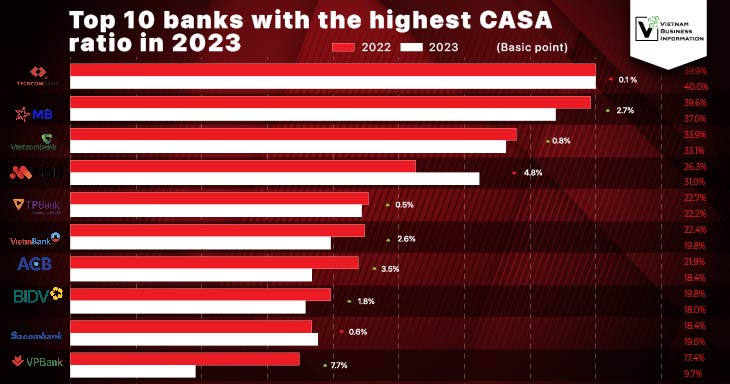

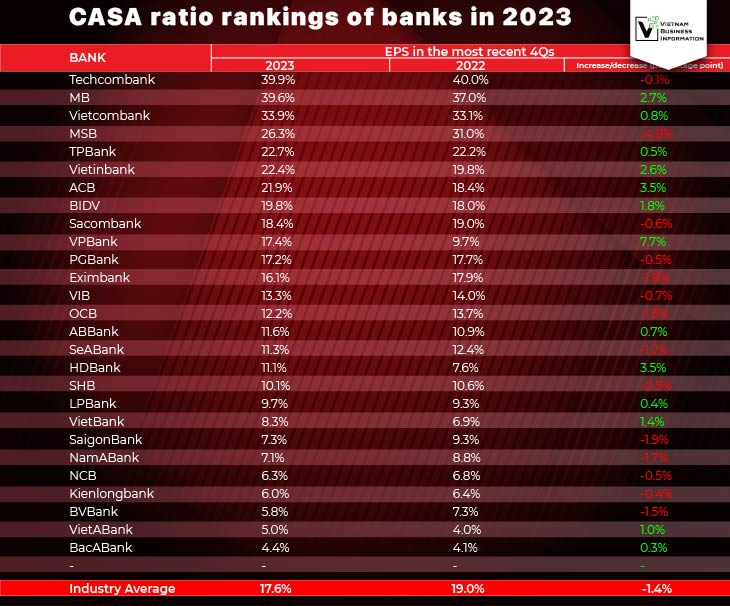

Top 10 banks with the highest CASA ratio in 2023

Techcombank continued to be the champion

According to data calculated from the financial statements of banks that have published their financial statements for the fourth quarter of 2023, the CASA ratio of banks varied in 2023, in which the number of banks with reduction in CASA accounted for a higher proportion (15/28 banks).

Techcombank continued to be the champion in CASA with a ratio of approximately 40%, nearly equivalent to the rate at the end of the previous year. Closely behind was MB with a CASA ratio of 39.6% and ranked third was Vietcombank with a ratio of approximately 34%, both slightly increased compared to 2022.

The following positions in the CASA ratio ranking are MSB, TPBank, VietinBank, ACB, BIDV, Sacombank, and VPBank.

In terms of increase or decrease (percentage points), VPBank was the bank with the most outstanding growth in CASA with an increase of 7.7 percentage points. The bank said that demand deposits became a bright spot in the mobilization segment with an increase of 33% compared to the end of 2022.

Mobilization including valuable papers of the parent bank increased by 37.1% compared to 2022, reaching 470,500 billion VND, 13.2% higher than the industry average, of which the individual customer segment continued to be the driver of growth, contributing 62% of the bank's total mobilization, reaching more than 290,000 billion VND.

Some banks with relative growth in the CASA ratio include ACB, HDBank (up 3.5 percentage points); MB (up 2.7 percentage points); VietinBank (up 2.6 percentage points).

On the contrary, MSB was the bank with the highest decline in CASA of 4.8 percentage points but it was still in the top 4 in CASA ratio of the entire industry. The bank said the reason was due to interest rate fluctuations in the last quarter of 2022 and in 2023, leading to a downward trend of CASA across the market.

Other banks with reduced CASA ratios include Sacombank, PG Bank, Eximbank, VIB, OCB, SeABank, SHB, Saigonbank, Nam A Bank, NCB, Kienlongbank, and BVBank.

CASA ratio rankings of banks in 2023

Source: Wichart, vietnambiz

Compiled by VBI

Top 10 most profitable banks in Vietnam in 2023

Thanks to the prosperous fourth quarter business results, bank profits...