Published Aug 2024

Top 10 banks with the highest profits in the first half of 2024

The banking sector experienced a notable acceleration in profits during the first half of 2024, driven by a recovery in net interest margins (NIM) and a reduction in provisioning costs.

An analysis of financial reports from 28 banks, including 27 listed banks and BaoViet Bank, reveals significant growth in profitability across the sector. In the second quarter alone, these banks collectively reported a 23% year-on-year increase in pre-tax profits, totaling approximately VND 76,100 billion. For the entire first half of the year, pre-tax profits rose by 16%, reaching nearly VND 148,400 billion.

This robust performance contrasts sharply with the modest 3.8% profit growth recorded for the full year of 2023, during which several banks experienced periods of declining profitability.

Top performers in the banking sector

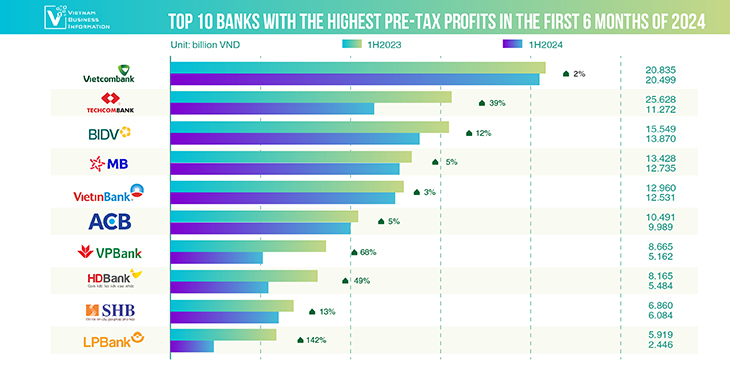

- Vietcombank retained its position as the most profitable bank, reporting a pre-tax profit of VND 20,835 billion, a 2% increase year-on-year. After two consecutive quarters of declining profits, the bank regained its growth momentum in the second quarter. A notable reduction in provisioning costs enabled Vietcombank to maintain positive profit growth despite declines in income from both credit and non-credit segments.

- Techcombank surged to second place in the profit rankings, with a six-month pre-tax profit of VND 15,628 billion, marking a 39% year-on-year increase. However, in the second quarter alone, BIDV surpassed Techcombank’s profitability.

- BIDV reported a first-half profit of VND 15,549 billion, up 12% from the previous year. The bank achieved a second-quarter profit of VND 8,159 billion, placing it second only to Vietcombank in quarterly profits.

- MB secured the fourth position, with a pre-tax profit of VND 13,428 billion, a 5% increase year-on-year. The bank showed a strong recovery in the second quarter, reporting a 23% year-on-year increase in pre-tax profits, amounting to VND 7,633 billion.

- VietinBank fell to fifth place, posting a first-half profit of VND 12,960 billion, up 3% year-on-year.

The remaining top 10 banks were ACB, VPBank, HDBank, SHB, and LPBank. Notably, VPBank climbed from tenth to seventh place, while SHB dropped from seventh to ninth. VIB, which was previously in the top 10, fell to twelfth place, while LPBank made a surprising entry into the top 10 with a remarkable profit growth of 142%.

Overall trends and notable changes

Among the 28 banks analyzed, 22 reported positive profit growth. Techcombank led in absolute profit growth, increasing its profits by nearly VND 4,400 billion compared to the same period last year. VPBank and LPBank followed, with increases of VND 3,503 billion and VND 3,473 billion, respectively.

On the downside, VIB experienced a decline in pre-tax profit of over VND 1,000 billion, while OCB’s profit decreased by approximately VND 450 billion.

In terms of growth rate, BVBank (Bản Việt) stood out with an impressive 284% year-on-year increase, followed by LPBank with 142% and VPBank with 68%.

The primary drivers of this profit surge included an increase in net interest income, supported by the recovery of NIM, and a decrease in provisioning costs. Additionally, other income sources, such as foreign exchange and service fees, contributed to the growth.

Source: FS of banks

Compiled by VBI