Published Sep 2024

Top 10 banks with the highest ROE in 1H2024

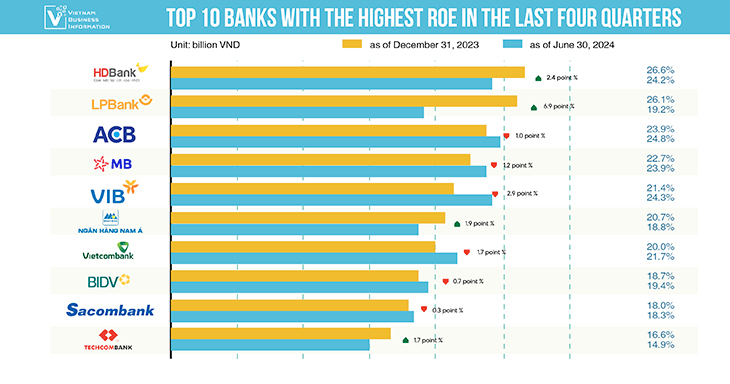

HDBank continues to maintain its position as the leader in Return on Equity (ROE) across the banking industry, reaching 26.6% by the end of Q2 2024. Meanwhile, LPBank made a significant leap to second place, driven by robust profit growth in the first half of the year.

Industry-Wide ROE Recovery

According to data from WiChart, the trailing 12-month ROE of 27 listed banks recovered to 17.1% by the end of Q2 2024, a 0.4 percentage point increase compared to Q1. However, compared to the end of 2023, this ROE still reflects a slight decrease of 0.1 percentage points.

Among the 27 banks, 10 saw an improvement in their ROE during the first half of the year, with LPBank recording the highest increase of 6.9 percentage points.

HDBank Continues to Lead

HDBank remains at the top of the ROE rankings with a rate of 26.6%, an increase of 2.4 percentage points from six months ago. The bank also showed continuous improvement from the end of Q1, cementing its lead in the industry.

LPBank has surpassed major players like VIB, ACB, and MB, securing second place with an ROE of 26.1%, marking a 6.9 percentage point surge—the highest growth rate among all banks. In Q2 2024, LPBank reported a 200% year-on-year increase in post-tax profit, reaching VND 2,122 billion.

Despite being the ROE leader in 2023, ACB fell to third place with an ROE of 23.9%, a drop of 1 percentage point from the end of last year. This decline is attributed to a modest 4.7% growth in post-tax profit for the first half of the year.

MB ranked fourth with an ROE of 22.7%, a 1.2 percentage point drop. Like ACB, MB’s post-tax profit growth was modest at around 5.2%.

VIB, which was third in ROE by the end of 2023 and rose to second in Q1 2024, unexpectedly fell to fifth place with an ROE of 21.4% at the end of Q2, a decline of 2.9 percentage points. VIB’s post-tax profit in the first half of the year decreased by 18.4%.

Nam A Bank Outperforms Vietcombank

Nam A Bank saw an improvement in its ranking, surpassing Vietcombank with an ROE increase of 1.9 percentage points, reaching 20.7% by the end of Q2 2024.

The rest of the top 10 include Vietcombank, BIDV, Sacombank, and Techcombank. VietinBank, which was previously in the top 10, has been replaced by Techcombank. Notably, OCB, VIB, and Vietcombank experienced the steepest declines in ROE during the first half of the year, with decreases of 5.1, 2.9, and 1.72 percentage points, respectively.

Source: FS of banks, vietnambiz