Published Aug 2024

Top banks with the highest NPLs in 1H2024

In the first half of 2024, the banking sector faced a troubling increase in non-performing loans (NPLs), with some banks experiencing double-digit surges.

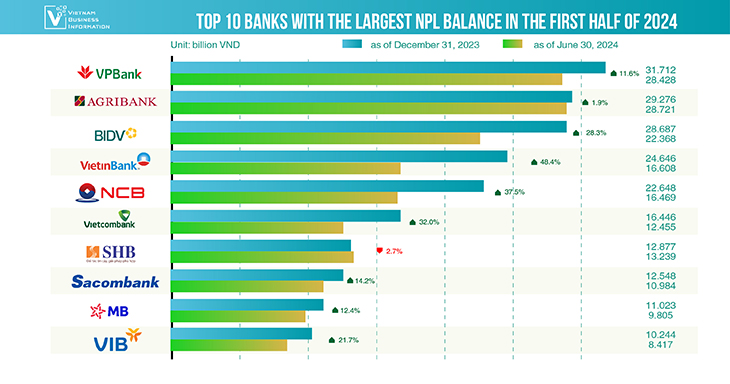

Top 10 banks in Vietnam with the highest NPLs

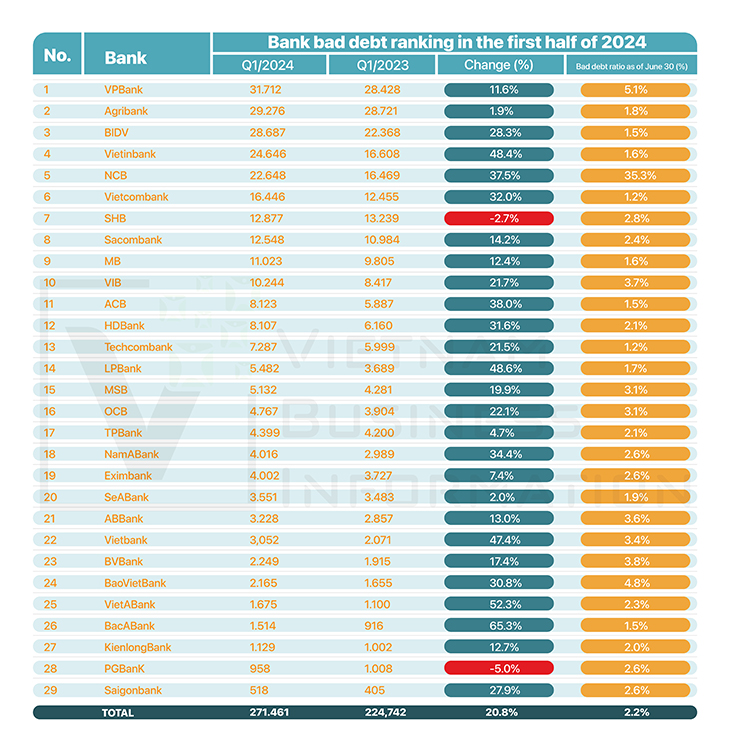

Financial statements for the second quarter of 2024 reveal that non-performing loans, categorized from Group 3 to Group 5, have risen across 29 banks that have disclosed their financials, including 27 listed banks along with Agribank and BaoViet Bank. This rise is evident when compared to both the first quarter of 2024 and the end of 2023.

After a decline of approximately VND 15,000 billion in non-performing loans by the end of Q4 2023, the first six months of 2024 saw a resurgence, with non-performing loans increasing by VND 46,719 billion, or 20.8%, compared to the end of 2023. The financial reports for Q1 2024 alone had already shown a 14.4% increase in non-performing loans compared to the previous year.

Among the 29 banks analyzed, 27 reported an uptick in non-performing loans. The most significant increases were noted in the two largest banks of the Big4: VietinBank and BIDV. VietinBank saw its non-performing loans surge by VND 8,038 billion, or 48.4%, bringing the total to VND 24,646 billion. Similarly, BIDV's non-performing loans increased by VND 6,319 billion, or 28.3%, reaching VND 26,687 billion.

In contrast, two banks reported reductions in non-performing loans during the first half of the year: SHB and PG Bank. SHB’s non-performing loans decreased by VND 362 billion, or 2.7%, continuing the downward trend observed in the first quarter. PG Bank also saw a reduction, with its non-performing loans falling by VND 50 billion, or 5%.

During the Data Talk seminar in August 2024, Mr. Le Hoai An, Founder of IFSS and Lecturer at Banking University, highlighted that the overall non-performing loan ratio in the sector remains concerning, with significant variability among institutions. He noted, "Non-performing loans at listed banks average 2.2%, with larger proportions often found in non-listed and smaller banks."

The continuing rise in non-performing loans underscores ongoing challenges within the banking sector, emphasizing the need for robust risk management and strategic financial oversight.

Ranking of banks by NPLs