Published May 2024

Top largest companies in Vietnam's construction materials industry by revenue

In the dynamic landscape of Vietnam's construction industry, several key players stand out as pioneers and leaders in manufacturing high-quality construction materials. These companies play a pivotal role in shaping the infrastructure and architectural landscape of the nation.

Among them, the following are the largest construction materials manufacturing companies in Vietnam ranked by revenue in 2023.

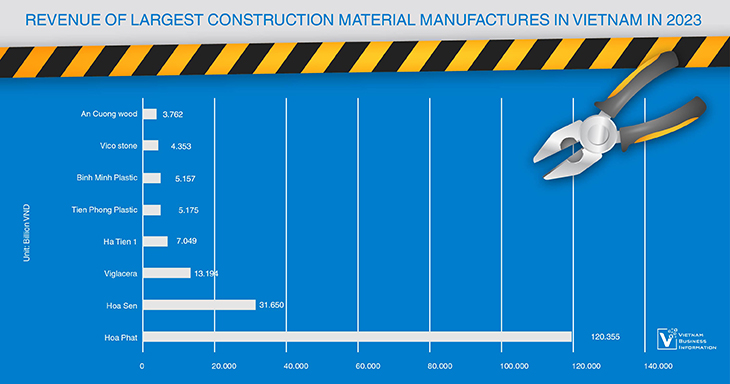

Hoa Phat Group

Hoa Phat Group has solidified its position as a powerhouse in Vietnam's construction materials sector. Renowned for its steel production, the company has diversified its portfolio to include a wide range of construction materials such as steel pipes, galvanized steel sheets, and construction steel bars. With state-of-the-art facilities and a commitment to innovation, Hoa Phat Group continues to elevate the standards of construction materials in Vietnam.

Throughout 2023, Hoa Phat's revenue reached 120.355 trillion dong, a decrease of 16% compared to the same period the previous year. After-tax profit reached 6.8 trillion dong, completing 85% of the annual plan.

In 2023, Hoa Phat produced 6.7 million tons of crude steel, a 10% decrease compared to 2022. Sales volume of HRC steel products, construction steel, high-quality steel, and steel billets reached 6.72 million tons, a 7% decrease. Specifically, construction steel and high-quality steel reached 3.78 million tons, an 11% decrease compared to the same period the previous year.

Hot-rolled coil HRC recorded nearly 2.8 million tons, a 6% increase compared to 2022. In addition to traditional steel product lines, Hoa Phat has invested in deep processing, enhancing the production of various high-quality steel products to meet domestic and export demand.

Hoa Phat's steel export market expanded to 39 countries and territories worldwide. Exporting helps diversify the company's consumption market, while contributing to foreign currency earnings and balancing Vietnam's trade balance.

Regarding steel pipe products, Hoa Phat supplied 685,000 tons to the market, a 9% decrease compared to 2022. Various types of coated sheets reached the same level as the previous year, with 329,000 tons.

With a crude steel capacity of 8.5 million tons per year, the largest in Vietnam and Southeast Asia, Hoa Phat leads the market share in Vietnam for construction steel, steel pipes, and is among the top 5 largest galvanized steel producers. It is also the only Vietnamese enterprise producing HRC steel, pre-stressed steel strands, and various high-quality steel types.

Other business sectors also made strides, officially supplying container shell products to the market from August 2023. Also in August, Hoa Phat inaugurated the first berth of the integrated container port in Dung Quat, Quang Ngai, to serve the cargo handling needs of enterprises in the Dung Quat Economic Zone and surrounding areas.

Hoa Sen Group

Hoa Sen Group is synonymous with excellence in steel manufacturing. Specializing in galvanized steel and pre-painted galvanized steel, the company has earned a reputation for delivering premium products that meet stringent quality standards. Hoa Sen Group's extensive distribution network ensures its products reach construction projects across Vietnam, contributing significantly to the nation's infrastructure development.

During the financial year 2022 - 2023 (from October 1, 2022, to September 30, 2023), Hoa Sen Group recorded revenue of 31,650.7 billion dong, a decrease of 36.3% compared to the same period, and after-tax profit of 30.06 billion dong, a decrease of 88% compared to the same period. The gross profit margin decreased from 9.9% to only 9.7%.

It is noted that during this financial year, Hoa Sen Group planned its business based on two scenarios.

The first scenario, with a finished product output of 1.4 million tons, the company planned revenue of 34,000 billion dong, a decrease of 32% compared to the same period, and estimated after-tax profit of 100 billion dong, a decrease of 60% compared to the same period the previous year.

The second scenario, more optimistic with a finished product output of 1.5 million tons, estimated revenue of 36,000 billion dong, a decrease of 28% compared to the same period, and estimated after-tax profit of 300 billion dong, an increase of 20% compared to the same period the previous year.

Thus, at the end of the financial year 2022 - 2023, with a profit of only 30.06 billion dong, Hoa Sen Group achieved 30.1% of the cautious plan of 100 billion dong and achieved 10% of the optimistic plan of 300 billion dong.

Viglacera Corporation

Viglacera Corporation, established in 1974, has emerged as a key player in Vietnam's construction materials industry. The company specializes in producing a diverse range of construction materials, including ceramic tiles, sanitary ware, and glass products.

In 2023, Viglacera reported a net revenue of 13,194 billion dong, a 10% decrease compared to 2022. Most revenue segments experienced declines over the past year: real estate (down 90%, reaching 100 billion dong), glass (down 31%, reaching 2,004 billion dong), ceramics, sanitary ware, and accessories (down 15%, reaching 925 billion dong), and roofing tiles (down 25%, reaching 1,270 billion dong). Only the tile segment saw a slight decrease of 3%, reaching 3,459 billion dong.

Pre-tax and after-tax profits were 1,602 billion dong and 1,162 billion dong respectively, decreasing by 30% and 39%. In 2023, VGC set a revenue target of 13,468 billion dong and a pre-tax profit of 1,216 billion dong. Thus, the company achieved 98% of the revenue target and exceeded the profit plan by 32%.

As of December 31, 2023, Viglacera's total assets reached 24,099 billion dong, a 5% increase compared to the beginning of the year. VGC holds a significant amount of cash at 2,467 billion dong; of which cash and cash equivalents reached 1,841 billion dong, a 9% decrease, and investment holdings maturing reached 626 billion dong, a 4.8% increase.

Inventory increased by 12% to 4,739 billion dong, with the largest proportion being finished glass, ceramics, sanitary ware, etc., reaching 2,603 billion dong. Inventory of unfinished construction real estate was 1,537 billion dong.

Basic construction costs for unfinished projects reached 6,229 billion dong, an 8% increase. The largest projects include Thuan Thanh Industrial Zone Phase 1 (1,665 billion dong), Yen My Industrial Zone (967 billion dong), Van Hai High-end Ecotourism Area (760 billion dong), Phu Ha Industrial Zone Phase 1 (847 billion dong), etc.

Last year, Viglacera reduced its investment value in joint ventures and affiliated companies by 37% to a total of 430 billion dong. This includes a significant reduction in investment value in Viglacera Dong Trieu, Viglacera Ha Long II, etc.

Regarding capital sources, total liabilities reached 14,575 billion dong, a 5% increase compared to the beginning of the year. Among them, financial debts reached 5,134 billion dong, a 42% increase, with short-term debts exceeding 2,897 billion dong. Unrealized revenue reached 2,670 billion dong, a 3% decrease.

In early January, the Large Enterprise Tax Department (General Department of Taxation) issued an administrative penalty decision regarding tax violations against Viglacera Corporation. Accordingly, Viglacera was fined over 1.4 billion dong, equivalent to 20% of the tax shortfall resulting from incorrect declarations leading to tax underpayment from 2018 to 2022.

Ha Tien 1 Cement JSC

Ha Tien 1 Cement JSC, a subsidiary of SCG Cement - Building Materials, is a leading producer of cement in Vietnam. With a commitment to quality and environmental sustainability, the company manufactures a comprehensive range of cement products tailored to meet the diverse needs of the construction sector.

In 2023, the net revenue of Vicem Ha Tien reached 7.049 trillion dong, a 21% decrease compared to 2022. However, the cost of goods sold only decreased by 19.7% compared to 2022, amounting to 6.445 trillion dong. Consequently, the gross profit from sales of this cement manufacturing enterprise reached only 603 billion dong, a decrease of 32.28% compared to 2022.

The declining revenue source, coupled with significant cost increases, resulted in Vicem Ha Tien's after-tax profit for 2023 reaching only 17.1 billion dong, "evaporating" over 93% of the profit compared to 2022.

As of December 31, 2023, the total assets of Vicem Ha Tien amounted to 8.622 trillion dong, an 8.12% decrease compared to the beginning of the year. Owner's equity was 4.832 trillion dong, a 5.56% decrease compared to the beginning of the year. Short-term assets amounted to 1.968 trillion dong. Among them, inventory was 846 billion dong, a decrease of 18.92% compared to the beginning of the year; Cash and cash equivalents amounted to 607 billion dong, a decrease of 10.14% compared to the beginning of the year.

Tien Phong Plastic JSC

Tien Phong Plastic JSC is a prominent manufacturer of plastic pipes and fittings in Vietnam. With a focus on product innovation and customer satisfaction, the company has established itself as a reliable supplier of high-quality plastic construction materials.

In 2023, the company recorded a net revenue of 5,175.8 billion dong, a 9% decrease compared to 2022.

However, pre-tax profit increased by 16.7% compared to 2022, reaching over 659 billion dong. After-tax profit reached over 559.4 billion dong, a 16.5% increase compared to 2022. This is the highest profit level that Tien Phong Plastic has achieved in a year since its listing in 2006.

At the beginning of 2023, Tien Phong Plastic's leadership predicted that the plastic industry would face many challenges in the year ahead. Consequently, they set the business plan for 2023 with a target revenue of 5,875 billion dong, a slight increase of 3% compared to the previous year. However, the pre-tax profit target decreased by 5% to 535 billion dong.

Thus, by the end of 2023, with the achieved results, Tien Phong Plastic accomplished 88% of the revenue plan but exceeded the profit target by 23%.

According to the consolidated financial statements for 2023, as of December 31, 2023, Tien Phong Plastic's total assets reached over 5,453.6 billion dong, an increase of nearly 390 billion dong compared to the beginning of the year, equivalent to an 8% increase. This increase was mainly due to cash (cash, cash equivalents, and deposits). It is noteworthy that Tien Phong Plastic's non-term bank deposits at the end of 2023 were 3.6 times higher than at the beginning of the year, totaling 451 billion dong.

As of December 31, 2023, the cash balance increased by nearly 850 billion compared to the beginning of the year, reaching 1,435 billion dong, accounting for over 1/4 of total assets. Inventory decreased by 25% compared to the beginning of the year, reaching 1,159 billion dong, mainly due to raw materials (674 billion dong), decreasing by 35%.

Basic construction costs increased significantly compared to the beginning of the year, from nearly 9 billion dong to over 47 billion dong at the end of the period, mainly reflecting basic construction costs of 21 billion dong and machinery and equipment costs of over 26 billion dong for the factory in Duong Kinh District (Hai Phong).

Total liabilities, with 100% being short-term debt, amounted to 2,338.2 billion dong, a 5% increase compared to the beginning of the year. Among them, short-term loan debt was at 1,702 billion dong, a slight increase compared to the beginning of the year. Undistributed after-tax profits reached over 645 billion dong, and the development investment fund reached 1,174 billion dong.

Binh Minh Plastic JSC

Binh Minh Plastic JSC is a leading producer of plastic construction materials, specializing in PVC pipes, fittings, and profiles. With a strong emphasis on research and development, the company continuously introduces innovative solutions to address the evolving needs of the construction industry.

In 2023, the revenue of the company reached 5,157 billion dong, a decrease of 11% compared to the previous year. However, the cost of goods sold decreased by 28%, boosting gross profit to 2,116 billion dong, an increase of 32%. The gross profit margin stood at 41%, higher than the 34% of the previous year.

The significant increase in gross profit was due to the benefits from the price of PVC raw materials in 2023, which constituted a large portion of the company's input costs and decreased significantly compared to the previous year, remaining stable throughout the year due to reduced global demand.

Additionally, the company benefited from the ecosystem of the major Thai plastic industry player, SCG Group, indirectly owning BMP through Nawaplastic Industries (holding 54.99% of BMP's capital at the end of 2023). Moreover, BMP had the potential to increase PVC imports from DGC when the Dung Quat Nghi Son factory became operational, aiming to increase the rate of domestic sourcing of raw materials, according to a report by KBSV Securities published in October 2023.

The company's financial revenue in 2023 also yielded positive results, reaching 119 billion dong, more than double the previous year. Of this, interest income and interest on loans accounted for nearly 117 billion dong. Conversely, financial expenses were reduced by 8% to 146 billion dong, with insignificant interest expenses.

BMP reported a record net profit, reaching 1,041 billion dong, more than doubling the previous year and exceeding the annual profit plan by 60%.

Vicostone JSC

Vicostone Joint Stock Company is a premier manufacturer of engineered quartz surfaces, catering to the demands of both residential and commercial construction projects. Renowned for its exquisite designs and exceptional durability, Vicostone's products have become synonymous with luxury and sophistication in the construction materials market. With a global presence and a focus on craftsmanship, Vicostone continues to redefine standards of elegance in interior design and architecture.

By the end of 2023, Vicostone achieved net sales revenue and total pre-tax profit of 4,353.86 billion dong and 999.44 billion dong, respectively, completing 92.38% and 94.29% of the approved Annual General Meeting's plan. In 2023, Vicostone continued to achieve a pre-tax profit margin/net revenue ratio above 22%, and the after-tax profit margin/net revenue ratio was consistently maintained around 19%-25%, reflecting the company's efforts to overcome challenges, optimize profitability, stabilize employee income, and protect shareholder rights.

In terms of market activities, Vicostone implemented companion programs to strengthen and consolidate long-term stable cooperation with partners and customers in key markets to overcome the common market difficulties. In the North American market, leveraging its existing position, the company continued to develop new direct distribution channels in Missouri and Ohio to increase brand coverage, reduce transportation time and costs, and enhance product experience for customers. In the domestic market, Vicostone continued to implement the "leading brand companion" strategy and develop authorized workshop models.

Regarding product development, Vicostone continued to intensify research and development activities for new product lines, diversifying in styles, designs, and with reasonable costs for customers, increasing competitiveness in the market. In 2023, the company introduced 08 new products inspired by nature such as BQ2612 – Polaris, BQ6710 - Nefeli, BQ6712 – Matarazzo, which not only attracted attention from architects and industry experts but also received positive feedback from consumers.

An Cuong Wood Working JSC

An Cuong Wood Working Joint Stock Company specializes in manufacturing and distributing high-quality wood-based construction materials. From decorative veneers to engineered wood flooring, the company offers a diverse range of products tailored to meet the aesthetic and functional requirements of modern construction projects.

In 2023, An Cuong Wood reported net revenue of 3,762 billion dong and net profit of 437 billion dong, marking a decrease of 16% and 43% respectively compared to 2022. This represents the lowest profit margin for the company since 2017.

The company holds over 1,900 billion dong in cash and deposits, accounting for 36% of its asset structure and increasing by 33% compared to the beginning of the year. Inventory levels are at 1,134 billion dong, reflecting a decrease of 22.6%.

The enterprise carries financial liabilities of over 700 billion dong while its equity stands at 4,173 billion dong.

As of the end of 2023, An Cuong Wood's short-term investments include time deposits in commercial banks with remaining terms of less than one year, earning interest rates ranging from 4.9% to 11.5% per annum (as of December 31, 2022: 5% - 12% per annum). Additionally, the company has used time deposits valued at 343 billion dong as collateral for short-term loans from banks.

An Cuong Wood has a strong connection with Thang Loi Real Estate Group, owning a 30% stake in Thang Loi Homes Joint Stock Company. Furthermore, it also invests in Thang Loi Real Estate Group Joint Stock Company.

Specifically, as of December 31, 2023, ACG still holds a 30% ownership stake in Thang Loi Homes, equivalent to the ownership ratio as of December 31, 2022.

In 2023, An Cuong Wood invested a total of 405 billion dong in Thang Loi Homes, an increase of over 4.2 billion dong compared to the figures as of December 31, 2022, while Thang Loi Real Estate Group Joint Stock Company received an investment of nearly 120 billion dong.

In conclusion, these largest construction materials manufacturing companies in Vietnam play a pivotal role in driving the nation's infrastructure development forward. Through innovation, quality, and sustainability, they continue to shape the built environment and contribute to Vietnam's economic growth and prosperity.

Vietnam Business Information