Published May 2024

Top largest listed information technology companies in Vietnam

Vietnam's tech industry has been rapidly evolving, establishing itself as a significant player in the global market. From software development to telecommunications, the country boasts a diverse range of IT companies making significant strides in innovation and growth.

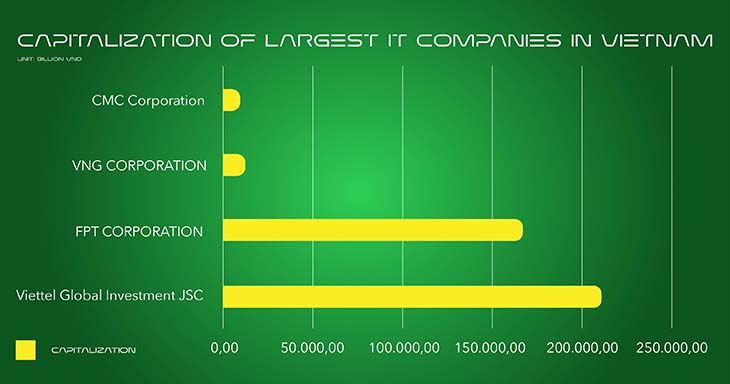

Below are the largest listed IT companies in Vietnam according to VBI's assessment based on market capitalization as well as non-financial factors such as development history, position, and reputation in the industry.

1. Viettel Global Investment JSC

Viettel Global Investment JSC is the international arm of Viettel Group, Vietnam's largest telecommunications company. With a presence in 12 countries across Asia, Africa, and the Americas, Viettel Global has positioned itself as a key player in the global telecommunications market.

The company provides a wide range of services, including mobile telecommunications, internet, and digital services, catering to millions of subscribers worldwide. Viettel Global's commitment to innovation and expansion has solidified its position as one of Vietnam's leading IT companies.

In 2023, Viettel Global's consolidated revenue from sales and services reached 28.2 trillion VND, marking a 19.4% increase compared to 2022. Converted at the exchange rate at the end of 2023, Viettel Global's revenue amounted to approximately 1.18 billion USD.

All nine market companies under Viettel Global recorded growth, with four markets experiencing revenue growth of over 20%. These markets include Viettel Haiti (+36.2%), Viettel Mozambique (+28.2%), Viettel Myanmar (+20.2%), and Viettel Timor (+20.3%).

With the positive revenue growth, Viettel Global's consolidated pre-tax profit for 2023 reached 3.879 trillion VND, indicating a 28.7% increase compared to 2022. The consolidated after-tax profit amounted to 1.647 trillion VND, representing a 107 billion VND increase compared to 2022.

2. FPT Corporation

FPT Corporation is a pioneer in Vietnam's IT industry, offering a comprehensive suite of services, including software outsourcing, digital transformation, and IT consulting. Established in 1988, FPT has grown into a multinational conglomerate with operations spanning across 40 countries.

The company's focus on research and development has led to groundbreaking innovations in artificial intelligence, blockchain, and cloud computing. FPT's strategic partnerships with global tech giants further enhance its capabilities, making it a formidable force in the digital economy.

In 2023, FPT recorded a revenue of 52.618 trillion VND and a pre-tax profit of 9.203 trillion VND, achieving growth rates of 19.6% and 20.1% respectively compared to 2022. The after-tax profit for the parent company reached 6.470 trillion VND, marking a growth of 21.8%, with earnings per share (EPS) reaching 4,666 VND per share, up by 21.3% compared to the previous year.

In particular, the Technology Division (including domestic and overseas IT services) continued to play a key role, contributing 60% of the total revenue and 45% of the pre-tax profit of the entire FPT Group, equivalent to 31.449 trillion VND and 4.161 trillion VND respectively, representing growth rates of 22.1% and 23.6%.

The year 2023 was historically significant for FPT as the revenue from overseas IT services officially surpassed the 1 billion USD mark (reaching 24.288 trillion VND), with a growth of 28.4%; pre-tax profit reached 3.782 trillion VND, up by 27.1% compared to the previous year. Key markets maintained high growth momentum, especially in Japan, despite the depreciation of the Yen, with a growth rate of 43.4%. On December 16, 2023, FPT signed cooperation agreements with two major Japanese companies, Yamato Holdings and TradeWaltz.

Digital transformation revenue from overseas markets in 2023 reached 10.425 trillion VND, growing by 42% compared to the same period, focusing on new technologies such as Cloud, AI/Data Analytics...

Newly signed contracts in overseas markets reached 29.717 trillion VND, growing by 37.6%. Among them, there were 37 projects with a scale of over 5 million USD, demonstrating a shift in focus towards large contracts, affirming the effectiveness of FPT's "whale hunting" strategy.

Meanwhile, domestic IT services recorded a revenue of 7.161 trillion VND, growing by 4.6%, and a pre-tax profit of 379 billion VND, a slight decrease of 2.6%. Thanks to high applicability, focus on core technologies, and the Made-by-FPT technology ecosystem, witnessing a strong growth rate of 40.8%, bringing in revenue of 1.620 trillion VND, continuing to play a role as one of the long-term growth drivers of the Group.

Other sectors such as Telecommunications Services recorded a revenue of 15.186 trillion VND, growing by 8.8%, and an after-tax profit of 2.895 trillion VND, up by 15.4%; the Education sector achieved a revenue of 6.159 trillion VND, growing by 31%.

3. VNG Corporation

VNG Corporation is synonymous with Vietnam's booming digital entertainment industry. Founded in 2004, VNG quickly rose to prominence as a leading provider of online gaming, social networking, and digital content services.

The company's flagship products, including Zalo, Vietnam's most popular messaging app, and Zing MP3, a leading music streaming platform, have garnered millions of users nationwide. VNG's relentless pursuit of creativity and user engagement has propelled it to become one of Vietnam's largest IT companies, shaping the way people interact and consume digital content.

In 2023, VNG reported a revenue of 8.607 trillion VND, a growth of over 10% compared to the previous year. Online gaming services dominated the revenue composition with over 75%, amounting to 6.488 trillion VND, an increase of over 1,000 billion VND compared to the previous year. The remaining revenue sources came from value-added services on telecommunications and internet networks, online advertising, ringback tones, and song copyrights.

After deducting all expenses, the company reported a post-tax loss of 756 billion VND, halving from the loss of over 1.533 trillion VND in the previous year. This marks the third consecutive year of losses for this tech unicorn. Although the loss amount significantly reduced compared to the previous year, it was still not enough to meet the company's target of reducing net losses to 378 billion VND as planned at the annual shareholders' meeting.

At the end of 2023, VNG's total assets reached 9.716 trillion VND, an increase of 817 billion VND compared to the beginning of the year. Cash and cash equivalents accounted for a large proportion of the asset structure with over 3.838 trillion VND, approximately 39.5%. The company currently has 5.344 trillion VND in liabilities, increasing by approximately 1.560 trillion VND compared to the beginning of the year.

The long-term investment value of VNG increased by 36% compared to the beginning of the year, reaching 4.839 trillion VND. Among them, the ownership stake in Zion (the entity that owns ZaloPay) increased from 69.98% at the beginning of the year to 72.654%, equivalent to an investment value of nearly 3.365 trillion VND, an increase of 190 billion VND compared to the previous quarter and over 400 billion VND compared to the beginning of the year.

VNG's shareholders' equity at the end of 2023 decreased significantly compared to the beginning of the year, amounting to 4.371 trillion VND. The company currently has over 4.402 trillion VND in undistributed post-tax profits.

4. CMC Corporation

CMC Corporation stands at the forefront of Vietnam's technology-driven transformation, offering a wide array of solutions in information technology, telecommunications, and digital transformation. Since its inception in 1993, CMC has been instrumental in driving innovation and modernization across various sectors, including finance, healthcare, and government.

The company's expertise in cybersecurity, cloud computing, and data analytics has earned it a reputation for reliability and excellence. With a focus on delivering cutting-edge technology solutions, CMC continues to play a vital role in shaping Vietnam's digital future.

In 2023, CMC achieved a revenue of 50.8 billion VND and a post-tax profit of 1.9 billion VND. This marks a significant turnaround compared to the same period last year when the company incurred a loss of nearly 1.8 billion VND.

These companies represent the epitome of Vietnam's tech prowess, each making significant contributions to the country's digital transformation. From telecommunications to digital entertainment and beyond, they continue to push the boundaries of innovation, driving Vietnam's emergence as a tech powerhouse on the global stage. As they continue to thrive and expand their reach, the future looks incredibly promising for Vietnam's dynamic IT industry.