The VBI News blog provides a multi-dimensional perspective on global business information. Here, you can find important economic news, expert reviews, and opinions. The blog covers the latest business and financial news on the global economy, backed by facts and figures. Readers are provided with crucial information that may impact their financial decisions while conducting business.

Unexpected shifts in the top 10 banks by net interest income for the first half of 2024

Agribank has retained its dominant position, while VietinBank and BIDV have overtaken Vietcombank, and numerous joint-stock banks have exhibited impressive double-digit growth compared to the same period last year.

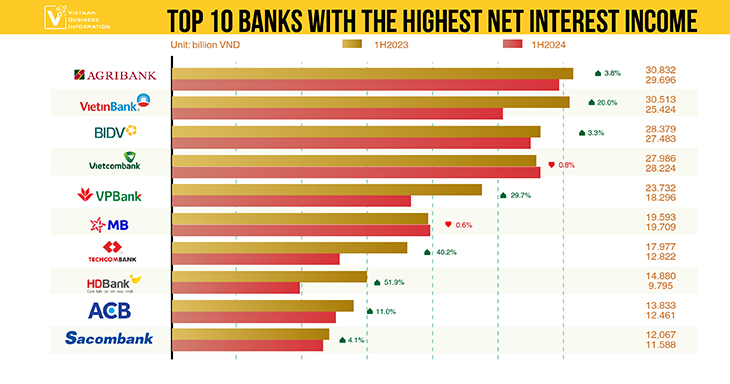

Top 10 banks with the highest net interest income

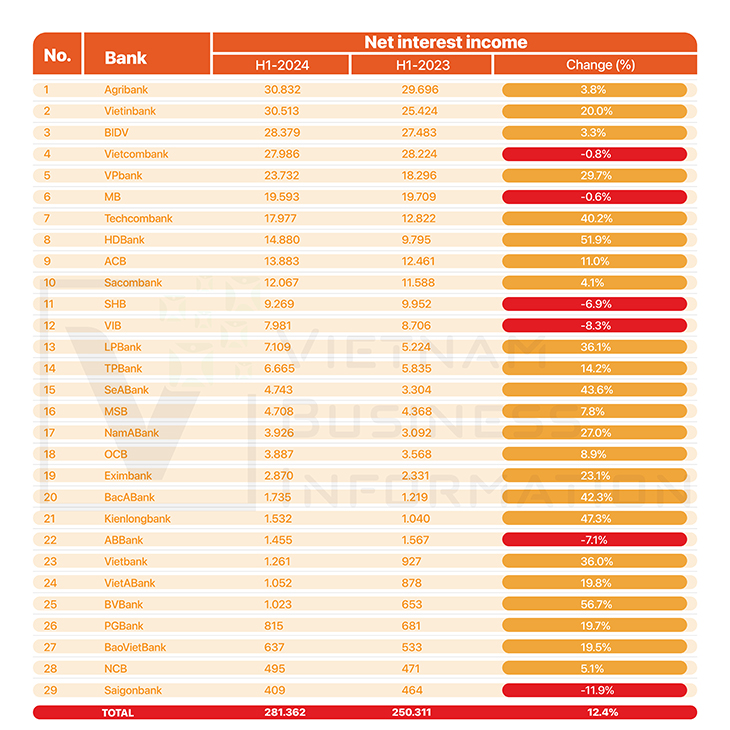

According to the 2024 semi-annual report, the aggregate net interest income for 29 banks reached VND 281,362 billion, reflecting a 12.4% increase over the first six months of 2023. Of these, 23 banks reported growth in net interest income during this period.

Agribank emerged as the top performer in net interest income for the first half of the year, generating VND 30,832 billion, a 3.8% year-on-year increase. Meanwhile, Vietcombank, the previous leader in profitability, was outpaced by VietinBank and BIDV, slipping out of the top three.

Within the Big 4, VietinBank delivered a standout performance with a 20% rise in net interest income compared to the previous year, securing the second position with VND 30,513 billion. BIDV and Vietcombank followed in third and fourth places, with net interest incomes of VND 28,379 billion and VND 27,986 billion, respectively.

Among the joint-stock banks, VPBank surged ahead, leading the pack with net interest income of VND 23,732 billion, marking a robust 29.7% increase over the prior year, bringing it closer to the Big 4. Conversely, MB slipped to sixth place with a slight dip of 0.6% in net interest income, totaling VND 19,593 billion.

The remaining positions in the top 10 were filled by Techcombank, HDBank, ACB, and Sacombank. Notably, HDBank ascended from 11th place in the first half of 2023 to 8th place, buoyed by a remarkable 51.9% increase in net interest income, the second-highest growth rate in the industry.

BVBank led the sector in growth rate, topping the chart with a 56.7% surge in net interest income, amounting to VND 1,023 billion in the first half of the year.

In addition to BVBank, other banks such as HDBank (51.9%), KienlongBank (47.3%), SeABank (43.6%), Bac A Bank (42.3%), Techcombank (40.2%), LPBank (36.1%), and Vietbank (36%) also demonstrated significant growth in net interest income over the past six months.

However, not all banks experienced gains. Vietcombank, for instance, recorded a marginal decline of 0.8% in net interest income for the first half of the year. Similarly, SHB, ABBank, and VIB saw reductions of 6.9%, 7.1%, and 8.3%, respectively. Saigonbank, in particular, faced a notable double-digit decrease of 11.9% compared to the first half of 2023.

Ranking of net interest income

Source: Banks’ FS, vietnambiz

Compiled by Vietnam Business Information

Vietnam’s 2023 credit growth to be lower than planned

Credit growth of Vietnam in 2023 is forecast to reach about 8.4%, lower...