The VBI News blog provides a multi-dimensional perspective on global business information. Here, you can find important economic news, expert reviews, and opinions. The blog covers the latest business and financial news on the global economy, backed by facts and figures. Readers are provided with crucial information that may impact their financial decisions while conducting business.

Vietnam’s monthly economic overview October - 2024

Vietnam’s monthly economic overview (October, 2024)

Vietnam's economy showed resilience and upward momentum in October 2024, with significant strides across industrial production, business registration, investment inflows, and trade dynamics.

This comprehensive analysis, grounded in the latest data from the General Statistics Office (GSO), delves into the nuances of each economic sector, reflecting the economic landscape and investor sentiment.

Retail sales of consumer goods and services

Retail activity continued to be a vital driver of economic growth. The total retail sales of consumer goods and services for October 2024 were estimated at VND 545.7 trillion, representing a 7.1% year-on-year increase. The consistent growth in retail sales points to robust domestic consumption, underpinned by steady economic recovery and improved consumer confidence.

- Year-to-date analysis: Over the first ten months of the year, retail sales reached VND 5,246.2 trillion, up 8.5% from the same period in 2023. When adjusted for inflation, the growth rate stood at 4.6%, indicating strong real consumption despite fluctuations in price levels.

- Sectoral contributions: The retail segment of consumer goods, services, and dining played a significant role, reflecting increased demand across urban and rural regions.

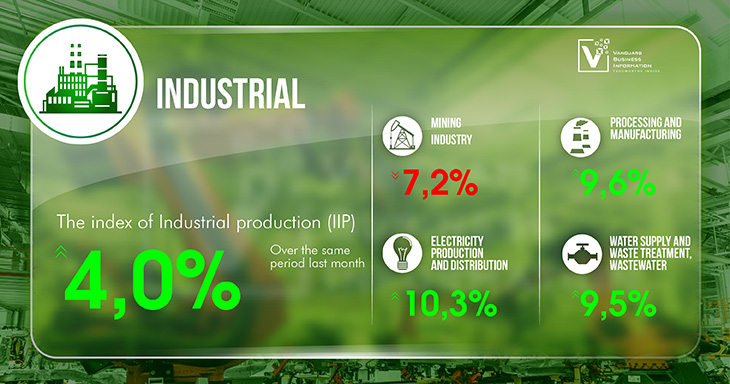

Industrial production performance

The industrial sector demonstrated marked growth, driven primarily by manufacturing and energy production.

- October Index of Industrial Production (IIP): The IIP rose by 4.0% from September and registered a robust 7.0% increase compared to October 2023. The ten-month cumulative IIP surged 8.3%, a stark contrast to the 0.5% growth during the same period in 2023, signaling a rebound in industrial output.

- Subsector analysis:

- Manufacturing and Processing: This subsector grew by 9.6%, contributing a substantial 8.3 percentage points to the overall IIP growth, benefiting from heightened demand for electronics, apparel, and machinery.

- Electricity Production and Distribution: This area increased by 10.3%, adding 0.9 points to the IIP, driven by industrial and residential power consumption.

- Water Supply, Waste Management, and Treatment: Grew by 9.5%, contributing 0.2 points, highlighting increased investment in environmental infrastructure.

- Mining Sector: The sector contracted by 7.2%, detracting 1.1 points from the IIP, due to declining output in key minerals and fossil fuels, reflecting a challenging global commodities market.

- Employment trends: The workforce in industrial enterprises grew by 1.0% month-on-month and 5.7% year-on-year as of October 1, underscoring robust hiring in manufacturing hubs.

Business registration trends

The business environment showed mixed signals, with a notable uptick in new enterprise creation alongside a high number of market exits.

- October business registration: Approximately 14,200 new enterprises were established, marking a 26.5% increase from the previous month but a 9.8% decline compared to October 2023. Meanwhile, around 8,700 firms resumed operations, recording significant month-on-month (33.5%) and year-on-year (53.7%) growth.

- Business suspensions and closures: Nearly 5,454 firms registered for temporary suspension, an increase of 28.8% month-on-month, though down 0.9% year-on-year. Additionally, 5,424 companies ceased operations, awaiting dissolution, a 26.8% monthly decrease but a 10.7% yearly increase. Dissolutions completed by 1,987 enterprises marked a 23.8% increase from September and a 34.3% rise year-on-year.

- Cumulative data: Over the first ten months of 2024, Vietnam saw over 202,300 newly registered and returning businesses, up 9.1% from the prior year. However, 173,200 businesses exited the market, reflecting an 18.4% increase. On average, over 20,200 firms were established or resumed operations monthly, while 17,300 withdrew from the market.

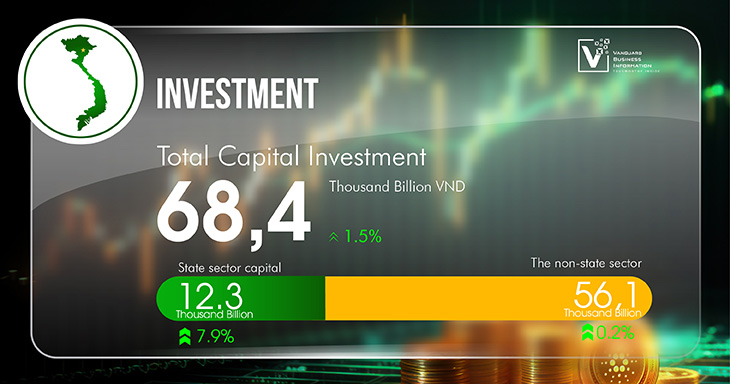

Investment insights

Investment activity remained a critical focus, with state budget disbursement and foreign direct investment (FDI) reflecting mixed outcomes.

- Public investment: October saw VND 68.4 trillion in state budget investment, a 1.5% year-on-year increase. In the first ten months, total state budget investment was VND 495.9 trillion, equivalent to 64.3% of the annual plan and a 1.8% increase from the prior year. This allocation was directed toward infrastructure, education, and healthcare projects, as the government aimed to catalyze economic growth.

- Foreign Direct Investment (FDI): Total registered FDI, including new licenses, capital adjustments, and share acquisitions, amounted to $27.26 billion by October 31, up 1.9% year-on-year. Realized FDI reached $19.58 billion, an 8.8% increase, demonstrating Vietnam's appeal to foreign investors despite global economic uncertainties.

- Outbound Investment: Vietnamese firms invested $473.1 million abroad, an 11.5% year-on-year increase, across 124 newly certified projects and 21 capital adjustment instances. This reflects growing internationalization among Vietnamese corporations, particularly in technology and renewable energy ventures.

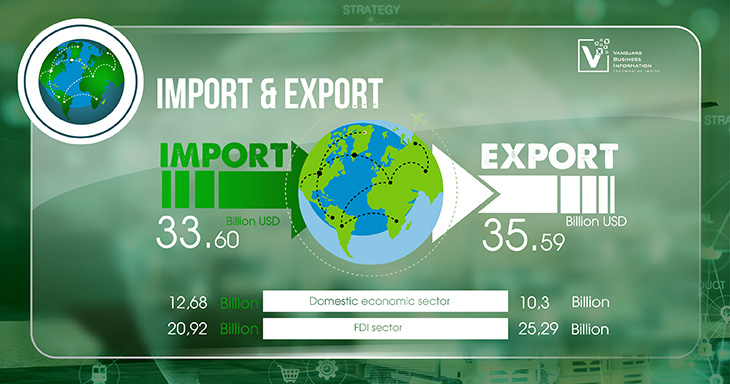

Trade developments

Vietnam's trade performance remained strong, supported by a well-balanced export-import structure.

- Trade volume: October's preliminary trade value reached $69.19 billion, up 5.1% month-on-month and 11.8% year-on-year. The first ten months recorded a total trade turnover of $647.87 billion, up 15.8%, with exports rising 14.9% to $335.59 billion and imports growing 16.8% to $312.28 billion.

- Exports: Preliminary export figures for October were $35.59 billion, a 10.1% annual increase. Year-to-date exports hit $335.59 billion, with domestic enterprises contributing $93.97 billion (up 20.7%) and foreign-invested firms (including crude oil) contributing $241.62 billion (up 12.8%). The export structure remained dominated by processed industrial goods, totaling $295.23 billion and representing 88.0% of total exports.

- Imports: October imports were $33.6 billion, up 13.6% year-on-year. Cumulative imports reached $312.28 billion, with domestic enterprises accounting for $113.58 billion (up 18.8%) and foreign-invested enterprises at $198.7 billion (up 15.8%).

- Key markets: The United States emerged as the largest export market ($98.4 billion), while China was the top import source ($117.7 billion).

- Trade balance: Vietnam achieved a trade surplus of $1.99 billion in October, contributing to a cumulative surplus of $23.31 billion, slightly below last year’s $24.8 billion. Domestic firms experienced a trade deficit of $19.61 billion, offset by a $42.92 billion surplus from foreign-invested enterprises.

Price indices: CPI, Gold, and currency fluctuations

Price indices reflected inflationary pressures and global market influences:

- Consumer Price Index (CPI): October’s CPI rose by 0.33% month-on-month and 2.89% year-on-year. The average CPI over ten months increased by 3.78%, driven by food, fuel, and transportation costs, while core inflation stood at 2.69%.

- Gold prices: Gold saw a 5.96% increase from September, marking a 38.88% year-on-year surge, influenced by geopolitical tensions and currency volatility. The ten-month average price index for gold was up 27.48%.

- US dollar: The USD index increased 0.7% from September, up 1.89% year-on-year. The dollar’s strength was driven by tightening global monetary policies and robust U.S. economic performance.

Compiled by Vanguard Business Information

ADB: Vietnam's GDP growth to rank 2nd in the ASEAN region in 2024

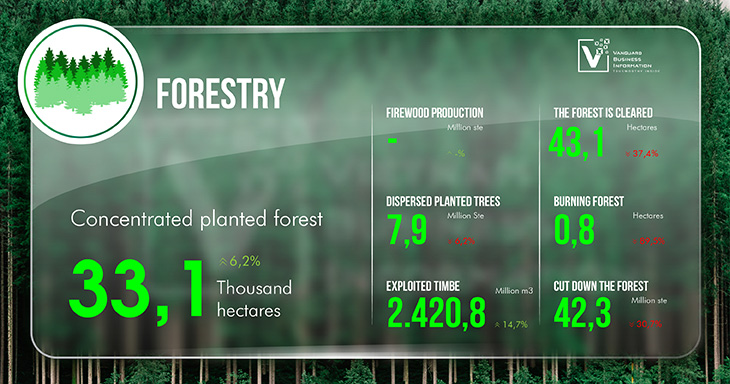

In 2024, Vietnam's GDP growth will be at 6%, ranking second in the ASEAN...