The VBI News blog provides a multi-dimensional perspective on global business information. Here, you can find important economic news, expert reviews, and opinions. The blog covers the latest business and financial news on the global economy, backed by facts and figures. Readers are provided with crucial information that may impact their financial decisions while conducting business.

Vietnam’s stock market to be upgraded?

Large scale investment capital flows

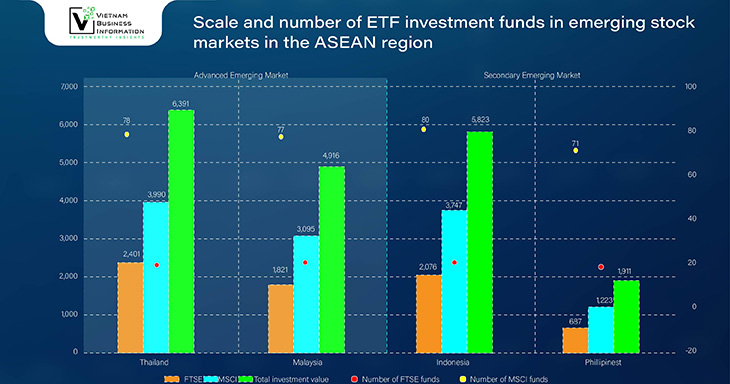

According to a report by BSC Research, in case Vietnam is upgraded to an emerging market by FTSE and MSCI organizations, the stock market in particular and the Vietnamese economy in general may benefit in some aspects.

Foreign investment capital flows through open funds and ETF funds - referenced by indexes of MSCI and FTSE are expected to "land" on Vietnam's stock market on a large scale.

According to data as of November 30, 2023 from Bloomberg, there are currently 491 funds with a total size of 956 billion USD, including 180 ETF funds (scale of 421 billion USD) and 311 open-ended funds (scale of 533 billion USD) is investing in emerging stock markets that are ranked by MSCI and FTSE, in which the proportion of reference funds according to MSCI (87%) is greater than that of FTSE (13%).

BSC Research notes that data on open-ended funds according to Bloomberg statistics does not cover the entire market/scale of active funds investing in regions, so the actual value will be greater than the compiled data.

Considering the ASEAN5 region alone, for the four markets of Thailand, Malaysia, Indonesia, and the Philippines, there are a total of 240 funds with a total asset value of 859 billion USD, including 135 open-ended funds (scale of 490 billion USD - with a total investment value of 13.12 billion USD) and 105 ETF funds (scale of 369 billion USD - with a total investment value of 19.04 billion USD) that are allocating assets into these 4 markets.

About 3.5 - 4 billion USD will be spent on buying new Vietnamese stocks

According to estimates by BSC Research, in case MSCI and FTSE upgrade Vietnam to an emerging stock market, about 3.5 - 4 billion USD will be spent on buying new Vietnamese stocks.

The estimate is based on the assumption that the average proportion of newly purchased Vietnamese stocks is about 0.7% - equivalent to the proportion of stocks on the Philippine stock market (ranked as primary emerging stock market by FTSE) in current fund portfolios.

In addition, investment funds will consider the country's economic growth potential to allocate appropriate investment portfolios, so this figure may be lower than reality when Vietnam is a developing country. It has a stable political environment, is participating in many major trade agreements, is a comprehensive strategic partner of major economies in the world and is highly appreciated by many prestigious organizations.

Because Vietnam is not currently on MSCI's upgrade watch list and is already on FTSE's watch list, in the near future the Vietnam stock market will be officially upgraded by FTSE to a primary emerging stock market.

When FTSE Russell officially upgrades, it is expected that the market will receive about 1.3 - 1.5 billion USD from open-ended investment funds/ETFs referenced according to FTSE's set of indicators, of which ETF funds will be expected to purchase at least about 700 - 800 million USD (equivalent to the current size of the Philippine stock market).

Source: Bloomberg, BSC Research

Compiled by VBI

Profits of beer businesses saw a decline

Beer enterprises all witnessed a decline in business results due to the...